Columns

The fiscal predicament: Public expenditure without taxation

View(s):The inadequacy of revenue collection is clear when compared with other countries. Our tax revenue has been well below what it should be at this stage of development. It should be about 20 percent of GDP at this stage of development.

Revenue as a proportion of GDP has been on a declining trend till last year. Government revenue has been inadequate to meet its committed current expenditure and in some years even inadequate to meet debt servicing costs. Consequently government has had to borrow to meet its current expenditure and fiscal deficits have been as high as 7 percent of GDP in certain years.

Revenue as a proportion of GDP has been on a declining trend till last year. Government revenue has been inadequate to meet its committed current expenditure and in some years even inadequate to meet debt servicing costs. Consequently government has had to borrow to meet its current expenditure and fiscal deficits have been as high as 7 percent of GDP in certain years.

In contrast to other countries’ experience, tax revenue has decreased with increasing per capita income. In 1990, government revenue was 21 percent of GDP. At the turn of the century the tax to GDP ratio had fallen to 16.8 percent of GDP and by 2015 it had fallen further to 13 percent of GDP. In 2016 there was an increase in revenue to 14.3 percent of GDP that is still much below other middle income countries with Sri Lanka’s per capita income that collect around 20 percent of GDP as revenue.

Global experience

Unlike the global experience, Sri Lanka has seen a decrease in revenue as incomes rise. In developed European countries, the revenue to GDP ratio is above 40 percent. East Asian countries also have much higher revenue to GDP ratio of 20 to 30 percent.

Importance of taxes

Government expenditure requires revenue — and taxation is one of the main means by which to obtain revenue. As long ago as in the days of the Roman Empire, Cicero emphasised the crucial role taxes played in the Roman Empire when he described taxes as “the sinews of the state”. Others before him and since have expressed similar sentiments.

No free lunch

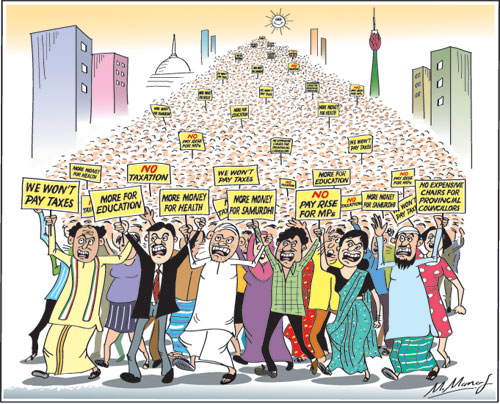

Milton Friedman’s famous statement that “There is no such thing as a free lunch” sums up the essence of the relationship between free goods and taxation. Most people in Sri Lanka want more and more free goods, while being opposed to any form of taxation. This is due to a fundamental misconception that the Government has inexhaustible resources that can be doled out in subsidies, free goods and services. There is a lack of understanding that what the Government spends, it gets from the public, in one way or the other.

Indebtedness

Indebtedness

Governments have pandered to this in order to be popular and taken the country on a path of high indebtedness, inflationary finances and inadequate investment. Consequently, macroeconomic stability has been undermined and economic growth stifled.

Dislike of taxes

Nobody likes to be taxed. An increase in taxes is disliked by people of any country. In mature democracies people are aware that if the government proposes to give a benefit, someone has to pay for it. This is due to the fact that in these countries nearly everyone is a taxpayer. Therefore they are conscious that government expenditure entails taxes that most people have to pay.

Funding public expenditure

In developed countries when politicians promise to grant some benefit, the immediate question is on how the funds are to be met and whether it would lead to higher taxes. Some mature democracies require political parties that make proposals to explain the means of funding them.

This understanding is not there in Sri Lanka. This is an underlying reason for the opposition to taxes and profligacy of politicians in spending public funds. It is a reason for demanding more free goods and the culture of entitlements.

No need to pay taxes

Apart from this lack of understanding, another reason for the reluctance to pay taxes is that people feel that they should not pay taxes as government revenue is wasted by politicians. An often quoted instance of such expense is the subsidised food to MPs in parliament and the various unlimited perks they enjoy.

Irresponsible

Political leaders spend lavishly on public events without any concern for public funds. In fact, they give ‘lunches’ as if the funds are from their own pockets. Politicians want the people to believe that these are personal hospitalities that should be reciprocated by political support for the hosts.

During the last regime, a large number of persons were taken on official visits abroad and the government met the exorbitant expenditure at expensive hotels abroad. Private receptions have been financed by the Government at the behest of politicians.

Current campaign

The current campaign against the proposal to increase salaries and perks to members of parliament and against the huge unjustified expenditure of Provincial Councils and Municipal Councils, is a healthy development that should gain momentum. It must expand to encompass such wasteful expenditure as grand events to give letters of appointment or announce policies, expenditure on foreign travel and medical expenditure of ministers and members of parliament abroad.

Tax evasion

The extravagant and wasteful expenditure of governments has led to a rationalisation that tax evasion is justified. Some of the highest income earners in the country justify evading taxes on this basis. When the new Inland Revenue Act was proposed they were vehemently opposed as their tax avoidance and tax evasion would be limited, though perhaps not entirely eliminated.

High earning professionals are the main offenders. Lawyers, doctors and tuition masters are among the offenders. The rich are against the poor.

Low revenue

For these and other reasons, direct tax revenue is low. Ours is one of the lowest tax-to-GDP ratios in the world. Fortunately revenue has increased to around 15 percent. The objective should be to achieve a tax revenue of about 20-22 percent of GDP that is the norm for countries that are at Sri Lankans per capita income levels.

Opposition to taxation

The recent effort to increase taxes to achieve a revenue enhanced fiscal consolidation was met with much resistance by people. Trade unions of high income earners, who are evading taxes, are opposed to measures for collecting taxes. This was surely not due to misconceptions about public finances, but their self-interest. They evade taxes at the expense of the poor who have to bear the burden of high indirect taxes on basic items of expenditure.

Tax administration

Another reason for the lower revenue collection is the inefficiency and corruption in the tax administration. Unless there are means of improving the efficiency of tax collection the efficacy of tax laws will be limited.

Concluding observation

The effort to increase tax revenue must be coupled with curtailment of wasteful public expenditure. Accountability in public expenditure is vital to change public attitudes towards taxation. The public must be educated on the Government’s need for revenue to enable, macroeconomic stability, higher investment and increased social expenditure. It is also important to strengthen the administrative capacity of the revenue administration. Unless the tax administration becomes efficient and honest tax evasion and tax avoidance would vitiate the objectives of increasing tax revenue.

Leave a Reply

Post Comment