Columns

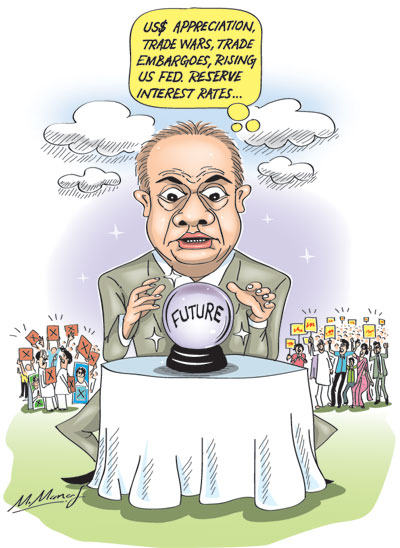

Threats to Lankan economy from global developments and trade tensions

View(s):Tremors from global financial markets and trading uncertainties are being felt in the Island’s economy. The depreciation of the rupee, increasing prices of petrol and gas, hikes in bus fares and higher costs of imports are among the inevitable repercussions of the global financial crisis. Global economic growth could also be affected by the current setbacks to free trade.

Reasons

Reasons

The increase in US interest rates, surge in fuel prices, and trade restrictions are the exogenous factors that are affecting most developing countries adversely. Most currencies have depreciated against the US dollar. The depreciation of their currencies is increasing the cost of living of many countries, as in Sri Lanka.

Global crisis

The current financial crisis is a global one. The problems are mostly beyond the control of the government. Admittedly, had the Sri Lankan economy and external finances been stronger, it would have enabled countervailing policies to reduce the impact of these external shocks. There is neither fiscal space nor external reserves to counteract or cushion the adverse impacts of the external shocks.

Impact of US policies

Impact of US policies

The appreciation of the US dollar; higher interest rates in the US owing to policies of the Federal Reserve Bank (US Central Bank); import restrictions and banning of some Chinese and Indian imports by the US; increased tariffs by the US; the imposition of trade embargos by the US on Iran; and the US threat of withdrawing from the WTO; are dark clouds of the gathering storm. The setbacks to free trade, trade tensions and higher oil prices would eventually slow global economic growth that would in turn affect our exports adversely.

If the United States is the villain of the piece, the rest of the world, particularly developing countries, are the victims of these international financial and trading developments.

No capacity

The Sri Lankan Government has no control over these developments, whose economic consequences are serious. The weak state of the Sri Lankan economy, especially its external finances, makes the country particularly vulnerable. The country has no capacity to cushion the impacts of these external shocks or take countervailing measures owing to the poor state of public finances and external finances.

The popular view that the Central Bank of Sri Lanka must intervene to arrest the declining value of the rupee is a sure prescription to further heighten the Island’s external vulnerability and destabilise the economy.

Other countries

Other emerging countries, including the giant and robust Indian economy, are facing these severe external shocks. Several countries have depreciated their currencies more than that of ours.

Among the countries that have depreciated by a larger percentage this year are Brazil (20), Argentina (53) and Chile (10). Australia has depreciated by 8 percent, China by 5 percent, Indonesia by 8 percent and the Philippines by 7 percent. The global impact of the crisis is clear from this.

India today

The Indian rupee has depreciated 11 percent against the US dollar, higher than the Sri Lankan rupee depreciation of about 7 percent. Consequently the Sri Lankan rupee has appreciated against the Indian rupee. As currencies of many of India’s trading partners, too have depreciated against the dollar, the IMF estimates that the real effective depreciation of the Indian rupee this year, compared to December 2017, is between 6 and 7 per cent compared to about 11 per cent in relation to the US dollar.

The real effective exchange rate depreciation of the Indian rupee is less than the nominal rate of depreciation against the US dollar as many of India’s trading partners too have depreciated against the dollar.

Increasing prices

The depreciation of the Indian rupee has raised the prices of oil, petroleum products and imported goods. However, India is much less an open economy than Sri Lanka and therefore the inflationary impact of the depreciation would be less. Furthermore, the Reserve Bank of India has taken the rising oil import prices into account and raised the policy interest rates.

The Monetary Board of the Central Bank has not raised interest rates fearing its downward impact on growth. This is no doubt a controversial issue. Higher interest rates would have reduced aggregate demand that would have reduced imports and improved the deteriorating balance of trade.

Global threats

There are continuing threats to the Sri Lankan economy from global developments even though global economic growth may remain at a satisfactory level of around 3.9 percent this year and in 2019. The current trade wars initiated by the US could have ripple effects. More so the sanctions that the US may impose on Iran that could undermine the country’s exports of tea and imports of crude oil. Already the government has decided to shift its purchases of oil away from Iran. Nevertheless the increasing price of oil will continue to dent our trade balance.

In conclusion

The appreciation of the US dollar, higher interest rates and increasing fuel prices that have already destabilised the economy would impact adversely on the Sri Lankan economy. These could affect the economy adversely and accentuate the external vulnerabilities. There are, however, very little remedial actions that could be taken to soften the blows owing to the weak external finances and lack of fiscal space.

The strong and robust economic growth of China and India could withstand these shocks, but other developing economies with weak fiscal and external finances like Sri Lanka are highly vulnerable. Unlike Sri Lanka, India’s economic growth is accelerating and expected to exceed 7 percent. China may grow at 9 percent.

As Central Bank Governor Indrajit Coomaraswamy said recently: “Though Sri Lanka has made progress in terms of stabilising the economy, the external factors are too powerful and we don’t have the capacity to withstand without experiencing some pressure on reserves and exchange rate leading to depreciation”.

Leave a Reply

Post Comment