Columns

Loosening the debt trap and resolving the foreign debt crisis

View(s):Resolving the foreign debt trap discussed last Sunday is a mammoth task as the annual debt servicing costs are very heavy in the next few years. Meeting the impending debt repayments for this year and next year are immensely difficult. The debt repayment of as much as US$4 billion in 2019 is unthinkable at present. The severity of the problem is such that further foreign borrowing is likely to be needed to meet this year’s debt servicing obligations.

Mitigating the crisis

Mitigating the crisis

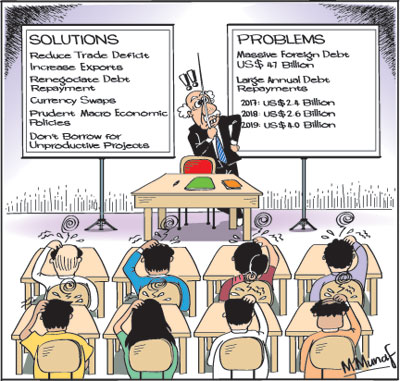

Three vital steps towards mitigating the impending debt repayment crisis are recognition of the problem and the need for strong measures to cope with it, monetary, fiscal and exchange rate policies geared to improve the balance of payments by reducing the trade deficit and professional management of the debt at this critical juncture that requires a judicious use of financial instruments in a manner that minimises debt servicing costs in the future. The prudent management of the foreign debt also requires clear cut bold economic decisions.

Debt repayments

Debt repayments

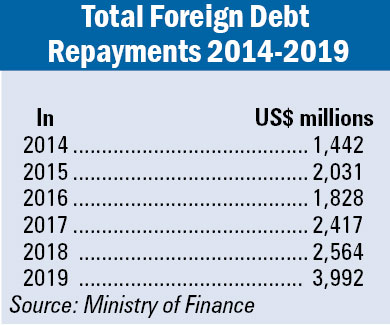

Foreign debt and repayments have been increasing since the unity government took office in 2015. According to the Treasury, debt repayments increased to US$2 billion in 2015 from US$1.4 billion in 2014. In 2016 debt repayments reached US$1.6 billion.

These figures are much less than those of the Central Bank as the Treasury figures only contain project loans and loans taken by the government. The Central Bank figures are higher as they contain all foreign loan liabilities. However the lower figures of the Treasury are adequate to demonstrate the severity of the problem.

Next three years

The impending debt repayments in the next three years are onerous. Debt repayments are increasing this year to US$2.4 and to US$2.5 billion in 2018. Then it balloons to as much as US$4 billion in 2019. Debt repayments in the last two years were a serious burden and resulted in further foreign borrowing.

Trade deficit

A significant balance of payments (BOP) surplus would ease the repayment of debt. To achieve this, the trade deficit must be contained at a much lower amount than currently. Recent balance of payments outcomes have been woefully unsatisfactory primarily owing to the large trade deficits. In 2015 the trade deficit reached a massive US$8.4 billion only to be surpassed in 2016 to US$9.1 billion. Consequently, there were balance of payments deficits.

The overall balance of payments had a deficit of US$1.5 billion in 2015 and US$0.5 billion in 2016. This was despite the trade deficits being offset by remittances from abroad, earnings from tourism and other service receipts. Had the trade deficit been contained to about US$ 7.5 billion, there would have been overall BOP surpluses.

BOP surplus

In the current crisis situation a BOP surplus of about US$2.5 billion is needed to make a dent in the debt profile. The containment of the trade deficit to below US$8 billion is vital to enable a significant contribution to the external reserves to assist in the containment of the debt servicing burden. Fiscal, monetary and exchange rate policies must ensure that the trade deficit is contained at about US$7.5 billion.

Debt management

Debt management

The magnitude of the debt repayment problem is too high to be resolved by improvements in the balance of payments alone. It is therefore essential that a professional management of the foreign debt that enables repayment obligations be put in place. Astute use of financial instruments would be needed to achieve this. Overcoming the foreign debt repayment problem would require the use of several financial instruments including currency swaps, renegotiation of debt repayments over a longer period and redeeming high interest loans with lower cost borrowing.

The possibility of getting these arrangements are a serious challenge in a context when the country’s external finances are at a low ebb and the country risk is high. Nevertheless it is important to attempt such means of easing the debt repayment.

Economic reforms

Economic reforms are a vital part of the strategy to improve the external finances immediately and in the long run. Divesting of loss making state enterprises would strengthen the public finances. Sales to foreign investors would bring in foreign funds that would help redeem foreign debt. However there is doubt about these being implemented owing to public protests.

Despite the government’s undertaking to reform loss making state enterprises, the current political context and incessant protests make it difficult to implement significant reforms. This could also jeopardise receiving the remaining tranches of the IMF Extended Fund Facility (EFF) that would aggravate the debt repayment.

The proposed Chinese investments in Hambantota of about US$2 billion would have made a significant contribution towards debt repayment.

Way Forward

The magnitude of foreign debt repayment is such that a multi-pronged strategy is needed to ensure that the country does not default in its repayments. In as far as this year’s challenge is concerned, it is important to generate a balance of payments surplus of about US$3 billion to ease loan repayments. This can be achieved only if the trade deficit is reduced from last year’s US$9.1 billion to about US$8 billion or less. A drastic reduction in imports is essential to achieve this as exports can be expected to increase only moderately.

Realistically the debt repayment obligations of this year would be difficult even with these improvements. Therefore prudent debt management through currency swaps, renegotiations of loan repayments, easing of interest costs by redeeming high cost borrowings with lesser cost loans and longer maturity periods and debt equity swaps are vital.

The strengthening of the economy by economic reforms and appropriate macro economic policies is vital to resolve the long term weaknesses in the external finances. Hard policy decisions to introduce economic reforms that propel the economy to a higher growth trajectory are essential. The fundamental weakness in the polity is that it shuns such decision making to aggravate economic problems.

The fundamental lesson that must be learnt is that foreign borrowings must be used for projects that are productive and bring returns above the costs of the borrowing. Even productive foreign loans with a long gestation period and short maturity create foreign debt liquidity problems. Foreign loans should be used for investments that increase tradable goods.

Leave a Reply

Post Comment