Columns

Resurgence of communal violence threat to tourism, FDI and balance of payments

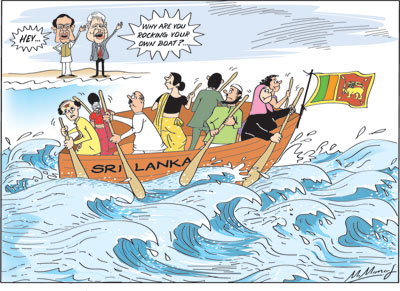

View(s):The recent communal violence has raised apprehensions on its repercussions on the economy. Although the violence was restricted to three areas in Ampara, Kandy district and Gintota, and its direct impact on economic activities was minimal, the fears of further communal violence has serious implications for the economy.

The violence has already affected tourism adversely and is likely to deter foreign investment, increase international borrowing costs and could cause a capital outflow. All these would affect the country’s balance of payments adversely at a time when a balance of payments surplus is vital for enabling the massive debt repayment in 2019. This setback has also come about at a time when an improvement in the balance of payments was expected owing to a growth in exports, tourist earnings and other services. This year’s economic growth could slow down.

The violence has already affected tourism adversely and is likely to deter foreign investment, increase international borrowing costs and could cause a capital outflow. All these would affect the country’s balance of payments adversely at a time when a balance of payments surplus is vital for enabling the massive debt repayment in 2019. This setback has also come about at a time when an improvement in the balance of payments was expected owing to a growth in exports, tourist earnings and other services. This year’s economic growth could slow down.

Balance of payments

The resurgence of communal disturbances is likely to affect the balance of payments adversely though is by no means confined to it. However, in view of the very large foreign debt repayments in 2019, the reduction of the balance of payments surplus or incurring a deficit would increase the difficulties of debt repayment. Therefore this space focuses on the impact of the communal violence on the balance of payments.

The importance of generating a significant balance of payments surplus to ease the very large foreign debt repayments of about US$4.2 billion in 2019 cannot be over emphasised. It is vital for the country’s balance of payments to achieve a higher surplus than last year’s US$2 billion to reduce foreign borrowing for debt repayment.

Trade, tourism and IT

Trade, tourism and IT

The key to improving the balance of payments is an improvement in the trade balance, increased earnings from tourism and enhanced earnings from services, especially information technology (IT). Workers’ remittances that offset about 70 percent of the trade deficit is not likely to increase.

Trade balance

A reduction of the trade deficit from US$9.6 billion last year to around US$8 to 8.5 billion this year is of critical importance to improve the balance of payments. This is a realistic expectation provided the government maintains fiscal and monetary policies that do not encourage imports. On the other hand, exports are expected to increase to US$13 to 14 billion. The Export Development Board expects exports to exceed this and reach US$15 billion.

The weakness in last year’s trade balance was in imports that increased to as much as US$21 billion. There were extenuating reasons for this increase. Increased food and fuel imports due to the prolonged drought was one reason. In the case of fuel imports it was also due to higher prices.

Normal harvests are expected this year and consequently rice and wheat imports are likely to be reduced. There is doubt that fuel import costs could be reduced. Although there could be an increase in hydrogenation of electricity, increased demand for electricity would require higher imports of petroleum and coal. Furthermore the option of containing domestic demand for electricity by increased consumer prices is not a realistic option for the government whose popularity has plummeted and requires to be restored by populist measures such as the reduction of the cost of living. Furthermore, there is little prospect of international oil prices falling.

Some other intermediate goods imports too may rise owing to increased production of exports like garments. This is not an unfavourable development as the increase in such imports results in increased exports by a higher amount. Imports that are for non-essential consumption must be restrained. Regrettably some fiscal measures, such as the reduction of duties on electric cars and the granting of duty free permits will increased imports.

If the import bill could be reduced by one billion US dollars to US$20 billion, it could assist the trade balance and the balance of payments. However the better prospect is of an improvement in exports that have been on a rising trend from March 2017. In January 2018 exports reached nearly US$1 billion. If this trend continues then exports could reach around US$12 billion and the trade deficit contained at around US$8 to 8.5 billion. The lower trade deficit would enable a significant current account surplus despite workers’ remittances and earnings from tourism not increasing.

Tourist earnings

The recent outburst of communal violence is a serious setback to tourism. Unfavourable travel advisories, media coverage of the violence and social media accounts and photos are serious discouragement to choosing Sri Lanka as a holiday destination. There are reports of cancelled hotel bookings and flights. Although tourist earnings were expected to increase significantly this year, from that of last year’s US$3.6 billion, this is unlikely in the current situation. This setback is serious for the balance of payments.

It is important to restore peaceful conditions and build confidence about the safety of the country for foreigners. And that this must be conveyed globally. Although this is an uphill task for some time, it is important for the longer run interests of the economy.

Workers’ remittances

Workers’ remittances have been the most important source of earnings for the balance of payments. They have offset as much as 70 percent or more of the trade deficit. Regrettably, workers’ remittances have been decreasing in recent months owing to both political conditions and depressed incomes in many Middle Eastern countries. In 2017, this trend continued with remittances declining to US$7.2 billion.

The implication of this is that lesser reliance has to be placed on the contribution of remittances to the balance of payments in the near future, as the factors reducing these remittances are beyond our control. However, if violence against Muslims erupt again, it can endanger employment in Middle Eastern countries. Recurrence of anti-Muslim violence could lead to import embargos from Muslim countries that are substantial importers of our tea.

IT services

Much higher earnings are expected from IT services that have shown an increasing trend and are not affected by the recent violence. In view of the reversal of tourism and reduction in workers’ remittances, there should be more reliance on increasing exports of IT services. Earnings from IT services are expected to increase to about US$1.5 billion this year from below a billion dollars last year.

Foreign Direct Investment (FDI)

Foreign direct investment that has been low must be increased substantially as such inflows not only provide support for the current balance of payments, but enhances exports in subsequent years. A significant increase in FDI was achieved last year though not in industries that produce tradable goods. The violence, political instability and uncertainty is not conducive for higher FDI inflows.

Concluding reflections

The economy would have a serious setback if peaceful conditions are not restored. Durable communal harmony is vital for Sri Lanka’s economic development. Other multi-ethnic and multi-religious societies in Asia, such as Malaysia and Singapore, have achieved harmonious conditions that have contributed much to their economic development. Can we emulate them? Or will we take the road to Myanmar.

Leave a Reply

Post Comment