Money Printing: Is there a proper control?

At present, money in the form of notes and coins is essential for people to purchase goods and services as well as to settle various transactions. In the good old days, people exchanged goods with each other which belonged to them or which they produced to meet their day-to-day needs. This system was known as the “Barter” system.

Currency notes

However, due to various difficulties of the barter system, many items like salt, sea shells, silver, gold and various kinds of other metals were used as money from time to time for transaction purposes. However, when transactions expanded and became varied over time and due to the scarcity of items used as money, people began to use notes and coins for transaction purposes, which was known as “fiat money” or “paper money”. Paper money can be used easily to settle any transaction or to value physical assets such as lands, houses and buildings. However, the success of using paper money in a country totally depends on the people’s trust in money. If the trust in money is lost, all the economic and business activities in an economy would collapse.

In most countries, the money printing authority is the Central Bank. Similarly, in Sri Lanka, the money printing authority is given to the Central Bank of Sri Lanka (CB) by Monetary Law Act No.58 of 1949. The CB was established in 1950 and since then the role of money printing has been done by the CB. Prior to the establishment of the CB, money printing was done by a Currency Board System. As mentioned above, people are ready to accept money only when they have a trust in money. For this, money must be a legal tender which is a medium of payment recognised by law that can be used to meet a public or private debt, or financial obligation. Therefore, printing counterfeit notes like the notes issued by a CB or a monetary authority is totally prohibited and it is a punishable offence.

Another way of losing people’s trust in money is when a country experiences a significant increase in prices of goods and services continuously which is considered as a hyper inflationary situation. Under such a situation, a large amount of money is required to purchase goods and services and to meet other payment obligations. Hence the money printing authority would have to print a large amount of new money. For instance, a hyper inflationary situation was experienced by Germany during 1920 – 1923 and it caused a significant deterioration of public trust in the German Mark. In 1920, the price of one loaf of bread in Germany was one mark and it went up to 4 billion Marks by 1923. So, people had to carry money in wheelbarrows to purchase goods. Due to a hyper inflationary situation, people’s trust in money was lost completely and it led to collapse of banks, as well as other business entities in Germany. People began to use the barter system again. German authorities had to destroy its currency as there was no value for it. Therefore, one of the main responsibilities of the CB of a country is to maintain the general price level of goods and services at a stable level through conduct of a prudent monetary policy.

Money printing authorities should print money only to match the value of overall transactions in the economy. When economic and business activities grow in a country, there should be an increase in total money supply as well to facilitate such transactions. Therefore, after estimating expected economic growth of a country (in nominal terms) in a given year, the monetary authority is responsible for adding new money to the economy only to the extent to meet that amount of growing transactions. If money is printed and released over and above the required amount, the result will be the increased demand for goods and services creating inflationary pressures in the economy. Therefore, the main responsibility of a CB is maintaining the country’s aggregate stock of money (money supply) in such a way that does not create inflationary pressures beyond the country’s tolerable level. The CB also estimates the required amount of money to meet the growing economic activities at the beginning of each year and maintains new money injections broadly to match that requirement.

Currently, various views are expressed in the media about money printing by the CB and some news reports mislead the public. The meaning of money printing is issuing new money to the economy and in economic terms, new money issues by a CB is known as issuing “reserve money” or “base money”. The main objective of this article is to make the public aware about the CB’s process of issuing new money to the economy.

Net foreign assets channel

Foreign exchange is received in the country through exports of goods and services, foreign investments and various other receipts by the private sector. Usually, foreign exchange on these transactions is received by commercial banks. After meeting foreign exchange requirements for importing goods and services and for various other payments abroad, if commercial banks have any excess it is usually sold to the CB. Meanwhile, the government also receives foreign exchange through foreign loans to the government. To meet the rupee requirements for making payments in the domestic economy, the government sells its foreign currency to the CB. In this way, when foreign exchange is purchased by the CB from commercial banks and from the government, the CB issues rupees. Through this the CB adds new money or reserve money to the existing money stock of the country. When the CB purchases foreign currency, it results in an increase in the foreign exchange reserves of the country which is maintained by the CB.

Meanwhile, foreign debt repayments are made by the CB on behalf of the government. Therefore, at the time of making debt repayments by the CB in foreign currency, the government should pay an equal value of rupees to the CB. Those payments are usually made through the government accounts held with the commercial banks.

When these rupee payments are made to the CB, it reduces the existing money stock in circulation in the country or in other words it reduces the level of reserve money.

Also, as the CB settles the foreign debt on behalf of the government, it reduces the level of foreign exchange reserves maintained by the CB.

Thus, by engaging in foreign exchange transactions with the government or with the commercial banks, the CB can change the rupee money stock in circulation in the country. This is identified as influencing the money in circulation in the country through the change in net foreign assets of the CB.

Net domestic assets channel

Secondly, the CB can influence the total stock of money in circulation in the country through the direct rupee transactions with the government or with the commercial banks. In addition, salaries and pension payments to the CB staff and any change in other assets and liabilities of the CB can also change the money in circulation. This change due to these direct rupee payments or receipts by the CB is known as the change in the money in circulation through net domestic assets of the CB.

With respect to the rupee transactions with the government, purchases of government Treasury bills in the primary market and provisioning of temporary advances to the government are the major transactions done by the CB.

When the government issues Treasury bills to finance its budgetary needs, the CB has the provisions as per the Monetary Law Act to purchase a certain part of bill issuances for monetary operation purposes at the discretion of the CB or on the requests made by the government. For making payments on the CB purchases of Treasury bills, the CB should issue new money equivalent to the value of the Treasury bills purchased. Those payments are credited to the accounts of the government held with commercial banks. As a result, the total money stock in the economy goes up. Usually, these Treasury bills consist of 91 day, 182 day and 364 day maturities.

When those bills mature, the government makes repayments to the CB through its accounts in the commercial banks. This reduces the total money stock in circulation.

In addition, as per the provisions in the Monetary Law Act, the CB should provide a temporary advance to the government at the beginning of each year which is equivalent to 10 per cent of the estimated government revenue for that year. This also adds new money to the economy increasing the money in circulation. These advances are usually for about a 6-month period and when the government settles these advances it leads to a decline in an equivalent amount of money in circulation.

Also, measures taken by the CB to maintain market liquidity at an appropriate level affect the amount of money circulation. When there is a liquidity surplus in the commercial banks, the CB takes measures to absorb the excess liquidity while when there is a liquidity shortage, the CB takes measures to inject liquidity through its open market operations.

New money issues 2013 – 2017

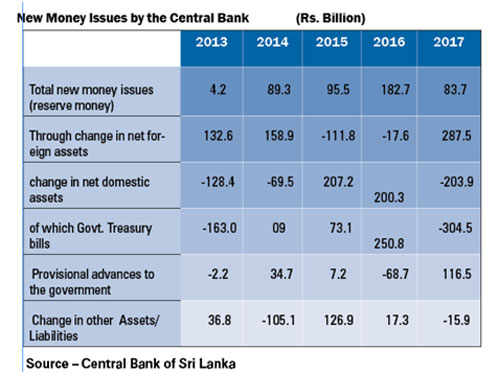

As per the table, the total new money printing of the CB during the five-year period from 2013 – 2017 was Rs. 455.4 billion. As mentioned above the new money printing by the CB was a net outcome of changes in net foreign assets or changes in net domestic assets of the CB. In the context of the composition of the factors affecting money printing, it is evident that when a significant amount of money is injected to the economy through acquiring net foreign assets, the CB reduces money injected through net domestic assets, to maintain overall money injection at a non-inflationary level.

Contrary to this, when money injection through net foreign assets has declined, the CB injects money by acquiring net domestic assets to maintain the money injection at the required level. For instance, in 2017 the CB has injected Rs.287.5 billion by acquiring foreign assets while reducing money injections through domestic assets by Rs.203.9 billion thereby increasing new net money injection to the economy only by Rs.83.7 billion. The reduction of money stock through reducing domestic assets was done mainly by retiring Treasury bill holdings by the CB amounting to Rs.304.5 billion and absorbing the equivalent amount of money back to the CB. Accordingly, money printing by the CB is done cautiously with some control so as to avoid buildup of inflationary pressures in the economy.

Since the 1980s the CB followed the monetary targeting policy framework which is the mechanism of controlling inflation through maintaining the total money stock at a level only to facilitate the increased transactions in the economy.

The CB is in the process of changing this monetary policy framework towards “Inflation Targeting” which is a mechanism to control inflation through changing CB’s policy interest rates. Many countries have been successful in controlling inflation through an inflation targeting policy framework. New Zealand, Canada, the UK, Australia, the Philippines and Indonesia are among these countries while India also moved to inflation targeting in 2015.

For Sri Lanka to move to an inflation targeting policy framework, it is required to amend the existing Monetary Law Act (MLA). In this context, the current provisions on the requirements to purchase Government Treasury bills by the CB and providing provisional advances to the government are two main important amendments. With these amendments, the CB will be able to prevent new money printing for monetary financing of the government. This would help the CB to conduct its monetary policy with more independence enabling to control inflation more effectively. The Cabinet of Ministers has already given approval for the amendments of the MLA and the CB expects to complete the amendments by end of 2019. The CB is in the process of taking necessary measures to implement the new monetary policy framework starting from 2020.