Commercial Bank shows growth amidst rate hikes

View(s):Commercial Bank’s overseas operations encompass Bangladesh, where the bank operates 18 outlets, Myanmar – where it has a Representative Office in Yangon and the Maldives, where the bank opened a fully-fledged Tier I Bank in September 2016.

The bank has also received a licence to operate a fully-owned Money Transfer Operation in Italy. Commercial Bank Managing Director/CEO Jegan Durairatnam said in a media release the bank achieved noteworthy growth in its loan book while continuing to improve the quality of its loan portfolio and significantly reducing impairment charges in the review period. “We continue to focus on key operational indicators as we grow and expand overseas, ensuring that the bank adapts well to the changing conditions,” he said

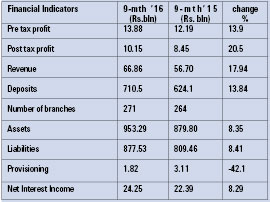

Commercial shows growth amidst rate hikes

The bank’s gross and net non-performing loans (NPL) ratios improved to 2.49 per cent and 1.26 per cent respectively from 2.74 per cent and 1.41 per cent at the end of 2015., the release said. “These ratios were 3.01 per cent and 1.52 per cent at the end of the third quarter of last year.”

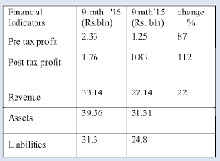

The bank’s interest margin reduced to 3.53 per cent at the end of the nine months reviewed, principally due to the rising costs of funds. Return on Assets (RoA) before tax improved to 2.02 per cent per cent compared with 1.95 per cent for the first nine months of that year, it added.

“As a group, Commercial Bank, its subsidiaries and associates reported profit before tax of Rs 14.006 billion for the nine months ending 30th September2016, an improvement of 14.48 per cent.” Profit after tax of the group for the period grew by 20.87 to Rs 10.195 billion.

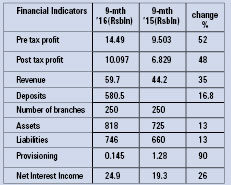

HNB happy with performance

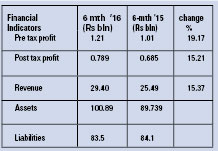

The increase in profits resulted in the bank delivering a high return on equity of 19.64 per cent, significantly higher than the 14.62 per cent achieved in the corresponding period of the previous year, a HNB media release said. MD/CEO of HNB Jonathan Alles has said: “Our efforts to adopt a dynamic service and sales culture combined with an unwavering commitment towards maintaining asset quality and operational excellence has resulted in a very strong all round performance. I would like to thank all our staff for their untiring efforts and contribution towards finalising an aggressive five year strategic plan”.

Core banking operations contributed strongly to HNB’s results with net interest income growing by 28.8 per cent year on year (YOY) to Rs 24.9 billion.

Growth in the bank’s interest income was driven by robust growth of 21 per cent YoY in assets, the release said. “Despite 2016 witnessing a substantial shift towards higher yielding deposits, the bank was able to maintain a rupee CASA ratio of 38.4 per cent. The total deposit base grew by 16.8 per cent YoY to Rs 580.5 billion.”Net Fee and Commission income grew by 22.7 per cent YoY to exceed Rs. 5 billion with credit cards and trade finance being the main contributors.

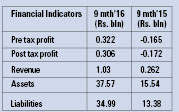

First Capital shows treasury profits

The group’s primary dealer arm, First Capital Treasuries PLC, was the leading contributor towards the financial results for this period, a company media release said.

“The group will continue to build on the current growth momentum across all its subsidiary businesses while expanding on research and equity advisory services,” Dilshan Wirasekara, CEO of First Capital Holdings PLC has said.

The Capital Markets Advisory of the Group, First Capital Limited, which specialises in structuring and placement of corporate debt securities, successfully mobilised Rs. 6.8 billion through listed debentures, asset backed securitisations and other corporate debt securities, according to the release.

“Research driven investment recommendations published by First Capital Equities (Private) Limited the Group’s stockbroker business have collectively outperformed the broad market index ASPI and the liquid counter index S&P SL20 in the past two years.”

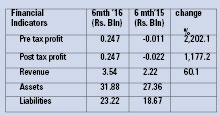

Profits rise at MTD Walkers PLC

The increased profitability of the group during the quarter is greatly due to the performance of the real estate sector, which MTD Walkers PLC ventured into recently through its subsidiary Walkers CML Properties (Pvt) Ltd.

“The results for this quarter have been encouraging and we hope to capitalise on our upcoming projects to further improve our performance in the next quarter,” Viraj de Silva, Chief Financial Officer of MTD Walkers PLC said in a media release.

The release said that the integrated infrastructure and engineering solutions provider MTD Walkers PLC has posted a revenue of LKR 3.6 billion for the second quarter of 2016/17.

“The group has managed to increase its gross profit margin to 27 per cent up from 20 per cent in the second quarter last year in what continues to be a tough year for the construction industry.”

Earlier this year the company said it has expanded its operations to the Maldives. Walkers CML International (Pvt) Ltd, a subsidiary of MTD Walkers PLC, was incorporated in the Maldives to meet the growing demand of infrastructure development activities in the country.

Singer Sri Lanka shows resilient growth

During the first nine months, significant initiatives undertaken by the group included the launch of Singer’s own Credit Card with Visa; the launch of the new Singer Vista Smart TV range, wholesale marketing of Sony products and the opening of Digital Media Corners in retail shops, company said in a media release.

Asoka Pieris, Group CEO has said, “Our growth momentum reflects the group’s capitalization of new business opportunities, especially from acquisitions and other initiatives.”

Consumer demand continued to grow despite the increase in interest rates, exchange rates, VAT and inflation, the release said.

“Traditional products, such as Refrigerators, Televisions and Sewing Machines continued to do well. Growth in major thrust product categories were even stronger: Smartphones grew by 63 per cent, Air Conditioners by 59 per cent, Air Coolers by 30 per cent, Water Pumps by 29 per cent, Furniture by 24 per cent, Computers by 15 per cent and Washing Machines by 18 per cent.”

During the year, Singer (Sri Lanka) acquired majority stakes in Singer Industries (Ceylon) PLCand Regnis (Lanka) PLC from its parent company Singer (Sri Lanka) B.V. resulting in a one-time gain on bargain purchase amounting to Rs. 507.7 million. Post- Acquisition Net Income of these two companies are consolidated in the group results of Singer (Sri Lanka) PLC. There was no impact on group revenue due to this acquisition.

Softlogic Holdings battling taxes

The release said that the group reported a cumulative revenue growth of 15.4 per cent to Rs. 29.4 billion with second quarter consolidated revenues increasing by 17.5 per cent to Rs. 15.1 billion. “Retail sector continued to lead its contribution to group revenue with 32.7 per cent up during 1HFY17 followed by ICT (31.3 per cent ), Healthcare Services (17.4 per cent ) and Financial Services (14.7 per cent).” The group’s fully-owned subsidiaries contributions have witnessed a gradual increase and are expected to perform better in the upcoming periods.

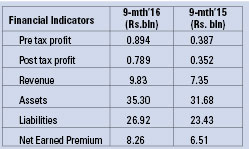

Janashakthi disburses Rs.5 billion in claims

“Achieving significant financial growth despite the spike in claims expenditure, resulting from the recent floods, further reaffirms our strong fundamentals and prudent reinsurance structure. I am confident that we will continue to progress along this growth trajectory towards attaining market leadership, while delivering greater value to all our stakeholders,” Prakash Schaffter, Managing Director of Janashakthi Insurance has said.

Janashakthi disburses Rs.5 billion in claims

The release said that the company entered into an agreement with Sanken Construction (Private) Limited (Sanken) in October 2015 to assign the leasehold rights of the property at No. 24, Staples Street, Colombo 02. “Approval for this transaction has been received from the Urban Development Authority (UDA) and the Cabinet of Ministers. The transfer of leasing rights will now be subject to additional fees levied by the UDA and as a result, profit on conclusion of this transaction is now estimated at Rs.361 million. In September 2016, the parties, JIPLC and Sanken, agreed to further extend the period of the agreement up to 31st December 2016 to finalise the formalities.”