Columns

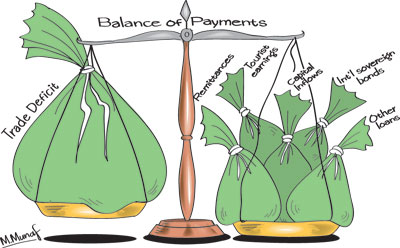

Balance of payments surplus despite large trade deficit and lower remittances

View(s):A balance of payments surplus of about US$1.6 billion was achieved in the first five months of this year in spite of the trade deficit increasing sharply, workers remittances decreasing and a slowing down in tourist earnings. This was owing to significant foreign borrowing and inflows of capital.

External reserves increased to US$6.8 billion by the end of July. With expectations of further capital inflows there is no likelihood of a balance of payments crisis. However this balance of payments and external reserves improvement should not blind us to the fundamental weaknesses in our balance of payments, particularly the large trade deficit.

External reserves increased to US$6.8 billion by the end of July. With expectations of further capital inflows there is no likelihood of a balance of payments crisis. However this balance of payments and external reserves improvement should not blind us to the fundamental weaknesses in our balance of payments, particularly the large trade deficit.

There are serious threats to the balance of payments due to decreased workers remittances from the Middle East and recent slowing down in tourist arrivals. These were strengths to the balance of payments in recent years.

Trade Balance

The fundamental weakness in the country’s balance of payments is the unsatisfactory trade balance. In the first five months of this year, the trade deficit expanded to as much as US$4.2 billion. This increase in the trade deficit by 23.5 percent in the first five months of 2017 compared to US$3.4 billion in the first five months of last year is alarming. If this trend continues the trade deficit is likely to reach as much as US$10 billion or more. However there could be an improvement in the trade balance if the surge in exports of recent months gains momentum and imports of fuel decrease.

Massive trade deficit

This widening of the trade deficit, despite an improvement in exports since March this year, has been brought about entirely due to a significant increase in imports that have nullified the gains in export earnings. During the first five months of 2017, exports grew by 4.3 per cent, while imports increased by 8.6 percent.

The trade deficit of US $ 4.2 billion in the first five months of the year is massive. It will certainly strain the balance of payments, especially as the downward trend in remittances would not be as much of an offsetting factor, as has been in recent years, when remittances and foreign exchange earnings from tourism have been increasing.

Exports

Exports

Sri Lanka’s export earnings expanded by 4.3 percent to US$4.4 billion during the first five months of 2017 mainly due to higher exports of tea, spices and seafood. However, export earnings from textiles and garments, gems, diamonds and jewellery and food, beverages and tobacco declined during the first five months. Exports are likely to increase during the rest of the year owing to higher exports of tea and fish. There is an expectation of increased garments exports and other manufactured items too.

Imports

Increased expenditure on imports by 12.6 percent to US$8.6 billion during the first five months of 2017 was mainly responsible for the deterioration in the trade deficit. Imports increased substantially due to higher imports of fuel, rice and gold. Imports of fuel increased by 63 percent, rice imports increased by more than twenty-fold and gold imports increased by 102 percent.

Drought conditions that destroyed as much as 40 to 50 percent of the rice crop necessitated the huge increase in rice imports. Both rice and wheat imports are likely to increase in the second half of the year as well. Imports of machinery and equipment, personal vehicles and other imports would have to be in check during the rest of the year.

Workers remittances

As a result of political convulsions and adverse economic conditions in the Middle East, workers remittances declined for the third consecutive month in May 2017. Consequently, during the first five months of 2017 workers remittances declined by 5.8 percent to US$2.8 billion. If this declining trend continues, it would weaken the balance of payments significantly this year.

Tourist earnings

Tourist arrivals declined by 2.5 percent In May 2017. However, during the first five months of 2017 tourist arrivals grew by 4.8 percent compared to the corresponding period of 2016 and earnings from tourism are estimated to have also increased by 4.8 percent to US$ 1.5 billion during the first five months of 2017.

The decline in tourism in May is disconcerting as it could be a trend decline. The garbage issue, the dengue epidemic, constant upheavals on the road and adverse travel adversaries have caused this setback to tourism.

Balance of payments surplus

In spite of the large trade deficit, decreasing workers remittances and a slowing down in tourist earnings, there was a balance of payments surplus of US$1.6 billion in the first five months of this year owing to significant foreign borrowing and inflows of capital.

According to the Central Bank, the government obtained a US$1.5 billion loan with a maturity period of 10 years by issuing an International Sovereign Bond (ISB) in May 2017 and a syndicated loan of US$450 million during the month. In addition, foreign investments in the CSE during the first five months of the year recorded a net inflow of US$191.1 million and foreign investments in government securities were a net inflow of US$109.8 million in May 2017. However, there was a net outflow of US$250.6 million from the government securities market during the first five months of 2017. These proceeds to the financial account helped strengthen the balance of payments.

Summing up

Despite the balance of payments surplus and the comfortable level of foreign reserves, the emerging balance of payments situation is alarming. The trade deficit could balloon to US$10 billion or more this year and the sluggishness in the growth of remittances and tourist earnings means that this large trade deficit would not be offset by these earnings. Therefore the current account deficit of the balance of payments is likely to be high this year.

The reduction of the trade deficit has become imperative owing to the slackening of workers remittances and tourist earnings that were two strengths in the balance of payments. Hopefully the recent export growth would gain momentum, imports would be curtailed and there would be a revival in workers remittances and tourist earnings.

The perilous state of the trade balance is leading to foreign borrowing. The increased foreign borrowing to support the balance of payments would increase the foreign debt burden further.

Leave a Reply

Post Comment