Columns

Will the new Inland Revenue Act enhance revenue and achieve fiscal consolidation?

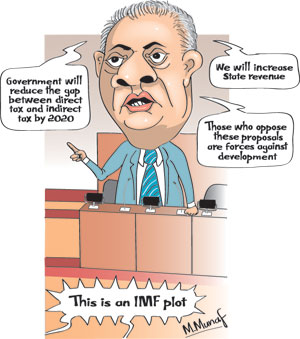

View(s):The three main objectives of the new Inland Revenue Act are to reduce the fiscal deficit, increase revenue and move towards a more progressive system of taxation. All three of these objectives are vitally important for the economy. To what extent is the government likely to succeed in achieving these important economic objectives?

Increase in revenue

Increase in revenue

The new Inland Revenue Act’s objective of increasing government revenue from its exceptionally low level is vital to achieve fiscal consolidation. Reducing the fiscal deficit to a small proportion of GDP, while increasing development expenditure is crucial for economic stability and growth.

The country has been plagued by an extraordinarily low level of government revenue in recent years. The revenue to GDP ratio has declined despite an increasing trend in per capita income. Government revenue that was around 20 percent of GDP several decades ago, fell to around 10 percent of GDP in 1990. One of the achievements of the government was that it increased it to 14 to 15 percent in 2014-2016. Revenue is expected to increase to 17 percent next year and to 20 percent in 2020. Although it is difficult to assess precisely by how much revenue would increase, the provisions of the new Revenue Act are likely to yield higher revenues.

Higher revenue

Higher revenue

Some of the provisions of the new Act that are likely to achieve higher revenue collection are: the elimination of most tax exemptions, higher tax rates on corporates, new taxes such as the capital gains tax and withholding taxes. Although these are likely to yield higher revenue, the extent of increased revenue would depend on the efficiency of the tax administration and the reduction of tax evasion and tax avoidance.

Tax base

The country’s tax base is small owing to extensive tax avoidance and tax evasion. The new legislation expects to broaden the tax base over time. The tax identification number for all over 18 years is a means towards achieving this. If its intent of broadening the tax base materialises revenues would increase.

Had some of the original proposals in the bill not been changed, revenue would have been higher. The exemption of religious organisations from taxation and reduction of tax rates on certain business enterprises has reduced potential revenue.

Although there has been a reduction in taxes of lower employment incomes, the rates of taxation are higher of higher personal and corporate incomes. On balance, the new taxes would yield higher revenue besides making the taxation more equitable. For instance, the introduction of the capital gains tax and several other new taxes will tax the affluent and increase revenue. All things considered, the new tax system is likely to increase revenue. However these increases would accrue over time.

Tax administration

An important factor in achieving higher revenues would be the efficiency and capability of the tax administration. An important cause of inadequate revenue collection has been tax evasion. While taxes such as the capital gains tax and withholding taxes would rake in such incomes indirectly, tax evasion is likely to persist on a large scale among some of the wealthiest businessmen and professionals, who are likely to continue large scale evasion of direct taxes. The introduction of a tax identification number for all those over 18 is a move in the right direction, but it will bear fruit over the long term when the system operates efficiently.

Fiscal consolidation

Bringing down the fiscal deficit to manageable proportions is the most important overall objective of this Act. This Act was designed to reduce the fiscal deficit by increasing revenue. As discussed earlier, government revenue is likely to increase, though it would not be as high as envisaged in the original law. However a progressive increase in revenue is likely in the next three years. This is highly dependent not only on the provisions of the law, but the efficacy of its implementation.

Government expenditure

On the other hand, it must be recognised that the expenditure side of the fiscal equation is also important to achieve fiscal consolidation. Government expenditure must be contained by reducing the huge losses of state enterprises that are a severe drain on government revenue. The reduction of these losses is vital to make a dent in the fiscal deficit and enable expenditure on productive activities such as economic and social infrastructure. The large expenditure on about a hundred ministers and other wasteful expenditure is required to be curtailed to complement the increased taxation. However this is not politically feasible. Instead remuneration of MPs is continuously increased. Such wasteful expenditure also has an adverse influence on tax payers who justify their tax avoidance and evasion on the imprudent expenditure and corruption of the government.

Progressive tax system

Several tax provisions will render the tax system more progressive. For instance, the threshold on tax liability earned income has been raised from Rs.600,000 to Rs. 1.2 million per year. On the other hand, those receiving incomes over Rs.300,000 per month would be liable for higher taxes. There is the reintroduction of capital gains taxes that would increase the tax incidence of the rich.

The government’s intention is to reduce its revenue from indirect taxes from 82 percent at present to 60 percent and increase direct taxes to 40 percent from the current 18 percent. The ultimate aim is to reduce indirect taxes to have a direct to indirect tax ratio of 40:60 percent. While this is to be achieved in the fullness of time, an incremental increase is likely in the next two years. One reasons for this gradual increase is that the effective implementation of the new tax system requires time and the efficiency of the Inland Revenue Department has to be improved and its staff strengthened.

Tax on food

One of the most regressive aspects of the country’s tax system is the high taxation on basic food items, such as wheat flour, wheat grain, sugar, milk, dhal and other basic items. Such taxation of food items is justified on the basis of providing incentives for domestic production. This is a half-truth. In fact it is the certainty of these tax revenues that makes governments resort to them. The reduction of these regressive taxes can be achieved only when other revenues are increased and wasteful expenditure is eliminated.

Concluding observation

Many provisions of the new Inland Revenue Act are expected to achieve a wider taxation base, reduce tax avoidance and tax evasion which will help the government to raise revenue in the long term. The extent to which revenue is increased depends not only on the legislation, but on the efficiency of the tax administration.

Leave a Reply

Post Comment