Columns

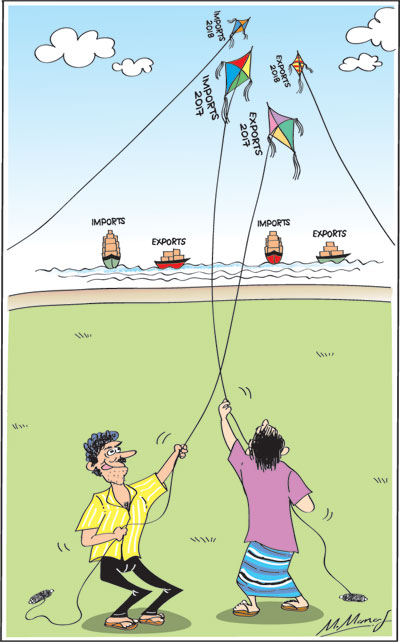

Increased export earnings fail to stem widening trade deficit

View(s):The trade deficit of US$ 5.7 billion in the first half of the year is a serious concern, as it portends a likely massive trade deficit of over US$ 10 billion this year. Such a large trade deficit would weaken the balance of payments (BOP), the external reserves and debt repayment capacity.

The expectation that this year’s growth in exports would reduce the country’s large trade deficit has been dashed to the ground by increased imports in the first half of the year. A lower trade deficit would have increased the balance of payments surplus that would have decreased the need for foreign borrowing for debt repayment obligations that are over US$ 4 billion in 2019.

The expectation that this year’s growth in exports would reduce the country’s large trade deficit has been dashed to the ground by increased imports in the first half of the year. A lower trade deficit would have increased the balance of payments surplus that would have decreased the need for foreign borrowing for debt repayment obligations that are over US$ 4 billion in 2019.

Trade deficit

The deterioration in the trade balance is particularly disappointing as it occurred despite a significant increase in exports of 6.2 percent in the first half of the year, compared to the same period last year. This was due to a higher increase in imports of US$ 5.7 billion. The widening trade deficit, reduces the balance of payments surplus. A lower trade deficit would enhance the balance of payments (BOP) surplus. The low BOP surplus increases the need to borrow for debt repayment. Reducing the trade deficit is important for the country’s external finances, as it would increase the balance of payments surplus and enhance foreign exchange reserves.

Small BOP surplus

Small BOP surplus

The large trade deficit in the first half of the year indicates that a higher BOP surplus is unlikely. At best it would lead to a small BOP surplus. Since debt repayment next year and beyond is high, the inability to achieve a significant balance of payments surplus is a serious concern, especially as the widening trade deficit, is despite significant increases in exports.

Export growth

The higher trade deficit was incurred in the first half of the year, despite a significant export growth. While exports increased by 6.2 percent to reach US$ 5.7 billion, imports increased by as much as 12.7 percent to US$ 12.4 billion in the first half of the year. Consequently the trade deficit expanded to US$ 5.7 billion in the first six months of this year, from the trade deficit of US$ 4.75 billion in the first half of 2017.

The country is heading to an even larger trade deficit in 2018 than that of last year’s large deficit of US$ 9.6 billion. The large trade deficit reduces the balance of payments surplus and weakens the external reserves.

Remittances and tourist earnings

Fortunately the entirety of the first half’s trade deficit is offset by remittances and tourist earnings, both of which have also increased. These and other capital inflows that have offset the trade deficit in the first half of the year, are likely to result in a balance of payments surplus in 2018, although not of as much as needed. The balance of payments surplus could have been larger had the significant export growth led to a lower trade deficit. In fact, despite the significant export growth, the trade deficit widened owing to a more than commensurate growth in imports.

Recurrent feature

This feature of increased exports not resulting in an improvement in the trade balance has characterized the trade performance of last year too. In 2017 exports increased by US$ 1 billion from US$ 10.3 billion to US$ 11.3 billion, but imports increased by nearly US$ 2 billion from US$ 19.1 billion to almost US$ 21 billion to increase the trade deficit from US$ 8.8 billion to US$ 9.6 billion (see table).

This year’s trade deficit is likely to be even higher owing to the increase in imports by as much as 12.7 percent to US$ 11.4 billion. This increase in the trade deficit could lead to a serious deterioration in the balance of payments, if not for the inward remittances of Sri Lankans living abroad and the increased earnings from tourism. While the widening trade deficit weakens the balance of payments, remittances and tourist earnings offset it to improve the final balance of payments outturn. This is the feature of the Sri Lankan balance of payments.

Fundamental weakness

The widening trade deficits in the last several years and the trade deficit of US$ 5.7 billion in the first half of the year is a serious weakness in the country’s external finances. The large and expanding trade deficits have weakened the balance of payments (BOP) and failed to enhance the country’s external reserves.

Strengths

However, the balance of payments has been in surplus in several recent years owing to workers’ remittances, tourist earnings and earnings from services. But these strengths in the balance of payments are vulnerable to external and internal shocks, as witnessed in the past. Both remittances and tourist earnings could have reversals.

In the case of remittances, over one half of them are from workers in the Middle East. The geopolitical situation is highly unstable. In fact last year’s remittances had setbacks as the security situation in the Middle East resulted in a shrinkage of workers to these countries.

Where tourism is concerned, this is a fast growing global market that could be exploited. However, internal shocks rather than external shocks are likely to setback tourist traffic. Sporadic outbursts of communal violence, as well as political upheavals that are ever present features of the country, could deter tourists from coming. Furthermore high rates for tourist accommodation could make the country comparatively less attractive to tourists. There is also much to be desired in transport services and security risks to tourists. Nevertheless tourist arrivals increased and earnings from tourism brought in US$ 2.1 billion in the first half of the year.

Summing up

Complacency about the country’s trade balance could lead the country to severe difficulties in external finances. In the country’s position of high indebtedness, it is vital that there is a much higher balance of payments surplus. The outcome in trade is an important determinant of the balance of payments outcome. While the growth in exports should gain momentum, there has to be a strategy to curtail imports.

Both monetary and fiscal policies must ensure that non-essential imports are contained and do not expand beyond the country’s import capacity. The dependence on tourism and remittances has risks and uncertainties. Increased exports and earnings from tourism should not be spent on non-essential imports.

Leave a Reply

Post Comment