Columns

Will presidential poll ensure political stability and economic growth?

View(s):

On November 16, a new pesident will be elected. Will the election usher in political stability or will the post-election period be one of confusion and chaos? Are there prospects of an economic revival? Would the election lead to a period of political instability?

The worst scenario would be another constitutional crisis. Constitutional experts have pointed out that the new president’s powers are severely limited by the 19th Amendment. However, the presidential candidates and vast majority of the electorate consider the presidential election of foremost importance as they appear to believe that the new president will continue to be the chief executive. In fact, the new president will not hold any portfolio. It is the Prime Minister and the cabinet that will govern the country.

If the newly elected president does not accept this constitutional position, the country could be in political chaos similar to the anarchy of October 2018. This would have dire economic consequences. Such a constitutional crisis is the worst possible outcome of this presidential election. A conflict between the newly elected president and the Prime Minister would cripple the economy.

Bleak prospects

Bleak prospects

The country cannot go through a period of political instability when the economy is performing poorly. An economic recovery is vital to meet the daunting economic challenges. Will there be a new resolve to solve the fundamental problems of the economy? Or will we have a period of political confusion that will aggravate the economic crisis? The prospects of political stability and an environment conducive to economic growth are bleak.

Economic policies

It is the Prime Minister and the government backed by parliament that will have to resolve the formidable economic problems and get the economy moving much faster. However, since a parliamentary election is due in 2020, the government is likely to take economic decisions that are politically popular rather than correct. The continuation of populist economic policies will worsen economic problems.

Economic challenges

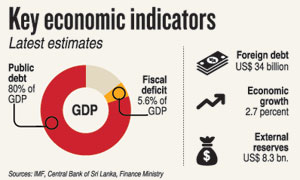

Whatever the election outcome, whoever forms the next government, it cannot escape the serious economic problems of the country. The next government would have to face the issue of a high foreign debt of US$ 54 billion and difficulties of meeting the high foreign debt repayment obligations.

The weak external finances and external financial vulnerability would be compounded by political instability. The sooner a parliamentary election is held and a stable government established the better the prospects for an economic recovery.

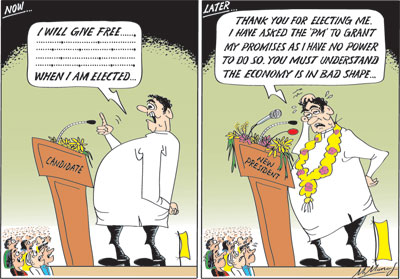

Election rhetoric

The election campaign of most candidates did not disclose an awareness of how they would resolve the very serious economic problems facing the country. Instead, if the election promises made by the elected president are implemented, the economy would be in a worse crisis.

Scarce resources

Scarce resources

The Sri Lankan electorate knows fully well that election promises, bar a few, would not be implemented. What the electorate does not know and understand is that resources are limited, in fact very scarce, and that the need of the hour is a resolve to implement stringent fiscal policies and limit public expenditure.

Fiscal slippage

In the run-up to the election, political compulsions of electoral politics have resulted in considerable fiscal slippage that has weakened the economy, or in economic jargon, it has weakened the macroeconomic fundamentals and undermined macroeconomic stability.

The consequences of the increased fiscal deficit would be, inter alia, an increase in the public debt, inflationary pressures, weakening of the country’s export competitiveness and low economic growth.

These consequences of an expansion in the fiscal deficit are serious. They will erode price stability, increase public debt, exert pressures on the exchange rate, affect external trade adversely and people’s livelihoods would be affected on top of the adversity caused by the tourism crash that has been experienced. With economic fundamentals being eroded, the country is heading towards an economic crisis.

Political compulsions

The political compulsions of the elections have driven the government to adopt policies that are vote catching. These are moving the economy into the brink of a fiscal and economic crisis. The economy’s macroeconomic fundamentals are being seriously eroded by politically motivated economic policies. This is especially so with respect to heavy public expenditure that would expand the fiscal deficit, increase the public debt and release inflationary pressures that would affect the economy adversely both in the short run and longer term.

Neither the electorate nor the candidates are aware that what is needed is fiscal austerity and not fiscal profligacy. A renewed process of fiscal consolidation could begin only with the budget for 2021. The 2020 budget is likely to be a fiscally imprudent one with further handouts, increased public sector employment, salary increases and other politically motivated unproductive expenditure. Therefore fiscal slippage will worsen before remedial measures could be implemented. The fiscal deficit target of 3.5 percent of GDP in 2020 is now a distant dream.

Public debt

Both the debt-to-GDP ratio and the fiscal deficit are far too high and burdensome. The debt-to-GDP ratio at the end of 2018 was as much as about 80 percent. This is an unacceptable level. It’s further increase this year and its servicing costs are a severe burden. The high debt servicing cost as a proportion of revenue has a crippling effect on the economy. In most years the debt servicing costs exceed government revenue or absorb nearly all government revenue.

The inadequacy of revenue to even meet the debt servicing costs is alarming. Debt servicing costs absorbing the entirety of government revenue implies that the government’s current and capital expenditure have to be from further borrowing. This is an unhealthy situation like the plight of a household whose total income has to be spent on debt repayments and has to borrow for even its basic consumption needs.

The inadequacy of revenue to meet debt servicing costs means that funds are not available for other essential expenditure. Consequently, all current and capital expenditure have to be met by further borrowing from domestic and foreign sources. This lack of funds from revenue results in a distortion in priorities in public spending. There is an inadequacy of public expenditure for education, health and development projects. It is in this fiscal context that promises are made to spend money in various ways.

External vulnerability

The increasing debt — both domestic and foreign – is a serious economic concern. The acknowledged threshold for the fiscal deficit is about 3 to 4 percent of GDP and the debt-to-GDP ratio is expected to be kept at no higher than 60 percent of GDP. The current position exceeds both these thresholds.

Conclusion

Resolving the deterioration in macroeconomic fundamentals would be a herculean task for whoever forms the government. Only deep surgery can resolve the economic crisis. The massive public debt, whose servicing costs absorb more than the entirety of government revenue, would pose a serious difficulty with inadequate finances for development needs. Restoring the eroded business confidence in such macroeconomic background would indeed be difficult. In turn, inadequate economic growth would impact on the employment, incomes and livelihoods.

The adoption of sound economic policies would have to await a new government after the parliamentary elections. Meanwhile, the state of the economy is likely to get worse and the remedial measure more difficult to adopt. The fiscal slippage that is occurring is a fundamental weakening of the economy. It would create serious economic difficulties. Restoring economic stability and enhancing economic growth are massive challenges for the next government.

Leave a Reply

Post Comment