Economy of failure: Way-out of disastrous 5 interlocking economic traps

Since, 2015 the economy has seen politically confused, policy formulation. Two political ideologies with two-way-policy making processes make economic “traps” faster than their due timeframe. Economist Nimal Sanderatna has clearly pointed out and warned about (Sunday Times 2013) “three fundamental economic traps as fiscal deficit, trade deficit and debt trap”.

The very same three have amplified into Five Interlocking Economic Traps (FIETs) after six years although none of the authorities seriously considered this.

Infrastructure-led development strategy in 2010

File picture of Red Nadu rice packs ready to be dispatched. Rice farming is no more a lucrative or efficient sector in Sri Lanka's economy.

In 2010, the Government changed its’ development strategy to public infrastructure-led growth policy; as the main engine of growth and funds were borrowed and invested with a vision of long-term benefit generation. The Government may have expected multiple benefits together with trickle-down growth effects in the long-run irrespective of the capacity to pay-off debt repayments. Although theoretically it is a workable development strategy for achieving growth and placing the country on the development path, it practically is a failure.

Since 2015, unfortunately, the government has also followed blindly the very same “policy of development through future generations’ earning” irrespective of prevailing “bust- roll-models” and their poor outcomes. The Government could have adopted feasible and pragmatic economic policies instead of blaming predecessors taking high-cost debt while following the same development strategy. With the budget deficit- financing through foreign market, total foreign debt has gone over sustainable level, ultimately creating FIETs, destabilising the economy.

Exponential vicious cycles created Five Traps

Since 1990, every Government used to follow expansionary fiscal policy, spending for winning voters’ support in every election. Sri Lankan voters are also used to vote for the biggest “perjurer” who promised a baggage of benefits and free concessions. As a result, the Government became the biggest borrower in the market and use borrowed funds for consumption purposes than investments in addition to “crowding out” of market savings. The outcome is FIETs and a vicious cycle of five real traps which are-inter connected, ruining the whole economy.

The effects of FIETs clearly appeared when the media reported on January 18, 2019, that the government is going to raise new debt for repaying old-debt, an amount of US$5.9 billion from international markets at high cost. Under these circumstances escape from five traps is not an easy task unless implementing long term recovery plan with structural reforms together with committed political will. These five traps are amplifying annually until such time they transform into economic downturn and recession.

Gigantic public expenditure trap

Since 2000, the year by year accumulated public expenditure components have turned out into a trap because the Treasury expenditure has grown beyond affordable levels; 100 per cent over state revenue. Total estimated budgetary deficit from 2006 to 2016 was Rs. 11,035 billion or $78.8 million. A research finding indicated that the “Growth Effects of Fiscal deficit financing in Sri Lanka is negative during 1970 to 2015″. In other words, the outcome of expansionary fiscal measures are negative.

Since 2000, the year by year accumulated public expenditure components have turned out into a trap because the Treasury expenditure has grown beyond affordable levels; 100 per cent over state revenue. Total estimated budgetary deficit from 2006 to 2016 was Rs. 11,035 billion or $78.8 million. A research finding indicated that the “Growth Effects of Fiscal deficit financing in Sri Lanka is negative during 1970 to 2015″. In other words, the outcome of expansionary fiscal measures are negative.

FIETs hit the economy with the budgetary estimates for 2019 clearly demonstrating a real picture. The total state expenditure is Rs. 4470 billion and recurrent expenditure Rs. 1425 and capital expenditure Rs. 858 while debt repayments is Rs. 2200 billion. Within recurrent expenditure, there are unavoidable large cost components which are due to politicians’ promises and subsidized election winning public expenditure programmes for voters in order to win political power. Once benefits are offered out of government pocket, it cannot be withdrawn and becomes a trap. For example, promises like two million job creation or jobs for all graduates without specific duty or productivity or jobs for political supporters in state companies and Rs. 20,000 pay-hike for government officers, etc. There are loss-making but social obligatory services like Railway, CTB, etc which have also turned into traps As a result, there are lesser allocation for essential public services and goods such as agriculture, small industries, law and order, health, education, social protection, etc.

The way out of an expenditure trap is through public expenditure reforms and supply-side policy implementation in order to enhance aggregate productivity. Capital work could be shared with the private sector on the basis of PPP, FDI and inviting MMCs to invest while minimising corruption and waste. In the meantime investing in human resource development; education, training, health, knowledge-based projects may be positive strategies strengthening the economy and also supportive debt disbursement. Similarly implementation of supply-side policies particularly, producing exportable or import competitive goods and services and also those generating sizable foreign exchange are positive gateway solutions.

Poor public revenue base trap

Although Sri Lanka is in the level of lower middle income countries, the government revenue base is almost below the level of similar countries. Revenue is around 11 per cent of GDP in 2019 while expenditure is around 20 to 25 per cent. One of the fundamental reasons for borrowing is due to the inability to enhance the revenue base; which has turned into a trap. In addition the composition of revenue structure itself is a trap because there is no developed tax-paying culture. It is extremely difficult to increase the revenue unless revenue sector reforms are completed in order to expand the tax-base at least to 80 per cent of expenditure. Eventually, the whole tax administration system is corrupted; and needs immediate reforms.

Way forward strategies are; first enhance tax-base and Production Possibility Capacity (PPC) particularly, producing exportable goods and services with lowest opportunity cost, strengthening professional services, import competing events and expanding import substitutions which have comparative advantages. Provide incentives to enhance economic activities in the private sector, stimulating production capacities in order to broadening corporate tax base and strengthening tax-administration. Furthermore, operating all state organisations – Railway, CTB, etc at least no-cost-no-loss basis and making them self-sustained and relief to the Treasury.

Foreign debt trap

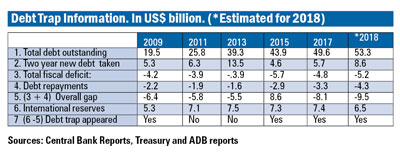

The ins and outs of the foreign debt trap almost originated as a result of both colossal public expenditure trap and limited revenue base trap particularly since 2009. The compounding budget deficit and excessive, expensive foreign debt financed- infrastructure projects resulted in accumulated huge debt balance as foreign liabilities. Impact on war expenses were clearly seen in the foreign debt balance until 2009 as $19.5 billion. Since 2009, debts are unsustainable beyond manageable level and repayments only by raising new costly debts. The table shows estimated information about debt trap and its root causes

The debt trap which appeared in 2009 and 2015 onwards is a permanent trap, clearly unsustainable debt creation. It is also clearly indicated in 2019 budgetary estimates, where the debt-service obligation is estimated to Rs. 2200 billion, almost 50 per cent of total budget and estimation for 2020 indicates around $8.2 billion. It is reported that the Central Bank is going to raise $5.9 billion for debt repayment in 2019. It further said that China will contribute $0.5 billion, India $400 million, $2 billion from Panda and Samurai bonds and $400 million. In the absence of strong international reserves and considerable level surplus of balance of payments, debt repayment is only through new borrowed funds. International reserves balance needs to be enhanced through strong dollars earned.

The way out from a debt trap is with financial discipline; following competitive procurement procedures for minimising corruption and investing borrowed funds in foreign exchange generating projects; encouraging private sector for production of tradable goods and services for export, and import competing domestic resource utilisation projects, tourism and knowledge-based services making foreign exchange inflows. Furthermore, the authorities may go for debt-relief measures: Multilateral, biateral and debt forgiveness depending on government policy. For example; policy of creditor managed debt-based projects and also limiting debt-based huge projects until such time the debt is reduced.

Balance of Payment (BoP) trap

The BoP is the indicator of net results of all international-transactions between Sri Lanka and rest of the world; usually one year period. BoP is calculated under three stages, all three are trapped. The first is balance of trade (BoT) is always negative and is a trap. Exports are half of imports because many imports are compulsory, unavoidable, essential requirements irrespective of foreign exchange shortage. In 2000, BoT was a $1.8 billion deficit while 2010 BoT was $4.9 billion; the deficit has been estimated at $10 billion in 2018. Secondly, current account stage, among visible and invisible trade services; the biggest component is the debt repayments and capital inflows and outflows; also negative BoT deficits are set-off by workers’ inward remittances, tourism, financial services keeping a further negative balance of around $2 billion in 2014 and as estimated BoP in 2018; a negative of $3.5 billion creating poor support for foreign reserves build-up. BoP balance is the key to build-up essentially needed foreign reserves and determination of exchange rate.

Possible solutions are; firstly, strengthening BoT through enhancing exports sector and other services, capable of foreign exchange earning potential while reforming import-competing local production base. Theoretically it is a “pursuit of comparative advantages” which propose to change the structure of tradable goods and services which are produced at lower opportunity cost than Sri Lanka’s trading partners. Secondly, encourage export production which have absolute advantages with local resource mobilisation. Thirdly, encouraging skilled and knowledge-based services strengthening; remittances inflows. Fourthly, restricting unnecessary imports; while allowing absolutely needed imports, and encourage imports of capital good, input for exportable goods and monitoring inward remittances including tourism, hospitality and enhancing favourable outward-orientation in the export trading.

When acquiring a business any sensible businessman will firstly undertake an assessment regarding assets and liabilities; strength and weaknesses, risk and opportunities and accordingly prepare an operational plan. Very often, he will prepare forecasts of anticipated financial threats and vulnerabilities in order to avoid downturns and financial crisis. Such a businessman will never ever request a loan of $5.9 billion to settle old debts because loan is not free and is costly. Is this the fate of Sri Lanka when there are dozens of advisers maintained by the Government?

Way forward

Evidence has suggested that Sri Lanka is a spectacular political economy of failure. As a result, the country is attacked by FIETs. Sri Lanka has followed expansionary fiscal policy for the purpose of fulfilling electoral promises which resulted in total economic failure. Under this not only has the Government failed but also discouraged the private sector. Way out of these FIETs is in allowing the private sector to share economic activities in terms of PPP, FDI and MNC policies. The Government has to implement supply-side strategies to win the support of the private support instead of the Government doing everything.

More than anything else the state has to clear political uncertainties, instability, controversial political signals which are developing since 2015. Consequently, since the country is on the doorstep of a series of elections in 2019/20 it is puzzling that the political economy is having the courage to tell the truth regarding economic reality and taking appropriate policies resolving FIETs. The worst scenario is a populist election budget in 2019 at the expense of tax-payers and taking the risk of win or lose the elections. Whatever happens, the country is at risk; the political authorities should think of “the country first and not the ballot “.

(The writer is an economist with Treasury level wide experience on the subject. He could be reached at palithaeka@yahoo.com)