Columns

Inability to attract FDIs slows economic development

View(s): A n undisputed feature of modern economic development is the strong relationship between foreign investment and economic growth. Sri Lanka’s failure to obtain higher amounts of foreign direct investments (FDIs) of the appropriate type has been an important reason for the country’s low rate of economic growth.

A n undisputed feature of modern economic development is the strong relationship between foreign investment and economic growth. Sri Lanka’s failure to obtain higher amounts of foreign direct investments (FDIs) of the appropriate type has been an important reason for the country’s low rate of economic growth.

We have obtained only a fraction of FDI that other South and South East Asian countries have received. This year’s FDI inflow is expected to be even lower than last year’s. The country requires much larger FDI inflows of to achieve a sustainable high trajectory of economic growth.

Need for FDIs

There are irrefutable reasons for higher FDIs. For Sri Lanka’s economy to grow by 7 to 8 percent a year, there is a need to invest around 35 to 40 per cent of GDP. To achieve this, the country’s national savings is inadequate. Foreign borrowing and foreign investments have to meet this investment-savings gap.

This is generally recognised and successive governments have attempted to provide various incentives to foreign investors. However, the record of foreign investment into Sri Lanka has been far below expected levels and low in comparison with other Asian countries such as Malaysia and Vietnam.

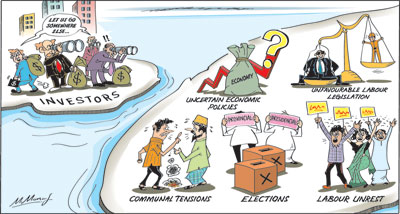

Although the need for a higher amount of FDIs to propel the economy to a higher growth is undisputed, the country has failed to attract then owing to the inhospitable conditions in the country.

Experience

Experience

The expectation of high inflows of foreign investment has been dashed to the ground on many occasions. After the liberalisation of the economy in 1977, international confidence in investing in Sri Lanka grew. In 1982, major foreign investors had decided to set up factories in Sri Lanka to produce especially electronic items. The July 1983 ethnic violence and subsequent insecurity and war put an end to these. And these investors moved into Malaysia, Thailand and other South East Asian countries which benefitted much from them.

End of war

The expectation of high foreign investment inflows into the country after the end of the war and terrorism in May 2009, too, did not materialise owing to the political conditions and economic policies. Concerns over the lack of the rule of law and property rights issues deterred investors. In fact, the EU even discontinued the country’s GSP Plus concession.

Unity government

There were expectations of a surge of foreign investment after the regime change in 2015. The political stability that was expected from the government composed of the two main parties did not materalise. The four and a half years of the coalition proved to be one of political instability and uncertainty in economic policies. Consequently, foreign investments, especially for export manufacturing, were minimal.

Absence of prerequisites

The failure to attract FDIs was due to many reasons. An important prerequisite for investment is the certainty of economic policies. Business confidence is influenced by political and economic stability, certainty in, and predictability of, economic policies, tax and other incentives, labour regulations, work ethics, social and economic infrastructure and costs of production. Most of these prerequisites were absent.

Guaranteeing of property rights, the rule of law and law and order are among the important pre requisites for developing a climate conducive for investment. Investments are sometimes deterred by perceptions of corruption. Sri Lanka is low in the Ease of Doing Business Index and corruption is high.

Politics and economics

Foremost among these prerequisites is an assessment of political and economic conditions in the country. Political conditions have been anything but stable. The political anarchy of last October, the security lapses, bomb blasts and subsequent communal violence are severe setbacks to measures to build international confidence for investment. Investors are primarily concerned about the safety of, and return to, investment. Therefore, these conditions are severe threats to FDIs.

Macroeconomic conditions

Sound macroeconomic conditions also influence investment. The high fiscal deficits, a large foreign debt and high debt servicing costs including revenue, external debt servicing costs, large trade deficit and potential inflation and instability in currency value, are among the other macroeconomic indicators that inhibit investment.

Labour conditions

Sri Lanka is no longer a cheap labour country. There are other countries such as Vietnam and Bangladesh where labour is cheaper. Labour regulations in the country also affect investment. Sri Lanka is perceived as a country where labour regulations do not permit labour discontinuance either owing to changing market conditions or on disciplinary grounds. Investors find the lack of freedom to hire and fire a disadvantage.

Costs

Costs of production play an important role in investor determination of investment locations. Several production costs, too, are high; this is especially so with respect to energy costs that is deemed one of the highest.

Limited market

An inherent weakness is the limited domestic market. Large countries like India and China offer good prospects of local sales. This is why countries such as India and China are attractive to reputed manufacturers of cars to establish manufacturing plants in these countries. The government’s plans for several free trade agreements were to overcome this weakness. However, owing to opposition to them, these opportunities have not opened up and there are doubts about their implementation.

Summing up

Foreign investment is a significant driver of economic development. It fills the savings-investment gap and contributes towards the country being able to supplement its savings with foreign savings and enhance its capacity for investment and thereby increase economic growth. While the quantum of foreign investment is important in determining the country’s economic growth, the nature and type of such foreign investment determines the long-term development of the country.

FDI contributes to improving work ethics, discipline, skills and knowledge of workers. It is an important means of technology transfer and transmission of management practices. FDIs also bring with them international markets.

It is the realisation of these economic benefits that has made former communist countries like China and Vietnam, and the formerly inward looking Indian economy to actively seek foreign investments. These three countries attract a large amount of foreign investments, with China leading the world as the largest foreign investment recipient.

Conclusion

Factors determining foreign investments are many. Whatever the reasons for tardy foreign investment inflow, the government must look into the reasons and provide a climate for enhanced foreign direct investment as a larger inflow of foreign investment is crucial for sustained high economic growth.

Leave a Reply

Post Comment