Budget 2019: Challenge in its implementation

View(s):

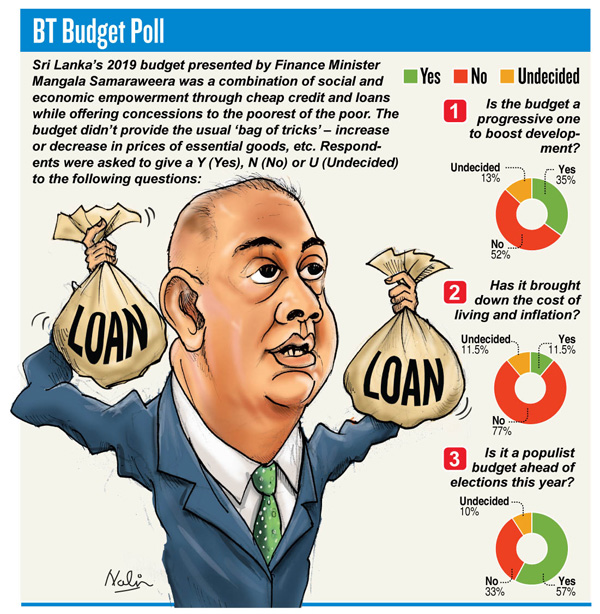

Contrary to expectations, Sri Lanka’s 2019 Budget was not totally a populist one. This was also confirmed in a Business Times email poll this week, which covered a cross section of the population and revealed that only slightly over half (57 per cent) believed it was a populist budget.

To the question, “Is it a populist budget ahead of elections this year?” 33 per cent of the respondents said “No” while 10 per cent were “Undecided”.

The poll was conducted soon after the budget presentation on Tuesday by Finance Minister Mangala Samaraweera. To the question, “Is the budget a progressive one to boost development?” 52 per cent said “No” while 35 per cent responded with “Yes”.

Responding to the third question, “Has it brought down the cost of living and inflation?” the tally was 77 per cent (No) and 11 per cent saying “Yes”. In many of the comments received, respondents said the biggest challenge is in the implementation of the proposals.

One of the respondents, in his comments said: “The budget has some progressive features such as incentives for additional maternity leave, new home buyers who can qualify for low interest loans and IT sector enterprises. But it is unlikely to boost development. It lacks measures to kick-start the economy most likely because of the focus on containing the budget deficit and reducing public debt. This is laudable. Despite 2019 being an election year the budget is not giving away unsustainable benefits to the masses with a view to winning votes except perhaps for the Rs. 2,500 salary increase to public sector employees. Would a VRS to the bloated public sector using these funds help deficit reduction in the medium to long term?”

Other comments by respondents are as follows:

n If there are no measures taken to contain the ever-escalating level of corruption, no development can take place. Neither can we expect much needed FDIs.

- The budget doesn’t encourage development.

- It looks like a mish-mash of give and take impacting on different sectors without addressing the core issues affecting the economy.

- It was not a populist budget.

- Inflation is general or brought down by the Central Bank (CB). The budget simply transfers money from one pocket to the other. Only the CB can create new money to finance the deficit.

- Cheap credit creates inflation on the short to medium term. This turn will increase cost of living

- COL cannot really be reduced unless the building blocks of the economy are in place. They are now been placed.

- There are a few populist measures, but generally it’s not a populist budget. There may be more “goodies” closer to elections.

- Yes the main objective is to woo voters to remain in power. The country will develop faster if the present leadership is voted back.

- The budget has avoided tax adjustments that could reduce the cost of living and inflation. VAT exemptions, reduction of taxes on fuel and thereby the price of fuel, subsidies and other measures could have brought down the cost of living but the economic damage would have been substantial.

- Resisting such populist measures is again praiseworthy especially in an election year.

- Overall, one has to question how seriously the budgeting process must be taken by the citizens of the country, given that much of it never gets implemented, it rarely ever achieves the objectives outlined, and is based largely on incorrect figures.