Columns

Prolonged political crisis serious threat to balance of payments and external finances

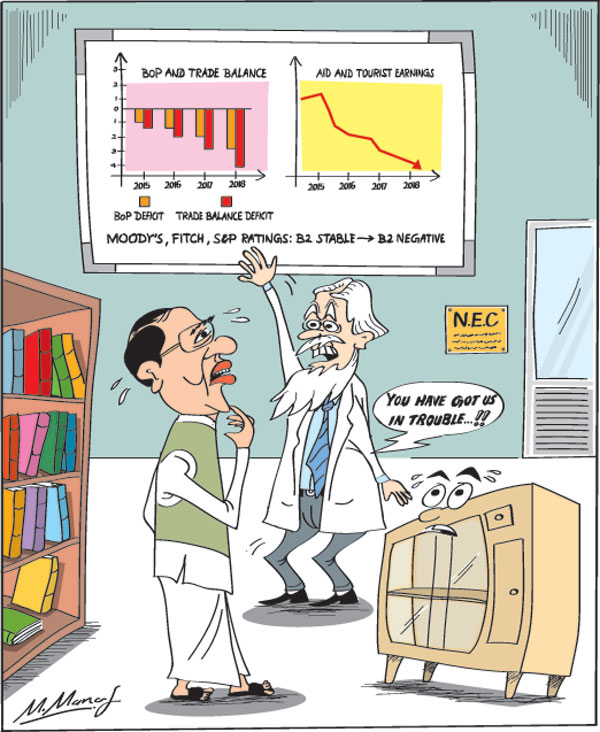

View(s):The longer the political crisis the more serious its adverse effects on the economy. This is especially so with respect to the balance of payments. A large balance of payments would weaken the external reserves and make the repayment of debt next year more onerous.

Twists and turns

Twists and turns

At the time of writing, there is a glimmer of hope that the constitutional crisis and political chaos may be resolved. However, there have been so many twists and turns in the political saga that it is difficult to predict the final political outcome. We cannot yet see the light at the end of this dark political tunnel.

Several setbacks

In any event, as we pointed out in last Sunday’s space, the political stalemate of over one month has been a severe blow to the economy in several ways. This year’s economic recovery has been retarded, next year’s economic performance adversely affected and long run economic development undermined by weakening macroeconomic conditions.

First nine months

Unlike last year, when the balance of payments had an overall surplus, the balance of payments is likely to register a significant deficit this year.

The trade deficit ballooned to nearly US$ 8 billion during January to September this year. However, in the first nine months of this year, workers’ remittances of US$ 5.3 billion and tourist earnings of US$ 3.2 billion offset this deficit by nearly US$ 0.6 billion. However capital out flows have resulted in the overall balance being in deficit by 0.65 billion by end September.

Balance of payments

The political stalemate is weakening the balance of payments (BOP) in a number of ways. Tourist earnings are falling, capital outflows are increasing and foreign investments are drying up. Furthermore, foreign aid and an IMF loan are on hold. Perhaps export earnings are being withheld.

As the country is very much dependent on these sources to offset the large trade deficit, the balance of payments is severely weakened. In contrast to last year’s balance of payments surplus, this year’s overall balance is heading to a significant deficit.

In 2017 and 2018

In 2017 and 2018

In 2017, the country achieved a balance of payments surplus of nearly US$ 2.1 billion owing to workers’ remittances, tourist earnings and capital inflows offsetting the large trade deficit of US$ 9.6 billion. These favourable factors are weaker this year.

In the first 9 months of 2018 the BOP deficit had reached 0.6 billion. This was in contrast to a balance of payments surplus or overall balance of US$ 1.4 billion in the first 9 months of last year. This deficit was due to a reduction in workers’ remittances by 1.5 percent and large capital outflows from the stock market and government securities.

While these outflows were initially due to developments in global financial markets, the outflow intensified after October 26 owing to the political crisis and are continuing to increase the BOP deficit.

Reversal

Despite the adverse developments in global financial markets, the balance of payments was on the way to once again generating a surplus owing to remittances, tourist earnings, aid and loans offsetting the emerging large trade deficit, when the political convulsions occurred. A dip in tourist earnings, aid and loan inflows are responsible for this reversal.

Capital inflows

Several significant inflows of capital that were about to be disbursed have been withheld. The inflow of the first instalment of about US$ 0.5 billion of an agreed IMF loan facility of US$ 1.5 billion, US aid of about US$ 0.45 billion and Japanese aid of around US 0.4 billion are on hold till political stability is restored.

These inflows would have most probably turned the overall balance into a surplus. Furthermore, there was an expectation of enhanced tourist earnings of US$ 3.5 billion this year. The tourist earnings in November and December are expected to dip owing to large scale cancellations from important destinations like India, Europe and North America. Perhaps this shortfall would be in the region of US$ 400,000.

Higher borrowing need

Although these changes would affect the balance of payments only in the last two months, they are severe enough to erode the balance of payments and turn it into a deficit. Consequently, we would require higher borrowing to repay foreign debt obligations next year.

Higher costs

In the current context when international rating agencies, Moody’s, Fitch and Standard & Poor, have downgraded the country and increased its risk ratings, the costs of international borrowing would increase. So we are getting into a predicament of a need for increased borrowing at higher costs and getting into a pathetic economic predicament owing to the current political anarchy.

Implications

The implications of the deteriorating balance of payments is serious. A surplus in the balance of payments would have enhanced the country’s foreign reserves and these could have been used for the repayment of the large foreign debt obligations next year. The balance of payments deficit this year means that the debt obligations would have to be met by the current reserves and further borrowing. Further borrowing to meet debt repayment obligations would increase foreign debt.

Furthermore, in the current context, borrowing costs would be very high for the country owing to the adverse risk ratings of the country. There is no doubt that the political crisis has brought the country to the brink of an economic and financial crisis.

Imperatives

The release of the agreed IMF facility of US$ 1.5 billion is crucial as the other adverse factors cannot be reversed easily. However the release of this facility is conditional to political stability and meeting fiscal provisions that have been violated by the post October regime.

The resolution of the political gridlock is vital to prevent a further deterioration of the balance of payments that the country can ill afford in a context of large repayments of debt in 2019 and beyond. The current reserves of about US$ 7 billion that are declining are inadequate to meet the debt obligations and meet the country’s foreign exchange needs for imports.

Final word

Only the restoration of political stability and stable economic policies could hope to achieve this. Time is running out.

Leave a Reply

Post Comment