Columns

Sri Lanka’s massive foreign debt generates a debt trap

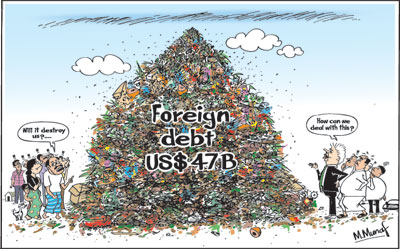

View(s):Sri Lanka’s foreign debt has reached proportions when its servicing is a serious problem. It has to borrow to service the massive foreign debt of around US$47 billion that has accumulated mostly over the last decade. Undoubtedly the country is in a foreign debt trap as the government must borrow to meet annual debt repayments and interest obligations.

Debt servicing

Debt servicing

The debt servicing cost (interest payments and debt repayment) that was US$1.8 billion in 2015 increased to US$2.4 billion last year. What is particularly worrisome is that although debt repayments are modest this year, they are expected to be heavy in the foreseeable future. They are estimated to rise to a mammoth US$4 billion in 2018-19. An underlying reason for the difficulty in servicing the debt is due to the large borrowed funds being utilised in high cost unproductive infrastructure projects that have not increased tradable goods.

Growth of foreign debt

Foreign debt increased significantly between 2000-2009. It doubled from US$9 billion in 2000 to US$ 18.6 billion in 2009. In the next five years it more than doubled and at the end of 2014 foreign debt had risen to US$ 42.9 billion or 53.6 percent of GDP.

The foreign debt continued to grow in the last two years under the new government. At the end of 2015 the foreign debt reached US$ 44.8 billion or 54.4 percent of GDP and by July 2016, it reached 47.4 billion. It dipped slightly to US$46.6 billion at the end of January 2017. The current foreign debt is estimated at about 55 percent of GDP.

Although debt repayments was one reason for increasing foreign borrowing in the last two years, the economic policies pursued by the unity government too contributed to the need to borrow. Monetary and fiscal policies aggravated the problem by increasing the trade deficit.

Benefits of foreign borrowing

Benefits of foreign borrowing

Foreign borrowing is not intrinsically disadvantageous. In fact it is a useful means of supplementing inadequate domestic savings for investment and for undertaking large infrastructure projects that could enhance economic development over time. Foreign loans can assist in resolving constraints in foreign resources for development and also assist in overcoming temporary balance of payments difficulties. Foreign borrowing can enhance economic growth by spurring an economy to higher levels of economic growth than its current resources permit.

However the extent of borrowing, interest costs and terms of borrowing of foreign funds, and most important, the use of funds have significant implications for containing foreign debt to manageable proportions and ensuring debt servicing.

Foreign borrowing could have either beneficial or adverse impacts on long-term economic stability and development. Therefore management of foreign debt servicing costs is vital for economic stability and long term economic development, especially for a trade dependent export-import economy to avoid a debt trap. Economic mismanagement of the past political leadership and the current unity government are responsible for the impasse that the country is currently in.

Use of foreign funds

The crux of the foreign debt issue lies in the manner in which foreign funds are utilised, the costs of the borrowing and the repayment periods. These must ensure the capacity to repay the debt without adverse consequences of the debt servicing costs on the economy. The large increase in the country’s foreign debt in recent years has become a serious problem owing to their use on large infrastructure development projects not yielding returns to repay the debt obligation. Monetary and fiscal policies have aggravated the problem by increasing the trade.

Deficit foreign debt sustainability

Is Sri Lanka’s foreign debt sustainable? The World Bank and IMF defines foreign debt sustainability as a situation when a country “can meet its current and future external debt service obligations in full, without recourse to debt rescheduling or the accumulation of arrears and without compromising growth”. On this definition Sri Lanka’s foreign debt is not sustainable. It is in foreign debt trap.

In conclusion

Sri Lanka’s foreign debt of US$47 billion that is about 55 percent of GDP has reached a point when its servicing requires further foreign borrowing to service the foreign debt. Undoubtedly the country is in a foreign debt trap as the government must borrow to meet annual debt repayments and interest obligations.

An underlying reason for the difficulty in servicing the debt is due to the large borrowed funds being utilised in high cost unproductive infrastructure projects that have not increased tradable goods. The debt servicing cost (interest payments and debt repayment) that was US$1.8 billion in 2015 increased to US$2.4 billion in 2016. Of serious concern is that although debt repayments are modest this year, they are expected to be weighty in the foreseeable future. Debt repayments are expected to increase to a mammoth US$4 billion in 2018-19.

There is no doubt that the country is in a foreign debt trap. Comparisons with other country debt to GDP ratios are irrelevant as many of them do not have serious balance of payments difficulties. The fact is that we have mismanaged our foreign borrowing by using the large amount of borrowed funds in unproductive infrastructure projects and living beyond our means.

It is vital that this year’s reduced repayment be used to strengthen the balance of payments to enhance the capacity to meet the large repayment obligations in 2018-2019. Appropriate monetary and fiscal policies and economic reforms are vital to ensure debt sustainability and avoid an impending crisis in the external finances. The reform and privatisation of loss making state owned enterprises are an important means of reducing the debt burden. Bold decisions that are politically unpalatable must be taken to resolve the debt crisis.

Estimates of foreign debt servicing obligations vary. The country’s indebtedness could be even higher than those mentioned above. One reason for this is that these are based on loan and interest payments for government project loan repayments and international sovereign bond repayments only. The burden of debt could be higher when other debt is included.

Leave a Reply

Post Comment