Columns

Policies to overcome persistent balance of payments difficulties

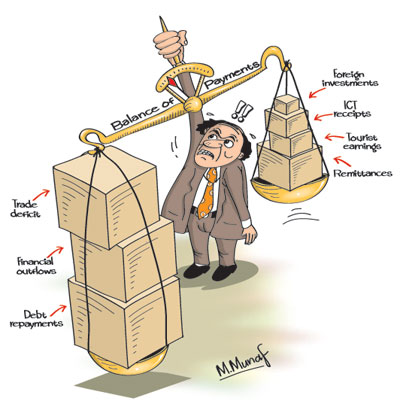

View(s):The persistent balance of payments (BOP) problems of the country must be resolved to ensure economic stability and long-term economic growth. Short-term measures like currency swaps, short-term borrowing and sale of assets could resolve the immediate crisis, but long-term measures are needed to stabilise the external finances.

The Government must address the inherent weaknesses in the balance of payments and resolve them in the next few years. Coherent, consistent and clear-cut economic policies are a foremost prerequisite for achieving stability in external finances. The lack of policy coherence and consistency and ineffective implementation of policies have been significant causes for the erosion of foreign investor confidence, outflow of capital and weakening of the country’s export potential. Some statements and actions of the government have also been deterrents and disincentives to foreign investments.

The Government must address the inherent weaknesses in the balance of payments and resolve them in the next few years. Coherent, consistent and clear-cut economic policies are a foremost prerequisite for achieving stability in external finances. The lack of policy coherence and consistency and ineffective implementation of policies have been significant causes for the erosion of foreign investor confidence, outflow of capital and weakening of the country’s export potential. Some statements and actions of the government have also been deterrents and disincentives to foreign investments.

Components of the BOP

The outcome of the country’s external finances is dependent on three components in the current account of the balance of payments: the trade balance, receipts from services and net financial transfers. If these generate a significant surplus it lessens the strain on the balance of payments. Net capital flows to the capital account of the balance of payments is important due to the high debt repayments and weaknesses in the external finances.

An effective resolution of the balance of payments difficulties requires a year-in year-out significant improvement in the trade balance, higher foreign investments, reduction of debt servicing costs and net foreign capital inflows. Each of these requires a whole array of macroeconomic policies.

Trade balance

At the root of the balance of payments problem is the persistent trade deficits. The country had a trade surplus only in five years since 1950 — mostly in the early years after independence. The last trade surplus was a small amount in 1977.

Trade deficits have been massive in recent years. These large trade deficits were one of the main strains on the balance of payments in the last three years. The massive trade deficit of US$ 8.3 billion in 2014 was surpassed in 2015 to reach US$ 8.4 billion. It is likely to exceed US$ 9 billion in 2016 as it had reached US$ 8.1 billion in the first eleven months.

Such large trade deficits strain the balance of payments to an extent when other favourable factors such as remittances and tourist earnings are unable to bring down the balance of payments deficit.

Services

Services

While the trade deficit is a huge strain on the balance of payments, workers remittances and earnings from tourism have more or less offset the trade deficit in recent years. In 2016, these two inflows of about US$ 10 billion (9.6 billion in the first 11 months) are likely to offset the trade deficit of around US$ 9 billion. An increase in earnings from ICT services is also expected to ease the current account of the balance of payments. However there have been net outflows from the CSE.

Capital account

The weakest component of the balance of payments is the capital account. This is owing to the huge foreign debt whose annual capital repayments and interest payments are a large drain on the reserves. The foreign debt of US$ 57.4 billion at the end of 2015 is now estimated at about US$ 63 billion. Interest payments and capital repayments of this high external debt continue to make the BOP vulnerable.

The debt-servicing costs absorb about one fourth of the country’s export earnings. Consequently the Government has to borrow to meet its foreign debt requirements. This debt burden that has serious repercussions on the external finances has to be addressed by policies that strengthen the trade balance, reduce financial outflows and increase foreign investments.

Long-term solutions

It is imperative to contain the trade deficit to a much lower amount to resolve the problems in the external finances. The trade deficit that is US$ 9 billion should be contained at around US$ 7 billion to generate a current account BOP surplus of over US$ 2.5 billion to meet the country’s debt service obligations and not increase the foreign debt. This has to be achieved by both an increase in exports and containment of import expenditure.

Export performance

The country’s recent export performance has been most disappointing. In 2015 exports decreased by 5.6 percent to US$ 10.5. In the first eleven months of 2016, exports were 2.8 percent less than in 2015. Exports have to be enhanced significantly to reduce the trade deficit.

The key to expanding exports lies in macroeconomic policies that are conducive to investments in exports, economic stability, regulations that don’t render exporting cumbersome and attraction of foreign investors to produce exports.

Sri Lanka’s exports have declined from as much as 30 per cent of GDP in 1970 to as low as 17 per cent in recent years, while other Asian countries have expanded their exports by leaps and bounds. While agricultural exports have declined, the growth in manufactures has been inadequate to finance increasing imports.

Imports

With limited prospects for increasing exports in the short run, a reduction in imports is crucial. This has to be achieved by monetary, fiscal and exchange rate policies that restrain imports. The Government must continue and strengthen its monetary and fiscal policies. The depreciation of the rupee, increased taxation of certain imported goods and tighter credit are likely to decrease imports.

However, despite these policies, imports increased marginally by 1.7 percent in the first eleven months of last year. One of the difficulties is in reducing capital imports. Imports of large machinery and transport equipment for large infrastructure projects such as the Colombo Port City are increasing investment goods imports. In the first eleven months of the year, investment goods imports increased by 13.7 percent from US 4.16 billion to US$ 4.74 billion.

On the other hand, consumer imports decreased by 8.4 percent and intermediate imports increased by just 1 percent. The trade deficit would have been much larger, if the fuel import expenditure had not declined significantly by nearly 14 percent due to lower international oil prices.

In conclusion

The state of external finances of a country reflects the management of the domestic economy. Domestic policies must be formulated and implemented to increase investment, reduce the fiscal deficit, encourage exports, restrain imports and attract foreign investors. The weak external finances reflect bad economic policies. The long-term improvement in external finances is dependent on correct economic policies.

The inadequate resolution of the fundamental flaws in the country’s balance of payments, the inability of the country to attract foreign investments, the non-realisation of expected inflows of capital to the government and the outflow of financial investments in the treasury bond market are symptomatic of poor economic management.

Leave a Reply

Post Comment