Columns

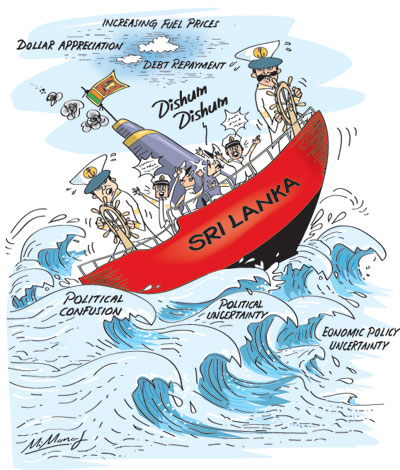

Political confusion and uncertainty severe threats to economy

View(s):The political confusion and uncertainty caused by the dismissal of the Prime Minister and the Cabinet and the prorogation of parliament are serious setbacks to the economy, especially as they come at a time when the economy is facing several challenges from global financial developments and escalating fuel prices.

Reduced tourist earnings, capital outflows and higher interest costs would affect the balance of payments and external finances adversely. Further deterioration in the country’s external finances owing to political instability would render the large foreign debt repayment obligations next year onerous.

Immediately, the political uncertainty would affect the economy adversely in several ways. Exporters are likely to withhold remitting their earnings in the expectation of further rupee depreciation. Tourist arrivals are likely to drop as several countries have already issued travel advisories that travelling in Sri Lanka is risky as deterioration in law and order is imminent. These adverse travel advisories have come during the peak tourist season. Foreign investors are likely to be dissuaded from investing in a politically unstable country.

Immediately, the political uncertainty would affect the economy adversely in several ways. Exporters are likely to withhold remitting their earnings in the expectation of further rupee depreciation. Tourist arrivals are likely to drop as several countries have already issued travel advisories that travelling in Sri Lanka is risky as deterioration in law and order is imminent. These adverse travel advisories have come during the peak tourist season. Foreign investors are likely to be dissuaded from investing in a politically unstable country.

Capital outflows

A serious consequence of the political crisis could well be capital outflows that would further deteriorate the balance of payments. Such outflows are likely from the stock market, government securities and bond market.

These will be a severe strain on the balance of payments that was deteriorating before the current political crisis due to the expanding trade deficit and capital outflows owing to more attractive interest rates in the US…

Foreign Investment

Foreign investments are likely to be withheld. Not that the country was receiving large foreign investments in the last three years, but the glimmer of hope that there would be a pickup of foreign investment has once again faded away.

International ratings

The unstable political conditions would undoubtedly result in poor ratings of the economy by international rating agencies like Fitch, Moody’s and Standard and Poor. This would increase the cost of international borrowing. The already high rates of interest the country borrows at could increase if the country risk is ranked high.

This would be a further blow to the economy’s external finances, as foreign borrowing is needed to meet the large debt servicing of over US$ 4 billion next year.

Negative rating

Moody’s has already pointed out that the current political crisis is credit negative for sovereign bonds and that social tensions that may unfold in the next few weeks would have a negative impact on the economy that is growing slowly.

Moody’s statement pointed out that “at a time when global financial markets are turbulent, uncertainty about the direction of future policy could have a large and lasting negative impact on international investor confidence”. It went on to warn that: “Such a development would undermine Sri Lanka’s ability to refinance forthcoming external debt in early 2019 at affordable costs.”

Imprudent policies

The political crisis and further developments could result in the adoption of inappropriate economic policies dictated by short term political gains. Imprudent economic policy measures for political gains could include the abandonment of the fuel price formula and a reduction of the consumer prices of petrol, diesel, kerosene and gas.

The political crisis and further developments could result in the adoption of inappropriate economic policies dictated by short term political gains. Imprudent economic policy measures for political gains could include the abandonment of the fuel price formula and a reduction of the consumer prices of petrol, diesel, kerosene and gas.

In fact, at the time of predicting this, the government has done just this. This change in policy would increase demand for fuel and enhance imports of fuel that is already the highest single import expenditure accounting for nearly a fifth of import expenditure. It would also increase the fuel subsidy and strain government expenditure.

Defend rupee

Another possibility is that the government would defend the rupee and deplete the low foreign reserves. This is a popular policy whose adverse impact on the foreign reserves are not understood.

Such an exchange rate policy could bring the country to the brink of a foreign exchange crisis.

Long run

In whatever manner the current political developments are resolved, the current political uncertainty has the likelihood of undermining the fiscal consolidation process. There were concerns even before this crisis that the budget that was scheduled to be presented tomorrow would have been a populist one where expenditure on employment creation, salary increases, subsidies and other programs that would increase government expenditure would expand the fiscal deficit.

Budget 2019

The next budget would have far reaching impacts on the country’s economic stability and development. The fundamental issue is whether the government’s concern would be its popularity in the run-up to elections next year or economic stability and long run economic development.

The budget can either ensure that the essential ongoing process of fiscal consolidation is continued by prudent expenditure or destabilise the long term interests of the economy by pandering to the electorate by populist expenditure programs that would increase public expenditure, expand the fiscal deficit and derail the progress in fiscal consolidation.

Populist budget

In the current political context, whoever presents the budget, the budget is likely to be a populist one that proposes a large number of subsidies, populist programmes and salary increases. The large expenditure on these populist measures would increase the fiscal deficit unless there are other expenditure controls and new taxation measures.

There is also the possibility of some measures of tax relief. These, too, would expand the fiscal deficit by decreasing revenue. Furthermore, the depreciation of the rupee is increasing the rupee cost of debt servicing that would also impact adversely on the fiscal outturn.

Fiscal consolidation

Ensuring that the fiscal deficit is contained is vital for economic stability and growth. The fiscal deficit that ballooned to 7.4 percent of GDP in 2015 was brought down to 5.4 in 2016. It increased slightly to 5.5 percent of GDP in 2017, mainly due to the dip in economic growth to 3.1 percent last year.

The fiscal deficit was on course to be reduced to 4.8 percent of GDP this year with the mid-year fiscal deficit reduced to 2.4 percent compared to last year’s 2.5 percent of GDP. However, even this year’s deficit could expand owing to increased expenditure on several programmes that could increase expenditure in the second half of the year.

The political instability is likely to result in government increasing expenditure to placate the voters to ensure its popularity.

Fiscal target

The fiscal deficit is targeted to be reduced to 3.5 percent of GDP by 2020. Attaining this would be significant for economic stability and development. The paramount issue is whether government expenditure could be contained to reduce the fiscal deficit next year.

Salary increases, increased public service employment and expensive expenditure on popular rural programmes could increase expenditure much above expected revenue and increase the fiscal deficit rather than contain it.

In conclusion

All things considered, the uncertainty created by the political crisis is detrimental to the economy at this moment in time. This is particularly so as it comes at a time when the economy is facing several challenges from global financial developments and escalating fuel prices. The dangers to the economy have been repeatedly emphasised by many quarters.

One can only hope that political stability is restored speedily and the government would be concerned about economic stability and the long-run economic growth.

Leave a Reply

Post Comment