Developing or developed nation? The answer in 2018

View(s):Students often seem to be writing at the outset of their economic tutorials that “Sri Lanka is a developing country”. During my time too, as students of economics, we gave the same designation to our country: “Sri Lanka is a developing country”. I studied Sri Lanka’s development history mostly from the scholars of our previous generation. I remember they had also written in the same way in their books and papers: “Sri Lanka is a developing country”.

Over the past 70 years after independence Sri Lanka has been a developing country, whereas “development” does not require more than 20 years. When are we going to write that “Sri Lanka is a developed country”?

As the New Year 2018 dawns, I thought of leaving you a note on this, stressing our need to see the big picture for the country. Most of the time we have been troubled too much about petty issues such as the price of a coconut or a tax on a potato.

What we need to do is to change our perspectives: “Think big and act bold”. If our politicians and policy makers do not have that perspective, the country will never move forward.

Highest in South Asia

Good is the enemy of best; being comfortable with “good” can destroy the potential for “best”. If you think what Sri Lanka has achieved so far is good and be content with that, you are renouncing the best.

Quite often we hear that Sri Lanka has done well so that the status of the country is higher than the South Asian average. From reliable sources, I can quote many similar statements on Sri Lanka reported even as early as in the 1950s. The following is one of them:

“In the past 75 years [from 1875-1950] the population of Ceylon has trebled. Yet typical living standards, while low in comparison with the West, have been maintained and almost certainly improved; at present they are among the highest in Southern Asia.”

This was quoted from Economic Development of Ceylon, a report authored by the World Bank mission which visited Sri Lanka in 1951 and which was published in 1953.

Isn’t it also exciting to know that the World Bank (then, International Bank for Reconstruction and Development – IBRD) sent a mission to Sri Lanka just few years after it began operations in 1946, being established in 1944?

Comparing countries

Since the 1980s, I used to compare Sri Lanka’s economic status with a few East Asian countries like Singapore, Hong Kong, and South Korea. I even referred to the fact that Sri Lanka and South Korea had the same per capita GDP of US$152 in 1960.

Because these countries have gone way ahead of Sri Lanka, later I used to compare Sri Lanka with countries like Malaysia, Indonesia, China, and Thailand. These countries have also surpassed Sri Lanka. Now I am quoting countries like India, Bangladesh and Vietnam – countries that are still poorer, but performing faster than Sri Lanka. I hope that in a few years’ time I will not have to choose another set of countries for comparison – perhaps, from the African continent.

Fundamental need

Economic growth is the most fundamental requirement of a high-performing economy. Growth will enable the economy to improve its capacity to achieve and sustain all other developmental needs of the people.

People’s income will rise from economic growth, and not from government budgets or trade union pressure, which would actually diminish growth prospects of a country. Jobs will be created from economic growth, and not from a minister’s job list, which would indeed weaken growth prospects of the country. Poverty will decline when income rises and jobs are created, and not from subsidies from the government, which would actually keep the poor as poor.

How much growth for how long? The experience from rich countries in Asia suggests that on average the rate of economic growth should be around 8 per cent – 10 per cent a year, and that it has to be sustained over a period of 10 – 20 years, until the economy enters a self-sustaining stage.

Growth: Origin and destination

Input of growth should originate from higher investment in business (in addition to human resource and technology advancement). Output of higher growth should be directed at the global market through increased exports of goods and services; the domestic market is too small to sustain such a higher rate of growth, not even for a big country like China or India.

File picture of Indian workers enjoying a break at a construction site in Colombo. A major labour shortage is looming amidst a construction boom as contractors desperately employ foreign workers. Despite a lot of development over the years, people here still hold the view that Sri Lanka is a developing country and has not progressed beyond that.

It is interesting to note that Sri Lanka haphazardly hit 8 per cent growth rate only in four random years in history (1968, 1978, 2010, and 2011), but it was never sustained.

It is even surprising to think that when everything looks pretty good today both internally and externally, we do not expect the economic growth rate to rise more than 4 per cent – 5 per cent a year. It is realistic to anticipate slower growth in the medium term. Nevertheless, it is much lower than the potential high growth especially when Sri Lanka has the opportunity to make the breakthrough.

The “Opportunity”

Sri Lanka is passing through or perhaps, passing by the biggest opportunity that it ever had throughout its post-independent history. Why?

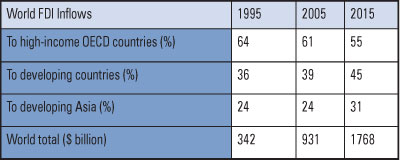

World capital outflows have grown exponentially, and have started diverting into developing countries in general, and into developing Asian countries in particular. Recessions in the West have been a cause of their capital outflows which have made the recessions even faster and sharper; this is the main source of investment funds in Asia.

In addition to the traditional export markets in the West, the world’s fastest-growing new markets are now in Asia: China and India alone account for one-third of the world population. China alone, being the second largest economy in the world, accounts for 15 per cent of the world GDP. The growing economic and political chaos in the West has put the growing Asian economies in the spotlight.

Internally, there are number of reasons to confirm it is the right time: Peace followed by the end of the war, non-reversing open economy model, and the historical convergence between the two main political parties all seem to be good, only if these factors are converted to be for good. Then, thinking big and acting bold for the country’s bigger picture would be a reality. Acting bold is risky in the short-run. But, not acting bold is risky all the time! Best wishes for 2018.

(The writer of this weekly column in the Business Times dealing with economic issues is Professor of Economics at the Colombo University)