Columns

Balance of Payments surpluses vital to face large debt repayments in 2019

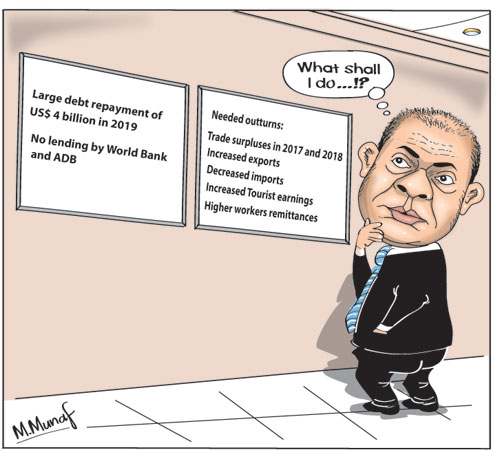

View(s):Two years from now in 2019 a massive debt servicing cost of US$4 billion is due. Therefore the impending challenges to the external finances in 2019 are quite formidable. How do we face this crunch in the country’s external finances? Meanwhile, the Prime Minister told parliament that the World Bank and the ADB will not be giving loans to Sri Lanka after 2019.

Prime Minister

Prime Minister

Prime Minister Ranil Wickremesinghe addressing members of parliament last week told them that Sri Lanka will not receive concessionary aid from the Asian Development Bank (ADB) and the World Bank (WB) after 2019. His assertion that the nation has to plan ahead, and devise methods of obtaining funds post 2019 is of much significance.

Implications

The serious implication of the Prime Minister’s statement is that the country would have to borrow funds at international interest rates. And these rates are dependent on a country’s risk rating that has not been particularly good. The non-availability of concessional aid from multilateral agencies is particular disadvantageous as large infrastructure projects that require massive investments and have a long period of gestation would not be financially feasible.

Foreign debt repayment

More serious than the stoppage of loans from the World Bank and ADB is the massive increase in foreign debt repayment obligations in 2019. While this year’s foreign debt obligations are about US$2.4 billion and increases slightly to US$2.6 billion in 2018, foreign debt servicing obligations increase sharply to US$4 billion in 2019.

Facing the crisis

In this imminent situation in external finances, it is imperative that the external reserves be strengthened to repay as much of the debt repayments as possible in 2019 with minimal foreign borrowing to avoid a foreign debt trap. This means that the balance of payments this year and in 2018 would have to generate a significant surplus.

The strengthening of the balance of payments implies the need to reduce the trade deficit to manageable proportions. A trade deficit of around US$8 billion in 2017 and 2018 would be needed to enable a significant balance of payments surplus. There are both favourable and unfavourable factors to achieve this.

The strengthening of the balance of payments implies the need to reduce the trade deficit to manageable proportions. A trade deficit of around US$8 billion in 2017 and 2018 would be needed to enable a significant balance of payments surplus. There are both favourable and unfavourable factors to achieve this.

Trade deficit

Reversing the growing trade deficit appears rather unrealistic in the context of the country’s growing trade deficits since 2014. The trade deficit increased from a little over US$8 billion in 2015 and 2016 to US$9.1 billion in 2016. And in the first half of this year it has increased further to US$4.7 billion. This increasing trend of trade deficit is hardly encouraging.

Yet, as pointed out in last week’s column, there are some hopeful signs that exports are reviving and that the trade balance could be reduced provided imports too are reined in.

Tea exports

A much improved performance in agricultural and industrial exports is vital for an improvement in the trade balance. Tea, the country’s main agricultural export has shown a resurgence and in the first half the year tea exports increased by 17.8 percent. The increasing trend in international prices must continue to next year to ensure a significant enhancement of tea export earnings. On the production side too there has been an improvement both in low grown small holdings as well as on estates. The improved rainfall in the highlands and the easing of floods in the low grown areas of the South are the main reasons for this increased tea production and enhanced tea export surplus. If international prices for tea hold the contribution of tea export earnings could make a dent in the trade deficit.

Fish exports

The other favourable development is the surge in sea food exports. In the first half of this year sea food exports, especially to the EU, increased by 17.4 percent. This increasing trend of sea food exports could also make a significant contribution to export earnings during the rest of the year and next year.

Industrial exports

The main industrial exports have not increased. In the first half of the year garment exports declined by 5.6 percent. As garment exports constitute about 40 percent of the country’s exports, it is imperative that there is a resurgence in garment exports to enhance export earnings. Garment exporters are confident of a swell in exports to the US later this year and the next.

Prospects

There are signs of an improved export performance with tea, fish and rubber exports expanding. Garment exports too must increase to ensure a significant growth in export earnings. The trade deficit can be contained only if imports are also restrained by appropriate monetary and fiscal policies that restrain imports. The resurgence in the growth of remittances and tourist earnings would make a significant improvement to the balance of payments.

Imports

Increased exports should be complemented with a restraint on imports. One of the recent deficiencies in our trade balance has been the increase in imports that has offset increased exports. Monetary and fiscal policies must ensure that non-essential imports do not increase significantly. Fuel imports are likely to fall owing to lesser need for thermal generation of power with higher rainfall enabling higher hydro generation of electricity.

Remittances and tourist earnings

Two discouraging features in the balance of payments has been the reduced workers’ remittances this year and the slowing down of growth in tourist earnings. One can only hope that the geopolitical factors responsible for the fall in remittances would be resolved and that the growth in remittances would resume.

Similarly, the setback to the tourist boom has to be arrested. An improvement in the country’s environment, especially with respect to the dengue epidemic and garbage disposal, could assist in enhancing tourist arrivals and tourist earnings. These are two of the most significant contributors to the balance of payments in recent years. They have offset the trade deficits in several years.

Imperatives

It is imperative that the country achieves a balance of payments surplus this year and in the next so as to reduce the need for fresh commercial borrowing to meet the large debt repayments in 2019. To achieve this it is vital to contain the trade deficit to around US$8 billion. This in turn requires an improvement in export earnings of both agricultural and industrial exports.

Leave a Reply

Post Comment