Columns

The state of the economy: Is it in crisis?

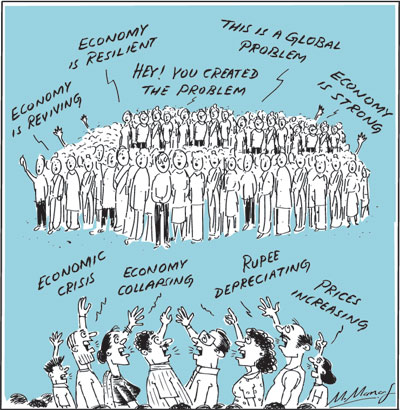

View(s):The current economic difficulties have given rise to a controversy on whether the economy is in a state of crisis. Extreme positions have been taken that either the economy is in a severe crisis or is stable and strong. The salient issue is whether the economy is strong enough to withstand the current international economic shocks.

Political bias

Political bias

Much of the discussion is clouded by politics and hardly based on facts and figures. Even when facts and figures are quoted their interpretation is biased and prejudiced. Worse still, the figures are often wrong. Furthermore, critics of the current economic situation fail to consider the antecedents to the problems and the international factors that have aggravated the economic problems.

Overview

The view that the economy is about to collapse is a colossal overstatement. To characterise the economy as robust and strong is as erroneous. Undoubtedly, the economy has fundamental weaknesses. These inherent weaknesses are not new. They were not brought about by the recent global financial developments, but were aggravated by them and they left no space to take countervailing measures to mitigate the economic difficulties.

Macroeconomic weaknesses

Undoubtedly, the economy has serious fundamental macroeconomic weaknesses that make the external shocks difficult to face. The weak fiscal position and external finances are among these fundamental weaknesses that make the economy vulnerable to the global financial developments. These fundamental weaknesses make it difficult to withstand the external shocks and to take adequate countervailing measures to mitigate their impact.

Fiscal weakness

The most serious fundamental weakness in the economy has been the weak public finances that were the result of economic mismanagement over a long period of time. The persistent large fiscal deficits over many years have been the root cause for economic instability, the large public debt, lack of fiscal space for investment and social infrastructure development and low economic growth.

In many years, government revenue was inadequate to even service the debt. In other years, more than 90 percent of revenue was spent on repaying debt obligations. This gave no fiscal space for investment. Since both current and capital expenditure had to be financed by borrowing, the public debt ballooned and inflationary conditions prevailed.

Fiscal consolidation

Fiscal consolidation

In 2015, when the present regime took over, it started off on the wrong foot, increasing government expenditure without enhancing revenue and thereby increasing the fiscal deficit from 5.7 percent of GDP in 2014 to 7.4 percent of GDP in 2015. Since then, however, the deficit was reduced to 5.4 in 2016. In 2017 the government took steps to achieve a revenue enhanced fiscal consolidation and the fiscal deficit was contained at 5.5 percent of GDP, despite a low GDP growth.

The latest estimate of the fiscal deficit released by the Finance Minister in parliament with the appropriation bill expects the fiscal deficit to be 4.8 percent of GDP this year. The fiscal deficit for the first half of this year is estimated at 2.4 percent of GDP.

Improvement

The fiscal position today is an improvement from what it was earlier. This improvement in the public finances is a significant strengthening of the economy. However, the public debt remains high and is undoubtedly a weakness of the economy.

External finances

The country’s external finances are among some of the most serious weaknesses and are being further weakened by the current global financial developments. The external debt has risen to US$ 53.5 billion in the second quarter of 2018.

Furthermore, owing to accumulated foreign debt, foreign debt servicing next year is estimated to be more than US$ 4 billion and will remain high in the two years to follow. Much of this increase in debt was incurred by the last regime and compounded by the need to borrow to repay loans. This does not absolve the present government of its imprudent expenditure.

Foreign reserves

Foreign reserves that peaked to nearly US$ 10 billion (US$ 9.6 billion) at the end of last year, have come down to about US$ 7 billion owing to the expanding trade deficit and outflows of capital due to the current global financial developments. However, the foreign reserves are adequate to meet the debt obligations though foreign borrowing may be needed as this year’s balance of payments surplus is likely to fall from last year’s US$ 2 billion to very little, if any.

Trade deficit

The widening trade deficit despite the growth in exports is a matter for concern. While the growth in exports is one of the significant achievements of the government, the trade deficit has expanded in the first 7 months despite the growth in exports owing to higher imports of fuel, motor vehicles and gold.

Although tourist earnings that are increasing and workers remittances that are high, but not rising, would offset the higher trade deficit, capital outflows are likely to reduce the BOP surplus this year. This is an unfavourable development as the expectation was that there would be a higher balance of payments surplus to strengthen the reserves and ease next year’s large foreign debt repayment.

Economic performance

The economy’s performance has been inadequate and far below its potential. The average annual economic growth in 2015-17 plummeted below 4 percent to 3.5 percent. Last year’s growth affected by drought and floods plunged to 3.1 percent. There has been a moderate revival of the economy in the first half to 3.4 percent with second quarter growth being 3.7 percent. Although there is an expectation of higher growth in the second half of the year, this year’s growth is expected to be less than the anticipated 4 percent.

Strong economy?

It is an exaggeration to contend that the economy is strong. The trade deficit is widening, foreign debt is high and burdensome, economic growth has slowed, business confidence is low and economic policies are uncertain and confusing. On the other hand, economic growth is rising though moderately, exports are increasing, the fiscal situation is a distinct improvement and foreign reserves are adequate to meet the onerous debt repayment.

Fundamental reasons

The underlying reason for the economic weaknesses of several decades is that rational economic policies were not adopted owing to political considerations and motivations. Reforms needed to improve the public finances were not taken owing to the political opposition to them not only by the opposition, but vested interests within governments and trade unions.

Outmoded and uneconomic ideological positions that are popular in the country have been a serious deterrent to economic reforms that would strengthen the economy. The persistence of huge loss making enterprises is illustrative of this policy impotence.

Summary and conclusions

The current global financial developments are a serious concern and one that is out of the control of the government. The situation is, however, not one that is a crisis that the economy is unable to withstand. There should, however, be policy moves to lighten the economic problems such as cutting down public expenditure on nonessential and wasteful areas.

There is little doubt that the economy is weak and vulnerable. Economic growth is lagging far below the sub regions growth of around 7 percent and the prospect of rapid economic growth is bleak. Key economic indicators of the state of public finances, the large public debt and foreign debt, the expanding trade deficit, the low BOP surplus, inadequate foreign reserves and foreign debt servicing burden, however, are not new weakness.

Some indicators such as the fiscal position are an improvement and further strides in fiscal consolidation could stabilise the economy. The significant growth in exports is a vital improvement. The benefits of this export growth to the economy need to be consolidated by taming unnecessary and ill affordable imports.

Leave a Reply

Post Comment