Columns

Budget concerns: Fiscal deficit, greening environment, technological capacity and medical education

View(s):The financial objectives of the 2018 budget are to reduce the fiscal deficit, increase revenue and move towards a more progressive system of taxation. It also attempts to reduce the massive debt servicing burden. Trade liberalisation to expand exports and strengthen the current account of the balance of payments is also an important thrust of the fiscal proposals. All these objectives are vitally important for economic stability.

The broader and longer term economic and social objectives of the budget are the greening of the environment, strengthening the technical and technological capacity of the country, expanding medical education, developing tourism and affecting many much needed reforms. The economy cannot grow without these structural reforms and strengthening of social infrastructure.

The broader and longer term economic and social objectives of the budget are the greening of the environment, strengthening the technical and technological capacity of the country, expanding medical education, developing tourism and affecting many much needed reforms. The economy cannot grow without these structural reforms and strengthening of social infrastructure.

Debate

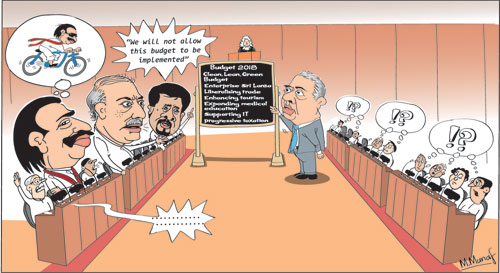

These objectives of the Budget are unlikely to be discussed meaningfully in the ensuing parliamentary debate and most discussions outside it. Political motives would dictate the parliamentary debate, while parochial interests and a myopic vision would colour other discussions. In these varied discussions the evaluation of the main thrust of the budget would hardly be the concern. This has been particularly so in recent years when Budgets have tended to be populist statements rather that the cornerstone of economic policies. And budget debates empty political rhetoric.

Serious discussions

Serious discussions on the Budget have however been mostly favourable. Accountants, economists, industrialists, chambers of commerce and other professional bodies have viewed it favourably and been in agreement with the general thrust and objectives of the Budget.

Criticisms

Criticisms

There have been critical comments on some taxation provisions of the budget, such as the tax on withdrawals from banks, as it is cumbersome and the same revenue could have been collected by other means. Although this tax is expected to be borne by banks and not passed on to customers, banks are likely to adjust their interest rates to cover the cost of the tax.

Other criticisms include the lack of measures to curb wasteful government expenditure, inconsistencies in vehicle taxes and criticisms on the reduction of the tax on beer and wine. Some of these criticisms may be taken into account and the proposals amended. Nevertheless, the general thrust of the budget is likely to improve the fiscal outturn and spur economic growth.

Achieving objectives

One pertinent question that is being asked is to what extent the government is likely to succeed in achieving these important economic objectives? There are underlying reasons why this question is being asked. For some time now, there were wide differences in the objectives and promises in budgets and their realisation. Furthermore, the objectives of reforming and expanding education, technological capacity and medical education are ambitious objectives that require considerable commitment, administrative capacity and technical skills for effective implementation.

Success imperative

The future of the country is dependent on the extent to which the budget proposals succeed in moving towards fiscal consolidation and strengthening the economic capacity of the country. To the extent the government succeeds to achieve the objectives, the country’s economic future would be hopeful.

The expansion and improvement of education, especially IT and other science and technology, is vital to escape the ‘Middle Income trap’ and move the country’s export capacity to hi-tech items in global value chains. The ambitious per capita income levels envisaged for 2020 and 2025 cannot be achieved without significant reforms and enhanced capacities for production.

Trade liberalisation

The liberalisation of trade envisaged in the Budget is vital to expand exports. The need to reform the highly protectionist trade regime by selectively eliminating para tariffs (non-tax charges and levies and special taxes and fees on imports) is a progressive move as these para tariffs increase costs of imports and thereby input costs of manufactures and renders our exports uncompetitive. The budget proposal to remove para tariffs to boost exports is an important step in the right direction and may also encourage foreign investors to set up manufacturing plants for exports. While the elimination of para tariffs would assist in making exports more competitive, there are supply constraints that both the government and private enterprise must address.

Environment

The budget’s emphasis on improving the environment by several measures is commendable. This forward thinking aimed at reducing pollution and improving the environment include: the reduction of import taxes for electrical vehicles; increase in import taxes on diesel three-wheelers by Rs.50,000 to encourage the purchase of electric three-wheelers; all government vehicles to be hybrid or electric by 2025 and to convert all vehicles to green vehicles by 2040.

This is an important move to improve the environment even though these measures may have adverse fiscal implications. These are measures in the long run interest of the country’s health and environment.

Technical and medical education

The budget had a number of proposals to expand medical education, information technology skills, and vocational training. These included the establishment of faculties of Medicine at the Wayamba, Moratuwa and Sabaragamuwa universities at a cost of Rs.1,200 million. Expansion of medical education in the country though essential, would not be easy, not only due to its high costs, but also the requirement of qualified medical teaching staff. The medical profession would need to give their fullest support to ensure the expansion of quality medical education.

Tourism

The Budget proposed several pragmatic approaches to the development of tourism. Its more multifaceted approach is more realistic than an expectation of large 5 star hotels alone to provide the huge expansion in tourism envisaged by the government. Besides, the expenditure of backpack tourists and bed and breakfast (B&B) travellers have an egalitarian distribution of tourism benefits. The benefits of tourism is not only the direct foreign exchange expenditure but the backward linkages of such expenditure. A notable feature of the budget was that it recognised the importance of maintaining and improving the environment, the safety of tourists and import policies that do not hamper tourism.

Concluding reflection

All things considered, the most important budgetary issue is the fiscal outturn. The 2018 Budget expects to bring down the fiscal deficit to 4.8 percent in 2018 and achieve the target of 3.5 percent of GDP in 2020. The taxation provisions of this budget have to be effectively implemented to achieve a lower fiscal deficit target and higher revenue collection.

There is much concern about government expenditure increasing owing to the impending elections that could generate severe political pressure for the government to adopt populist expenditure measures to gain popularity. Any such overruns in expenditure must be compensated in other areas of government expenditure to maintain the fiscal deficit target. This is vital to avoid an economic crisis.

Leave a Reply

Post Comment