Columns

The proof of the budget is in the implementation of it

View(s):By reducing the fiscal deficit to 4.7 percent of GDP the 2017 Budget has taken a significant step towards fiscal consolidation that is imperative for macroeconomic stability and sustained economic growth. This reduction in the fiscal deficit is a significant improvement from fiscal deficits of 7.4 percent in 2015 and an estimated 5.4 percent in 2016.

The lower deficit is expected to be achieved by an increase in government revenue to 15.5 percent of GDP from 13 percent of GDP in 2015. Next year’s government expenditure is estimated at 20.2 percent of GDP. If these goals are achieved it would be a significant improvement in the country’s fiscal performance.

The lower deficit is expected to be achieved by an increase in government revenue to 15.5 percent of GDP from 13 percent of GDP in 2015. Next year’s government expenditure is estimated at 20.2 percent of GDP. If these goals are achieved it would be a significant improvement in the country’s fiscal performance.

Scepticism

There is however scepticism on whether these budgetary outcomes could be achieved as the expenditure proposed in the budget does not appear to be consistent with the high expenditure in the promises and proposals in the Budget speech. Furthermore owing to the experience of last year when about 27 tax proposals were not implemented, there is also doubt in the minds of many that several tax measures would not be implemented this year too.

Promises to keep

This is particularly so with respect to education expenditure that was reduced in the appropriation bill for 2017. In contrast, the Budget speech waxed eloquent on many ambitious projects to improve the quality of education. These included the improvement of facilities in rural schools, the increase in the number of teachers, expansion in university education, new scholarships and financial assistance, health insurance for school children and iPads and computers for students. Most of these are much needed improvements and can contribute to the enhancement of the quality of education that is vital for development. Yet how can these be implemented with a budget allocation that is lower than that for the current year?

Conjecture

Conjecture

We can only speculate on several possibilities in the actual implementation of these promises. May be some of these programmes are mere political rhetoric and not intended to be fulfilled to the extent stated. This has been a frequent budgetary practice. It may be that some are to be financed by the recipients or from other sources.

Fiscal discipline

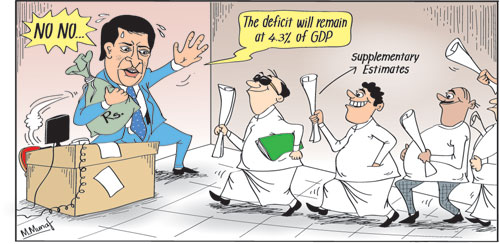

The history of our fiscal performance is that of revenue shortfalls and expenditure overruns. The Prime Minister and the Finance Minister have informed ministries that supplementary estimates would not be allowed. The containment of the budgeted fiscal deficit requires that there would not be overruns in expenditure. If this is achieved it would be a fiscal record. If there is increased expenditure the government must find new sources of revenue to contain the fiscal deficit to 4.7 percent of GDP. A strong political will is essential to contain expenditure to the budgeted figures.

Revenue

The increase in government revenue to 15.2 percent of GDP is a significant improvement in public finances. However the increase in revenue by over 2 percent next year is not an easy task as the capacity for tax collection is still weak and political pressures could make the government give in to political pressures on some taxes, as happened in the 2016 budget. Nevertheless the higher revenue target is a move in the right direction to find adequate fiscal space for needed developmental expenditure and for reducing the public debt.

Taxation

Some taxation measures in the budget are progressive. The proportion of direct to indirect taxation is estimated to have improved from 20:80 to 40:60. However direct taxation and indirect taxes have not gone far enough to ensure that high income earners pay their dues. As repeatedly argued in this column, progressiveness in taxation is not only indicated by the proportions between direct and indirect taxes, but whether the incidence of taxes fall on the affluent or the poorer sections of the community.

In a context when the affluent evade direct taxes, then indirect taxes that fall on the conspicuous consumption of the rich are the means to increase revenue. This budget has taken a few steps to impose such taxes, but not gone far enough. There have also been new taxes imposed such as on capital gains on transfer of properties. The removal of tax exemptions have also rendered the tax system more progressive and would rake in more revenue. In addition measures are afoot to bring into the tax net high income tax evaders. There could have been much higher expenditure taxes on luxury items, higher property taxes, increased licence fees on luxury vehicles, higher stamp duties on high value transactions and lavish expenditure.

Education

One of the most progressive steps taken in the budget is to increase expenditure in the development of rural schools and education infrastructure. The enhancement of education, especially in areas that support a higher technology-based economy are significant. The reform and expansion of education is vital for sustained high economic growth. However the budgeted figures for education do not appear to be adequate for such expenditure.

Regional and rural development

Plans to improve rural infrastructure, agriculture and related activities, increase lower income housing and establish industries in less developed areas are significant development policies if implemented effectively. However some of the priorities and specifics are questionable. Steel houses in warm locations, a high rise tower in the North are examples of distorted priorities.

Concluding comment

The 2017 budget is a move towards fiscal consolidation. However the fiscal deficit target of 4.7 percent of GDP could be achieved only if the taxation measures are effectively implemented and there are no expenditure overruns. Effective collection of revenue and careful management of expenditure are vital to achieve the lower fiscal deficit.

A vigilant monitoring of revenue collection and a preparedness to adjust taxes to achieve the revenue target is crucial. On the other hand, expenditure overruns should not be permitted. The government must stick to its commitment to not allow supplementary estimates and the Treasury must ensure that expenditure is within the allocated amounts. The government should not give in to additional salaries and other expenditures owing to popular demands.

In the event that there are expenditure overruns or taxation shortfalls, the government must take countervailing measures to increase revenue to ensure the fiscal deficit is contained below 5 percent of GDP. Midcourse fiscal changes must contain the fiscal deficit without reducing developmental expenditure.

Good budgeting is a difficult task for a dual controlled government and a political milieu that seeks more and more benefits, less taxation and higher government expenditure on welfare, subsidies and economic development.

Leave a Reply

Post Comment