Columns

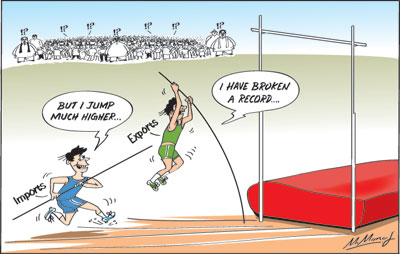

Trade deficit expands despite export growth: High import dependency persistent weakness

View(s):Despite an impressive export growth last year, the trade deficit of US$9.6 billion was the country’s highest trade deficit. Although exports reached a record high of US$11.4 billion, imports increased to US$21 billion. The high propensity to import has been the underlying cause for large trade deficits.

Import dependency

Import dependency

Imports exceeding exports has been a regular feature of the country’s trade balance. In the 67 years since 1950 there were only 5 years of a trade surplus. The last trade surplus was as far back as forty years ago in 1977, when a small trade surplus was achieved with stringent import and exchange controls. This reveals the endemic import dependency of the Sri Lankan economy.

Balance of payments surpluses

Nevertheless, the balance of payments has been in surplus in many more years owing to earnings from services, remittances and capital inflows. In recent years the significant growth in workers’ remittances have offset as much as about 70 percent of the trade deficit. This important source of funds has decreased last year by 1.1 percent mainly due to political upheavals and security conditions in some Middle Eastern countries.

Despite this setback, remittances of US$7.2 billion and tourist earnings of US$3.6 billion offset the trade deficit of US$9.6 billion and the balance of payments recorded a surplus of US$2 billion last year.

Trade performance in 2017

In 2017 exports expanded by 10.2 percent to reach a new high of US$11.4 billion. However the trade deficit expanded to a massive US$9.6 billion owing to imports increasing to US$21 billion. Consequently, the trade deficit increased from US$8.4 billion in 2016 to US$9.4 billion in 2017.

Import composition

Import composition

Sri Lanka’s import dependency is in all three categories of imports: consumer goods, intermediate goods and capital goods. In recent years capital goods imports have been significant owing to huge infrastructure projects that require machinery, transport equipment and other capital goods. Such projects have also increased imports of intermediate goods like cement, fuel and steel. However in 2017, capital goods imports declined slightly from US$4.5 billion to 4.3 billion.

Of the total imports of US$21 billion, capital goods imports accounted for US$4.9 billion, intermediate goods for US$11.4 billion and consumer goods imports for US$4.2 billion. Therefore the largest component of imports is intermediate imports that constituted over half (54.3 percent) of imports in 2017. These include essential items such as fuel imports that increased by 39 percent last year. Other essential imports include textiles, fertiliser, chemicals and iron.

These are all essential items and there is very little possibility of cutting down such imports. In fact most exports have a high import content. Import expenditure on these items are dependent on international prices and fuel prices are especially significant. In 2017 there was both an increase in the amount of oil imports and an increase in prices.

Food

Despite near self-sufficiency in rice in normal years, food imports are significant. Last year’s food imports were high owing to a shortfall in food crops, especially rice, owing to a prolonged drought. Food imports amounted to US$1.8 billion last year. This excludes the major item of wheat that is classified as an intermediate good as it is processed to flour locally. Wheat imports increased by 43 percent last year, but constituted only a small proportion of total imports at a cost of only US$356 million.

Therefore total food imports cost U$2.5 billion or 11.5 percent of total imports. Food imports include many basic and essential items such as wheat, sugar, milk, dhal and basic foods. In brief, import expenditure in 2017 was the highest ever at US$21 billion. This large increase was owing to higher imports of fuel and rice and wheat mainly owing to the prolonged drought. In addition, expenditure on gold also increased significantly during the year. However, import expenditure on machinery and equipment, sugar, spices and fertiliser declined during the year.

Policy implications

The reduction of the trade deficit is of fundamental importance in improving the balance of payments and strengthening foreign reserves. Unfortunately there was a deterioration in the trade performance last year owing to higher imports of food, fuel and essential intermediate goods. It is therefore vital that non-essential imports are contained.

Fiscal and monetary policies should be designed to reduce imports. However some of the budgetary proposals are likely to increase imports, while fuel costs may rise owing to international prices increasing. Already electric car imports have increased. Rice and wheat imports are likely to decrease in the second half of this year owing to better harvests. Vigilance on other imports such as motor vehicles is vital to achieve a lesser trade deficit in 2018.

BOP surplus vital

In view of the very large foreign debt repayments in 2019 and beyond, it is vital for the country’s balance of payments to generate a significant surplus. The key to an improvement in the trade balance is much higher export earnings and enhanced earnings from services. The setback in tourism must be corrected and much higher earrings must be from IT services. Fiscal, monetary and exchange rate policies must be geared to increasing exports and restraining imports.

In the context of the increasing trade deficit, where export growth was nullified by higher import growth, there has to be a concerted set of policies that would restrain non-essential imports. Fiscal, monetary and exchange rate policies should be geared to restrain imports. There does not seem to be an adequate policy thrust to restrain aggregate demand. There is a need to change the policy stance on interest rates to restrain aggregate demand.

Concluding reflections

All things considered, Sri Lanka’s prospects lie in enhancing exports significantly. Some commentators have pointed out quite rightly that our exports have a high import content and that tourist earnings and remittances too increase imports. This being so there is a need to expand exports exponentially to ensure a trade surplus. The scope for reduced import expenditure is limited owing to the essential nature of most imports.

Leave a Reply

Post Comment