Columns

Environmental-friendly budget must achieve fiscal deficit target for economic stability and growth

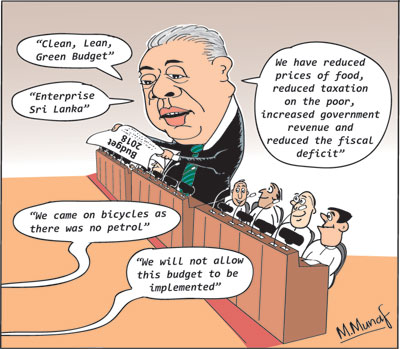

View(s):The 2018 Budget speech of Finance Minister Mangala Samaraweera on Thursday was a long recitation of programmes to usher in “Enterprise Sri Lanka” and promote an environmental-friendly country. The Minister promised assistance for the development of small and medium enterprises (SMEs), information technology and technical skills, the expansion of medical education and the reduction of para tariffs to spur exports.

Although a large number of government programmes incur additional government expenditure, the fiscal deficit was expected to be reduced to 4.8 percent of GDP next year. Achieving this target is essential for economic stability and economic growth.

Although a large number of government programmes incur additional government expenditure, the fiscal deficit was expected to be reduced to 4.8 percent of GDP next year. Achieving this target is essential for economic stability and economic growth.

Recent budgets

Budgets of recent years have been a long list of what the government expects to do in the coming fiscal year and beyond. It is no longer a clear statement of government expenditure and government revenue and the measures by which it hopes to finance its expenditure. New taxation measures that are an integral part of a budget were mentioned, but there was no detailed and systematic presentation of the specific revenue derived from taxation measures.

The two hour forty five minute speech hardly presented a conventional budget. That was left to the accompanying book titled Budget 2018 that gave the budget details. The Appropriation Bill, presented by Finance States Minister Eran Wickremaratne on October 9, indicated the Government’s expenditure and the expected collection of revenue.

Budget deficit

The Finance Minister indicated that he would bring down the fiscal deficit to 4.8 percent of GDP in 2018 and to 3.5 percent in 2020. This objective of achieving a lower fiscal deficit is vital for macroeconomic stability and economic growth.

Continued vigilance to not increase government expenditure is essential to ensure that there are no overruns in government expenditure. Far too often there have been revenue shortfalls and expenditure overruns. This must be averted to ensure that the fiscal deficit is contained at the targeted 4.8 percent of GDP.

The next few months being an electioneering period does not augur well for fiscal discipline; that would be more difficult due to political compulsions. In the event there are expenditure overruns owing to populist measures, the Government must take countervailing actions to reduce other expenditure or introduce new taxes.

Revenue

Revenue

The budget expects to raise revenue to 16.3 percent of GDP next year, mainly through the tax reforms of the new Inland Revenue Act that expects to eliminate most tax exemptions, increased taxes of higher income and corporate taxes, increased taxes and expanding the tax base. However much of the success in this bid to increase revenue depends on an effective tax administration. One positive development has been increased revenue collection this year.

Expenditure

Government expenditure is expected to increase to Rs 3 trillion. The numerous schemes to promote exports, develop information technology and assist Small and Medium Enterprises (SMEs), among other projects stated in the Budget, may exceed the budgeted figure.

SMEs

The intent to assist SMEs is an important move. Yet as several studies have shown the constraints faced by these small and medium enterprises do not relate to credit alone. SMEs often lack technical knowhow, management skills and financial knowledge. They have difficulties in accessing raw materials and their access to markets is limited. An effective multidimensional programme is needed to make SMEs a vibrant sector. The budget has enumerated the whole gamut of needed prerequisites, but their implementation is no easy task.

Environment

The budget’s emphasis on improving the environment is commendable and timely. Several measures announced in the budget are aimed at reducing pollution and improving the environment. These include the reduction of import taxes for electrical vehicles, a Rs. 50,000 increase in import taxes on diesel three-wheelers to encourage the purchase of electric three-wheelers, all government vehicles to be hybrid or electric by 2025, conversion of all vehicles into green vehicles by 2040.

Technical and medical education

The budget had a number of proposals to improve information technology skills, medical education and vocational training. These included the establishment of faculties of Medicine at the Wayamba, Moratuwa and Sabaragamuwa universities at a cost of Rs 1,200 million. Expansion of medical education in the country would not be easy, not only due to its higher costs, but also the requirement of qualified medical teaching staff. There are also restrictive practices among some section of the medical fraternity as witnessed recently.

Trade liberalisation

The liberalisation of trade is vital to enhance exports. The need to reform the highly protectionist trade regime by eliminating para tariffs (non-tax charges, levies, special taxes and fees on imports) has been recognised in the budget. The Government intends to remove para tariffs on 1,800 items in the next year. These para tariffs increase the costs of imports and thereby the input costs of manufactures, rendering our exports uncompetitive. Therefore, the budget proposal to eliminate them would make exports more competitive. This is an important measure to make the country’s exports more competitive. It may also encourage foreign investors to set up manufacturing plants for exports.

Tax on food

On the eve of the budget, the Finance Minister announced the reduction of import duties on a number of basic food items. The reduction of these regressive taxes would reduce the cost of living of the poorer sections of the population.

Bottom line

Many of the development programmes mentioned in the budget have been also figured in previous budgets. For example, the setting up of storage and freezer facilities had been mentioned years ago. The ground situation is that there have hardly been any significant steps towards realizing these goals. Will there be a difference in the next few years?

This budget is charting the right course towards fiscal consolidation and public spending. It also has the correct strategies. It is a manifestation of the vision envisaged in the Government’s Vision 2025 and the policies enunciated by the Prime Minister’s statement on the economy in October. On the other hand, there are several fiscal imperatives such as the privatisation of the large number of loss making enterprises and wasteful expenditure that have not been touched owing to political impracticalities. It is when these two issues are resolved that the country’s public finances could be strengthened.

The proof of the budget proposals and programs lies in their realisation. The political rhetoric of the budget speech must be transformed into institutional realities and realised targets. Too often in the past the promises in the budget, like promises in party manifestos, are hardly implemented.

Leave a Reply

Post Comment