Columns

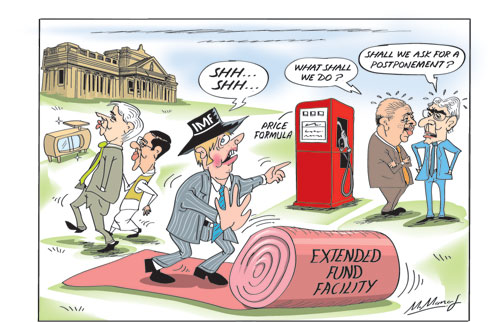

Political compulsions supersede economic rationality in fuel pricing

View(s):The implementation of a cost-reflective pricing formula for fuel could not have come at a more difficult and inopportune time for the government than now. A cost reflective fuel pricing formula that is needed to ensure economic stability is not politically feasible for a government attempting to gain political popularity in its final stretch towards an election.

However detrimental it is to not raise domestic fuel prices to achieve macroeconomic stability, it is politically unthinkable to increase fuel prices that would in turn increase the cost of living. Economic rationality and political popularity is in conflict.

However detrimental it is to not raise domestic fuel prices to achieve macroeconomic stability, it is politically unthinkable to increase fuel prices that would in turn increase the cost of living. Economic rationality and political popularity is in conflict.

Context

The government reduced the price of fuel no sooner it assumed office in January 2015 in order to reduce the cost of living and gain popularity. This was however done at a time when oil prices were low. Although import costs of fuel increased thereafter, fuel prices were not increased. Had a cost effective pricing formula been adopted earlier, domestic prices would have risen gradually in tandem with international oil prices.

Impact

The rising trend in international oil prices is causing a massive dent in the trade balance and straining the balance of payments. A reduction in imports of fuel is therefore imperative. Increasing the domestic price of fuel is the logical way of achieving a curtailment of fuel imports. However increasing the price of fuel and fuelling the cost of living is the surest way for the government to commit political suicide.

Economics

Economics

Fuel imports cost around 25 percent of the country’s import bill when prices are moderate. When international prices fall oil imports cost less and there is significant relief to the trade balance and balance of payments. At the time of writing, international prices are about US$73 per barrel and there are fears of it rising further with an upper limit of about US$80. The current price is about double what it was in 2015.

The increased import price implies an increase in import costs. The large trade deficits of 2016 and 2017, despite an impressive export growth was partly owing to higher oil prices offsetting the gains in exports. The country cannot afford to incur large trade deficits as it leads to a strain in the balance of payments. Therefore curtailing fuel imports is vital. Increasing domestic prices is the way of achieving this.

IMF rationale

It is owing to the fluctuations in international fuel prices that the IMF proposed a domestic pricing formula where domestic prices vary with international prices. When international; prices are low, domestic prices would be low and when international prices increase, domestic prices would increase automatically. Such a pricing mechanism is expected to stabilise import costs of fuel to some extent. This is a rational economic policy to safeguard the balance of payments and the fiscal deficit.

IMF statement

The IMF issued a statement on April 22nd that said: “Subject to cabinet approval of an automatic fuel pricing mechanism—consistent with the EFF-supported program, the Board is expected to consider Sri Lanka’s request for completion of the fourth review in June 2018. The measure would represent a major step towards completing energy pricing reforms in 2018.”

Politically impractical

The economic rationale for adopting an automatic fuel pricing mechanism is clear, but it is not politically feasible. The cabinet will probably defer its decision. The final decision is not likely to be one of implementing the IMF formula. The government would have to adopt alternate measures to contain fuel consumption and the fiscal deficit.

Other policies

There are also other measures and policies recommended by the IMF that would have to be shelved in the current political situation. These include the reform of several loss making state owned enterprises that were a part of the agreement to obtain the Extended Fund Facility (EFF) in 2015.

In the words of the IMF: “Further efforts remain needed to strengthen governance and mitigate fiscal risks from state-owned enterprises (SOEs). Progress in implementing the Inland Revenue Act (IRA) and other revenue measures in the 2018 budget remains essential for meeting social goals and improving debt dynamics.”

“Under the EFF-supported program, sustaining the reform momentum is critical to strengthen the resilience of the economy to shocks and promoting inclusive and strong growth.” While the economic rationality is irrefutable, these reform and austerity measures are not politically pragmatic measures. Whether the IMF would view this issue in a broader realistic perspective or insist on its pound of flesh remains to be seen.

Fiscal deficit

Fuel pricing has significant impacts on the fiscal balance. When international prices increase and domestic prices remain low, the government has to subsidies the price difference. This adds to increased public expenditure that in turn increases the fiscal deficit and destabilises the economy. This is a grave macroeconomic problem.

The fuel price subsidy, the losses in SOEs and wasteful government expenditure continues to be areas of fiscal slippage. As it is vital to ensure a reduction of the fiscal deficit, measures have to be adopted both on the expenditure side and revenue side to contain the fiscal deficit. There has been significant progress in increasing revenue, but in the current context when austerity measures are not possible much more has to be done on the revenue side. Furthermore it may be possible to modify the IMF conditions by employing fiscal measures that increase revenue and thereby reduce the fiscal deficit to agreed targets.

Fiscal measures

Some time ago, Joseph Stiglitz, the Nobel prize winning economist advised the country to adopt fiscal measures that enable higher social expenditure. He said: “Fortunately, there are many taxes that the authorities can impose that would increase efficiency, growth, and equity. Sri Lanka has abundant sunshine and wind; a carbon tax would raise considerable revenue, increase aggregate demand, move the country toward a green economy, and improve the balance of payments. A progressive property tax would encourage more resources to go into productive investments, while reducing inequality and, again, boosting revenues substantially. A tax on luxury goods, most of which are imported, would serve similar goals.”

Reducing expenditure

A vastly popular means of reducing expenditure would be a drastic reduction in the perquisites (perks) of Members of Parliament and the large number of ministers. Fuel allowances of the public sector should be reduced and import of luxury vehicles banned. Such measures are politically feasible, in fact popular ones. There full impact on the public finances may be inadequate in the current economic situation, but are policies in the right direction.

Conclusion

Although the implementation of a pricing formula for fuel that reflects international prices is good economics, it is impractical in the current political context. Therefore alternate policies must be found to contain the trade and fiscal deficits, especially as it is likely that there would be other expenditure such as increased wages, increased subsidies, expansion of welfare expenditure and increased employment in the public services. The realistic approach to avert am economic crisis and macroeconomic instability is alternate measures of taxation and reduced public expenditure in other areas.

Leave a Reply

Post Comment