Columns

Economic performance in 2016: Analysis and reflections

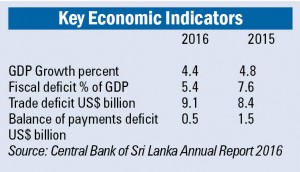

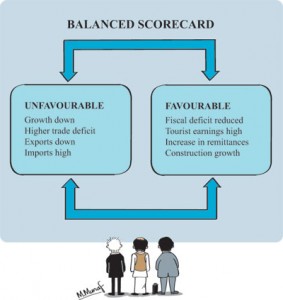

View(s):Economic performance is mostly judged by the annual growth in Gross Domestic Product (GDP). Accordingly, the lower economic growth of last year of 4.4 percent compared to 4.8 percent in 2015 is a setback. It is not this dip that is of significance. It is the inadequate performance in vital sectors and subsectors of the economy that should be the drivers of the country’s economic transformation that is disconcerting.

Analysis of economic growth

Analysis of economic growth

There were some extenuating factors, especially in the agricultural sector that caused the dip in growth. The drought impacted on agricultural growth as well as on hydroelectricity generation. Sluggish global economic growth and disruptive geopolitical factors impacted adversely on exports.

Agriculture

The agricultural sector contracted by 4.2 percent last year and contributed only 7.1 percent to GDP. This contraction in agriculture was not entirely due to adverse weather. An ill advised policy decision to not import certain fertilisers reduced tea production in particular.

Manufacturing

The manufacturing sector that accounts for 26.5 percent of GDP grew by 6.7 percent. However this growth was achieved, not by an expansion in manufacturing, but increases in construction and mining that are subsectors of the Industrial sector in the national accounts. The growth in manufacturing was only 1.7 percent.

The growth in construction results in increased imports, as it has high import content. This import bias is clearly seen in the fact that investment goods imports increased by 13.8 percent to a mammoth US$5.2 billion in 2016. In contrast, industrial exports fell 1 percent. This implies that even the growth in manufacturing was mostly for domestic consumption.

Services

The services sector that is the largest sector in the economy contributing 56.5 percent to GDP grew by 5.3 percent. Financial services, communications and transport were significant contributors to this growth. The expansion of tourism contributed much to the growth in services and more significantly to foreign exchange earnings of US$ 3.5 billion.

Import dependency

The preceding analysis demonstrates that the economy is an import dependent one rather than an export led one. Economic growth does not necessarily lead to an improvement in the balance of payments; in fact it could have an adverse impact. This is the fundamental structural problem that has to be addressed.

Exports

The economic growth of last year did not result in an expansion of exports. On the contrary, there was a 2.2 percent decline in exports. The two largest exports—tea and garments did not perform well. Garments exports grew by only 1 percent and tea export earnings fell by 5.3 percent.

Agricultural exports

Agricultural exports

In the case of agricultural exports there were extenuating factors both on the supply and demand sides. Owing to a prolonged drought and a misguided fertiliser import restriction, tea production fell. The unavailability of Glyphosphate, an herbicide that is vital for weed control, especially as manual weeding is not feasible due to labour shortages, reduced tea production.

On the demand side, disruption of Middle Eastern markets owing to geopolitical conditions and depressed incomes from oil exports impacted heavily on the demand for tea. Consequently tea exports declined by 5.3 percent and all agricultural exports declined by 6.3 percent.

Industrial exports

In 2016 manufacturing exports decreased by 1 percent from that of 2015. This implies that even the minimal growth of manufacturing fed mostly the domestic market rather than exports. While manufacturing exports fell, imports grew substantially to cause an unprecedented US$9.1 billion trade deficit that was the root cause of the balance of payments crisis.

Remittances and tourism

Remittances and tourism

In 2016, as in many past years, this weakness in the trade balance has been buttressed by large amounts of remittances from abroad. Remittances last year increased by a further 3.7 percent to US$7.2 billion and offset 79 percent of the trade deficit. The other favourable development was the continuing expansion in tourism. Tourist earnings increased by a massive 18 percent to US$3.5 billion.

Remittances and workers remittances that together amounted to US$10.7 billion more than offset the trade deficit of US$9.1 billion. Despite this, the overall balance of payments was in deficit by US$ 0.5 billion million owing to debt servicing payments and the outflow of capital, especially from the treasury securities market. This also underscores the vulnerability of the external reserves of the country owing to the large debt repayments.

Structural weaknesses

What these developments imply is that there are fundamental structural weaknesses in the economy. Economic growth leads to large trade deficits and balance of payments difficulties. The economy remains import dependent and not export led. Exports are only about 55 percent the value of imports.

Fiscal deficit

The bright spot in last year’s economic performance was the reduction of the fiscal deficit to 5.4 percent compared to a very high deficit of 7.6 percent in 2015.This was a significant achievement of the government.

Containing the deficit is critical in stabilising the economy and ensuring good macroeconomic management. Hopefully the taxation reforms and more efficient tax administration would continue to enhance government revenue and enable the fiscal deficit to be brought down to 3.5 percent of GDP in 2020.

It is important that the reduction of the fiscal deficit is achieved by an increase in tax revenue rather than the curtailment of development expenditure that are needed for long run economic development.

Economic reforms

The Annual Report of the Central Bank highlighted the serious structural weakness in the economy and urged the government to implement reforms speedily: “The performance of the Sri Lankan economy in 2016 reconfirmed the necessity to address the deep rooted structural issues, in order to enable the country to progress towards a higher growth trajectory”.

Furthermore it points out that “it is essential that such policies are implemented swiftly with consistency in order to improve productivity and efficiency of the economy and to attract much needed foreign direct investments (FDIs) and boost investments from the domestic private sector, while seamlessly integrating with the global production networks.”

Final word

The sixty seventh Annual Report of the Central Bank for 2016 is the source of the data, facts figures and information for this comment is more objective, forthright and balanced in content and more elegant in presentation than those of several preceding years. It brings out the weaknesses and vulnerabilities of the Sri Lankan economy and the need for immediate implementation of economic reforms. Its message on the need for reforms is loud and clear.

Leave a Reply

Post Comment