Columns

Mid-Year review: Economic recovery yes, but no robust growth

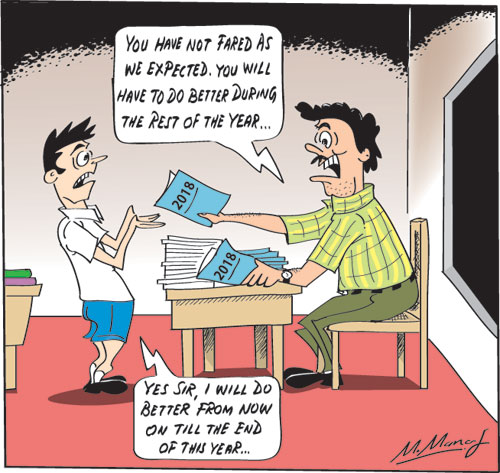

View(s):Today we enter the second half of this year with expectation of a better economic performance than in the first half. The first half of the year has been one of economic recovery, not of robust growth.

Hopefully this year’s economic growth would be around 4.5 percent, in spite of the first quarter’s economic growth of only 3.2 percent. There are reasons to expect a higher economic growth during the rest of the year.

Higher growth

Higher growth

The export growth of 7.7 percent in the first quarter with manufactured exports growing by 10.2 percent is one of the main reasons for expecting higher economic growth. Increase in manufactures, agricultural production and growth in services in the second half suggest a somewhat higher economic growth.

A projection of economic growth of 4.5 to 5 percent for the year is not unrealistic. However a higher than 5 percent growth is unlikely owing to the continuing political uncertainty that has eroded investor confidence and the slow implementation of economic policies. There are also challenges posed by the international economy.

Projected growth

This year was expected to be one of economic recovery from last year’s low growth of only 3.1 percent. The latest IMF review expects the economy to grow by 4 percent this year. All being well, it will grow somewhat faster in the second half to exceed the IMF’s projection.

The reasons for expecting the economy to grow somewhat faster are the export growth, revival of agriculture and the contribution of tourism and services. These could raise growth to above 4 percent.

First quarter

Economic growth in the first quarter has been below expectations at only 3.2 percent. This was despite a 4.8 percent growth in agriculture. Industries, including construction, have fared poorly. Construction that has grown consistently in recent years declined by as much as 4.9 percent to drag down industrial growth to only 1 percent. Services grew by 4.4 percent.

Higher all round growth

Higher all round growth

All five sectors of the economy are expected to grow this year. Agriculture that had a severe setback owing to drought conditions last year is expected to bounce back. Construction that has grown consistently for many years is expected to revive and continue to expand. Manufacturing is expected to grow owing to increased industrial exports, especially garments and rubber products. Tourist growth of 17 percent is expected to enhance the value of services with support from IT services. Growth in all these sectors would have backward linkages and multiplier impacts on the economy.

Agriculture

Agricultural production that plunged last year owing to a severe drought is expected to reach a higher level. Food crop production in particular is expected to increase and thereby also have beneficial impacts on the rest of the economy. The Maha bumper harvest and an expected good Yala crop will increase paddy production.

Tea production too is expected to be higher than last year’s owing to better rainfall and availability of glyphosate. Marginal increases in rubber output and coconut production are likely. The benefits of improved rainfall on coconut output are likely to come next year owing to the lag of a year or more for higher output.

However, the growth in agriculture would not have much impact on the overall growth rate as agriculture contributes only 7 percent to GDP. Nevertheless apart from its contribution to growth of the economy, increased food production would reduce food imports, reduce domestic food prices, improve rural livelihoods and have growth impacts on other sectors of the economy.

Export growth

The most favourable development this year has been the expansion of exports, especially industrial exports. Much of the growth is expected owing to this growth in exports.

In comparison with the first quarter of last year exports grew by 7.7 percent to US$ 2.96 billion in the first quarter. Manufacture exports grew by 10.2 percent mainly due to garment exports increasing by 3.8 percent and rubber goods expanding by 13 percent. The increase in raw material imports in the first quarter implies higher productions.

The robust export performance this year and the revival of agriculture would push the economy towards a 5 percent growth. Although the economic performance in the first quarter has been somewhat disappointing, there are indications that several sectors would grow at a higher rate in the second half of the year.

Global outlook

Despite these favourable developments, there are threats and challenges. There is still no certainty of escalating international oil prices declining. The strengthening of the US dollar has also resulted in the depreciation of the rupee. These factors are likely to exert pressures for the depreciation of the rupee and increase prices of essential items and increase the cost of living as well as increase costs of production.

The current trade war between the US and China could have an adverse effect for Sri Lankan exports especially through lower growth of the world economy. These external shocks require hard economic decisions that are difficult for the government to take in the run up to elections.

Long run

Furthermore there are likely to be politically motivated economic decisions that are harmful to the economy, especially in the long run. Prudent fiscal decisions are hard to take. The worst destabilisation could happen if the envisaged fiscal targets are undermined by expenditure overruns. The increase in government revenue collection has been a positive development that must not be eroded by wasteful and imprudent expenditure. The target of the fiscal deficit being brought down to 3.5 percent of GDP must be achieved in the long-term interests of the economy’s stability and growth.

Summing up

In contrast to last year, when the economy had a setback due to adverse weather conditions that not only reduced agricultural output, but increased food and fuel imports to result in a huge trade deficit, despite an upsurge of exports especially in the latter half of the year. The recovery in agriculture and export manufacture and services are likely to boost growth towards 5 percent.

The second half is likely to be a challenging one owing to high and increasing international fuel prices, consequent increase in import expenditure and its inflationary impact on the economy. There are also other destabilising factors in the world economy. They could pose stiff challenges.

This has been a year of economic recovery, not one of high growth. It is also one of economic hardships for people. It is a year when hard economic decisions for development cannot be taken and most needed reforms would be shelved. This implies that this year’s policies could have an adverse impact on the future economic stability and growth.

Leave a Reply

Post Comment