Columns

Prospects of economic recovery in the second half of 2019

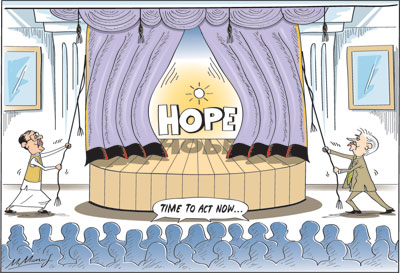

View(s):June is a critical month when peaceful conditions, security and law and order must be firmly established to enable an economic recovery in the second half of the year. The restoration of public confidence and an international perception that the country has returned to normal are crucial for an economic recovery.

An economic recovery of consequence would be possible only if the security situation improves, business confidence is restored and there are no political disruptions. The economic performance of the rest of the year depends on these preconditions.

An economic recovery of consequence would be possible only if the security situation improves, business confidence is restored and there are no political disruptions. The economic performance of the rest of the year depends on these preconditions.

Economic growth

The expectation that the economy would revive in the second half of the year to post a higher economic growth in 2019 than in 2018 depends on the normalisation of security in the country and stable political conditions. However, at best the economy is likely to grow at 3.5 percent this year as a number of other conditions are unlikely.

Political environment

While security conditions may be established, it is difficult to envisage a political environment conducive to economic development during the remaining few electioneering months of the year. Therefore, achieving even a moderate economic growth of 3.5 percent could be a challenging task.

The impending elections this year is a distinct economic disadvantage for both this year’s economic performance and long run economic growth and development. The next seven months would be full of political actions to retain or win political power. Economic policies and their implementation would be politically motivated, while the opposition would do their best to distract the government’s economic programme.

The government’s focus on the economy would be distracted by political debates, controversies and obstructionist actions of the opposition. These would be distractive of economic issues and even lead to countervailing measures that are not in the economic interests of the country. Good politics is likely to be bad economics.

International factors

International factors

Global economic conditions and the international financial environment could assist the economic recovery. The international financial conditions are likely to be far more hospitable than that of last year.

A more stable US dollar and US Federal Reserves’ interest rates unlikely to rise this year would ensure far more financial stability for the country.

Oil prices

International oil prices affect the balance of payments significantly. Fuel prices have declined and current indications are that oil prices are not likely to rise. However, the repercussions of the trade war between the US and China and economic sanctions on Iran by the US makes the international economic environment highly unpredictable and volatile. We can only hope for no external shocks during the rest of the year.

Last year

Economic growth was severely affected in the last quarter of last year by the 52 days of political anarchy. Had this dislocation not happened the economy may have grown by over 3.2 percent. Similarly this year’s second quarter’s growth was shattered by the spate of bombings and communal attacks.

This year

The biggest casualty of terrorism this year was the booming tourism. Investor confidence, too, suffered. There was also the slowing down of most economic activities. Despite these adverse impacts, it was an economic setback and slow down, rather than an economic destruction. The expectation is that economic activities would regain their momentum and succeed in gaining lost ground.

Tourism

In as far as tourism is concerned, the expectation of the trade is that if international confidence in the country’s security could be established soon, tourist arrivals could be high in the next tourist season beginning in October 2019. Recovering to what would have been the tourist arrivals and earnings in 2019 is rather optimistic. Some limited recovery in tourism is what could be expected.

Instead of the targeted and expected tourist earnings of more than US$ 5 billion this year, earnings of about US$ 3 to 3.5 billion is more realistic. Although this is a significant loss for the balance of payments, its adverse effect on the balance of payments is likely to be offset by lesser imports for the tourist industry that is estimated to incur import expenditure of about 50 percent of tourist earnings. Nevertheless, tourism contributes about 5 percent to GDP and the setback weakens this year’s economic growth.

Trade deficit

One of the serious weaknesses of the economy has been the increasing trade deficits in recent years. The trade deficit of US$ 9.6 billion in 2017 increased to US$ 10.3 billion last year. Such a large trade deficit weakens the balance of payments and erodes the foreign exchange reserves.

The increasing trade deficit has been in spite of a growth in exports. Import growth has been higher than export growth. In 2018 exports reached US$ 11.9 billion but imports were nearly double at US$ 22.2 billion. Will the trade deficit be reduced this year?

There has been a reduction of imports in the first few months of the year. If this trend continues, while export increase, the trade deficit could be reduced this year.

Concluding reflections

All things considered, the economy is likely to grow at around the same rate or slightly more than last year’s 3.2 percent. Achieving a growth of 3.5 percent or more is challenging but not impossible.

June is a critical month when peaceful conditions, security and law and order must be firmly established to enable an economic recovery in the second half of the year. The restoration of public confidence and an international perception that the country has returned to normal are crucial for an economic recovery.

An economic recovery of consequence would be possible only if the security situation improves, business confidence is restored and there are no political disruptions. The economic performance of the rest of the year depends on these preconditions.

Economic growth

The expectation that the economy would revive in the second half of the year to post a higher economic growth in 2019 than in 2018 depends on the normalisation of security in the country and stable political conditions. However, at best the economy is likely to grow at 3.5 percent this year as a number of other conditions are unlikely.

Political environment

While security conditions may be established, it is difficult to envisage a political environment conducive to economic development during the remaining few electioneering months of the year. Therefore, achieving even a moderate economic growth of 3.5 percent could be a challenging task.

The impending elections this year is a distinct economic disadvantage for both this year’s economic performance and long run economic growth and development. The next seven months would be full of political actions to retain or win political power. Economic policies and their implementation would be politically motivated, while the opposition would do their best to distract the government’s economic programme.

The government’s focus on the economy would be distracted by political debates, controversies and obstructionist actions of the opposition. These would be distractive of economic issues and even lead to countervailing measures that are not in the economic interests of the country. Good politics is likely to be bad economics.

International factors

Global economic conditions and the international financial environment could assist the economic recovery. The international financial conditions are likely to be far more hospitable than that of last year.

A more stable US dollar and US Federal Reserves’ interest rates unlikely to rise this year would ensure far more financial stability for the country.

Oil prices

International oil prices affect the balance of payments significantly. Fuel prices have declined and current indications are that oil prices are not likely to rise. However, the repercussions of the trade war between the US and China and economic sanctions on Iran by the US makes the international economic environment highly unpredictable and volatile. We can only hope for no external shocks during the rest of the year.

Last year

Economic growth was severely affected in the last quarter of last year by the 52 days of political anarchy. Had this dislocation not happened the economy may have grown by over 3.2 percent. Similarly this year’s second quarter’s growth was shattered by the spate of bombings and communal attacks.

This year

The biggest casualty of terrorism this year was the booming tourism. Investor confidence, too, suffered. There was also the slowing down of most economic activities. Despite these adverse impacts, it was an economic setback and slow down, rather than an economic destruction. The expectation is that economic activities would regain their momentum and succeed in gaining lost ground.

Tourism

In as far as tourism is concerned, the expectation of the trade is that if international confidence in the country’s security could be established soon, tourist arrivals could be high in the next tourist season beginning in October 2019. Recovering to what would have been the tourist arrivals and earnings in 2019 is rather optimistic. Some limited recovery in tourism is what could be expected.

Instead of the targeted and expected tourist earnings of more than US$ 5 billion this year, earnings of about US$ 3 to 3.5 billion is more realistic. Although this is a significant loss for the balance of payments, its adverse effect on the balance of payments is likely to be offset by lesser imports for the tourist industry that is estimated to incur import expenditure of about 50 percent of tourist earnings. Nevertheless, tourism contributes about 5 percent to GDP and the setback weakens this year’s economic growth.

Trade deficit

One of the serious weaknesses of the economy has been the increasing trade deficits in recent years. The trade deficit of US$ 9.6 billion in 2017 increased to US$ 10.3 billion last year. Such a large trade deficit weakens the balance of payments and erodes the foreign exchange reserves.

The increasing trade deficit has been in spite of a growth in exports. Import growth has been higher than export growth. In 2018 exports reached US$ 11.9 billion but imports were nearly double at US$ 22.2 billion. Will the trade deficit be reduced this year?

There has been a reduction of imports in the first few months of the year. If this trend continues, while export increase, the trade deficit could be reduced this year.

Concluding reflections

All things considered, the economy is likely to grow at around the same rate or slightly more than last year’s 3.2 percent. Achieving a growth of 3.5 percent or more is challenging but not impossible.

Leave a Reply

Post Comment