Columns

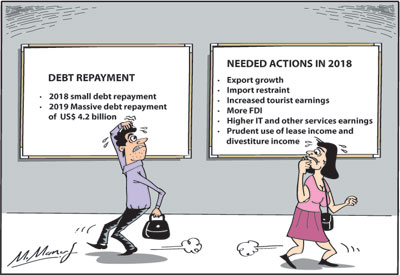

2018 crucial for strengthening foreign reserves to meet massive debt repayment in 2019

View(s):Improvement of the current account of the balance of payments is vital to strengthen the country’s external finances to enable repayment of the massive foreign debt repayment in 2019. Alternatively, further foreign borrowing to repay debt would increase future foreign debt liabilities.

What are the prospects of a substantial surplus in the current account of the balance of payments in 2018?

What are the prospects of a substantial surplus in the current account of the balance of payments in 2018?

Current account of BOP

The current account of the balance of payments (BOP) consists of the trade balance, service receipts and flow of investment capital. Therefore exports, imports, workers’ remittances, earnings from tourism, information technology (IT) and other services, such as payments for port services and foreign direct investments are the main current account items of the balance of payments. These non-debt creating inflows should be enhanced.

Trade balance

Trade balance

Since 1950, there has been a trade surplus in only about four or five years. Therefore the realistic objective should be to reduce the trade deficit as low as possible. Receipts from services should then be able to offset the trade deficit and generate a substantial current account surplus. In addition, larger foreign investments would increase the current account surplus of the balance of payments. What are the prospects of these being achieved?

Trade deficit

The reduction of the trade deficit is essential to improve the balance of payments. The growth in exports since March last year lends hope to achieving a lesser trade deficit this year. Exports are expected to have reached US$ 15 billion last year. If this momentum of export growth could be accelerated and imports contained at around last year’s level, the trade deficit could be reduced.

Lesser imports of rice and fuel and investment goods could enable this. However fuel prices are likely to rise. Monetary and fiscal policies should ensure that aggregate demand is contained to restrain import growth and not offset the gains in export growth.

Debt repayment in 2018 and 2019

There are no large repayments of capital this year. There are interest payments of US$ 600 million and US$ 2.5 billion of Sri Lanka Development Bonds (SLDB) maturing this year. This is expected to be met by the issuance of fresh SLDBs of US$ 3 billion. The total estimated foreign debt service payments, including interest and principal payments, amount to over US$ 2.9 billion in 2018.

In contrast, debt repayments in 2019 and beyond are massive. They are estimated to be as high as US$ 4.2 billion in 2019, almost twice the debt repayment for last year of US$ 2.2 billion. Debt repayments from 2020 to 2022 are estimated to be around US$ 3.6 billion annually.

Using the respite

The respite in debt repayments this year must be used to strengthen foreign exchange reserves to meet the massive debt repayment obligations in 2019. This must be achieved by an improvement in the trade balance and a surplus in the balance of payments. However as earned foreign reserves are inadequate to meet the massive debt repayments next year, a judicious resort to foreign borrowing is necessary as foreign borrowing to meet debt repayments increases future debt obligations.

Strategies

The government expects to meet this daunting challenge by strengthening foreign exchange reserves this year. At the end of 2017 foreign exchange reserves had risen to US$ 7.9 billion, one of the highest levels in recent years. Nevertheless much of this foreign reserve is from borrowed funds. It has also been reinforced by the Chinese investment of US$ 1.1 billion in the Hambantota Port.

Foreign borrowing

The Government has approved the raising of up to US$ 2 billion through foreign commercial borrowings and a further US$ 3 billion of Sri Lanka Development Bonds (SLDBs) to repay maturing SLDBs, loans and to finance development projects. This borrowing is in accordance with the 2018 borrowing programme outlined by the Central Bank to issue International Sovereign Bonds (ISBs) and Sri Lanka Development Bonds (SLDBs).

Prudent policy

The government has adopted a prudent policy of placing the lease income of properties, such as the Hambantota Port, and divestiture of state assets in a special fund for debt repayment. This is indeed a prudent move in debt management. However the amount of capital that could be raised by divestiture of state assets may not be much this year owing to little progress of reforms of loss making enterprises owing to a lack of consensus in the coalition government and violent opposition from opposition parties.

FDI

An important determinant of the ease in debt repayment would be the amount of Foreign Direct Investment (FDI) that flows in this year. There was an improvement in FDI last year when it is estimated to be about US$ 1.4 billion. If FDI could be increased to at least US$ 2 billion this year it would ease foreign debt repayment and reduce the need for foreign borrowing

Early borrowing

Central Bank Governor Dr. Indrajit Coomaraswamy is of the view that it is better to issue a sovereign bond as early as possible this year for three reasons. “One is that there are maturities at the beginning of the year in terms of ISBs, secondly, the consensus is that there would be three US interest rate hikes this year. So the earlier you go the better it is. Thirdly, if we bring significant amount of money, it reduces the pressure on interest rates and exchange rates.”

Summing up

The huge rise in debt repayment in 2019 and beyond implies the need to build up earned reserves in 2018. This in turn implies the need to strengthen the balance of payments, especially by reducing the trade deficit and increasing the current account of the balance of payments.

The balance of payments must be strengthened to cope with the impending high debt repayments in 2019 and beyond. Building up foreign exchange reserves to meet the large debt repayments with earned foreign exchange is imperative. To the extent that reserves are built up with earned foreign exchange, the country would need to borrow less in international capital markets for debt repayment. Strengthening of the balance of payments is vital to ensure that the country does not increase foreign debt. Otherwise, further borrowing for debt repayment would increase the country’s debt burden.

In view of the very large foreign debt repayments in 2019 and beyond, it is vital for the country’s balance of payments to generate a significant surplus. The key to such an improvement is a reduction in the trade deficit and enhanced earnings from services. Much higher earrings from tourism and IT services could ease the debt servicing burden. Fiscal, monetary and exchange rate policies must be geared to increasing exports and restraining imports.

Leave a Reply

Post Comment