Mixed views over EPF being private-managed

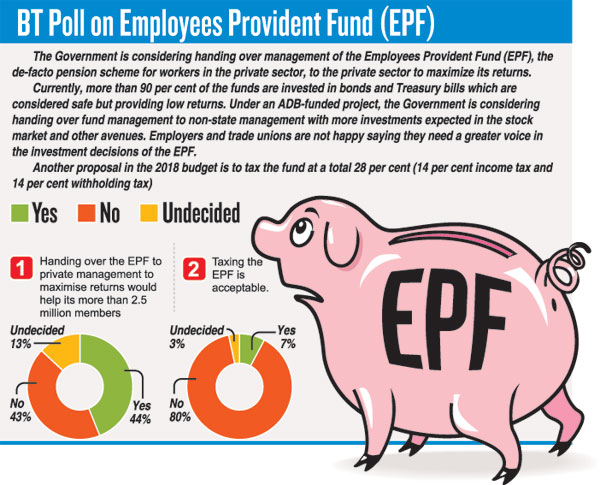

View(s):Sri Lankans, in a sample poll on email by the Business Times, have mixed views over plans by the Government to entrust management of the Employees Provident Fund (EPF) to the private sector. While 44 per cent were in favour of private management, 43 per cent were not while 13 per cent were undecided.

Last month, unions, representing both workers and employers, took a cautious approach to a proposal to reform the fund and maximise its returns largely through investing in the stock market among other options. At a meeting of the National Labour Advisory Council (NLAC), a draft White paper on EPF reforms prepared by US-based Aries Group Ltd under an ADB project (part of a US$300 million loan from the ADB) was discussed. Unions are demanding a greater role in the management of these funds, which were earlier invested allegedly in several loss-making entities in Colombo’s stock market.

The BT poll this week asked whether respondents were in agreement or not to, (a) Handing over the EPF to private management to maximise returns would help its more than 2.5 million members, and that (b) Taxing the EPF is acceptable. To the second question, 80 per cent were opposed to taxing the fund while only 7 per cent were agreeable.