Columns

Political compulsions could undermine fiscal discipline, economic stability

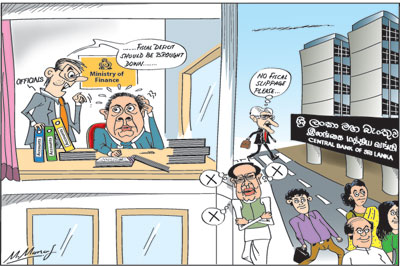

View(s):We are entering a critical period when the country’s macroeconomic stability could be jeopardised owing to excessive government expenditure to pander to the multitude for political gain. Excessive public expenditure to gain popularity at the forthcoming elections could increase the fiscal deficit and destabilise the economy.

The Central Bank and several eminent economists have expressed their concern about the likely fiscal slippage owing to economic policies being dictated to by political motives rather than the country’s long run economic interests.

The Central Bank and several eminent economists have expressed their concern about the likely fiscal slippage owing to economic policies being dictated to by political motives rather than the country’s long run economic interests.

Why fiscal consolidation?

The need for fiscal consolidation or the reduction of the fiscal deficit is not easily understood and appreciated. Large fiscal deficits harm the economy in many ways. Fiscal deficits lead to borrowing and in turn to huge debt servicing costs. Sri Lanka’s huge accumulated debt is a result of persistent deficits over the years.

Fiscal deficits are the root cause for inflation that in turn results in unfavourable conditions for investment, exports, the trade balance and the balance of payments. The adverse impacts of large fiscal deficits are pervasive to the economy in the same manner as diabetes affects many organs in the body.

Good economic management

Containing the fiscal deficit is vital for stabilisation of the economy and economic growth. Fiscal consolidation is important for economic stability and long-run economic growth. Successive governments have paid lip service to the need to contain the fiscal deficit, but not had the political courage and resolve to follow prudent fiscal policies to reduce the fiscal deficit. Consequently the macroeconomic outcomes have not been conducive to economic development.

Progress

Progress

After a fiscal slippage in 2015, when the deficit shot up to 7.6 of GDP, the Government took measures to reduce the fiscal deficit. The strategy was to reduce the deficit by increasing revenue. In 2016 the fiscal deficit was brought down to 5.4 percent of GDP by increasing revenue, but increased expenditure increased it to 5.5 percent of GDP in 2017. Although tax reforms are likely to enhance revenue, there are fears that overruns in expenditure would increase the fiscal deficit this year.

Reducing deficit

Containing the fiscal deficit is vital for stabilisation of the economy and economic growth. Reducing the fiscal deficit to less than 5 percent this year and 3.5 percent in 2020 is a move in the correct direction. It is important that the goals set for this year and the next are achieved. However the political context of today is not conducive to achieving this.

Politics

In the next eighteen months or so of its term, the Government would be focusing on the elections rather than long run economic stability and growth. The ruling parties would be pandering to the whims, fancies and immediate benefits of the multitude, rather than achieving economic stability and laying a firm foundation for economic growth. Even some of the gains of the previous three and a half years may be eroded in the coming months. To expect anything different is unrealistic in the country’s political setting.

Apprehension

A rise in imprudent government expenditure such as increasing state employment, increase in salaries, reduction in prices, increased subsidies and giveaways would result in overruns in public expenditure. Revenue collection too could be impaired by tax reductions, tax concessions and tax exemptions. If these were to happen, the fiscal deficit target is unlikely to be achieved.

This apprehension has been aired by the Central Bank and several eminent economists. They have expressed concerns that the efforts towards fiscal consolidation may not be realised and pointed out the importance of fiscal consolidation for economic stability and economic growth.

Targets

The fiscal deficit targets for 2018 and 2019 are likely to be exceeded and the goal of reducing the fiscal deficit to 3.5 percent of GDP in 2020 would not materialise. The increase in government expenditure to gain popularity, shortfall in revenue collection and slow growth of the economy would be the reasons for this outcome.

Central Bank

The Central Bank has expressed its concern of fiscal slippage. It said that amidst the measures taken towards revenue-based fiscal consolidation, the fiscal performance in 2017 deviated from the envisaged targets. It emphasized that “avoiding deviations from fiscal targets and achieving fiscal discipline are imperative to make the fiscal consolidation programme a success.”

The Central Bank said, “Maintaining fiscal discipline by adhering to fiscal rules is important to achieve overall macroeconomic stability.” It pointed out that revenue shortfall, expenditure overruns, high budget deficits and increase in government debt will lead to a fall in expenditure on public investment, while making fiscal consolidation a difficult task.

It pointed out: “Though the Government has taken several rigorous measures towards increasing revenue mobilisation, the continuation of such efforts is imperative to achieve revenue targets.”

Rationalisation of expenditure

The Bank highlighted the need for rationalisation of ineffective public expenditure, restructuring of SOEs to operate them as commercially viable entities, improving fiscal transparency and accountability in public financial management essential to achieve targets. It stressed the need for proper targeting of subsidies to improve the quality of public expenditure by aligning its composition with national priorities within the medium term budgetary framework.

Implementation

These are no doubt necessary policies to achieve fiscal consolidation. However, their implementation in the run-up to the elections is impractical and unlikely. The Central Bank admitted that “Fiscal consolidation is invariably politically challenging, particularly in a country which has been characterised by populist policies and an entitlement culture,” This is the crux of the problem.

Short run

It is to the credit of the Prime Minister and the Finance Minister that they share the conviction that fiscal consolidation is vital. However, with a lacklustre economic performance in the last three and a half years of the coalition government and the poor electoral performance at the local government elections, prudent and austere policies are beyond realistic expectations. The only glimmer of hope is that the recent increase in revenue collection will continue and enable a revenue based fiscal consolidation to some extent.

Future

Economic decisions in the long-term interests of the economy will not be the concern of the government at this stage of the election cycle and the state of the coalition. While a much different political environment cannot be expected in the remaining tenure of the government, hopefully economic policies pursued in the next few months would not be to the detriment of long term economic stability and growth.

We can only hope that political compulsions would have minimal harm on the economy and that a stable government would emerge to ensure economic growth.

Leave a Reply

Post Comment