News

Tax bonanza to trigger consumption boost: Analysts

The recent tax bonanza will boost local consumption with more buying power, finance analysts have predicted.

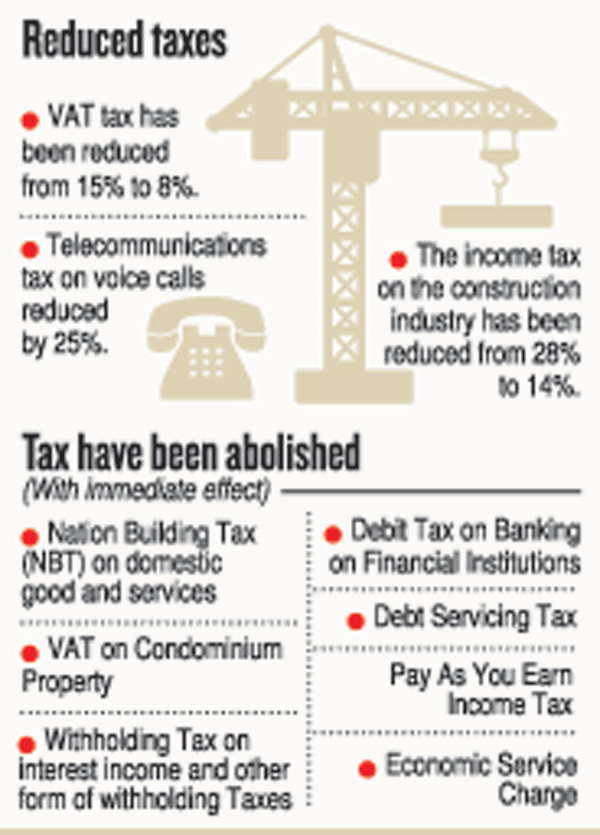

One of the major sectors identified for positive early growth is telecommunications. There will be a significant drop in the total bill, as telecommunication (Telco) levy is to drop by 25 percent — from 15 percent to 11.25 percent on voice revenue. At present, voice revenue contributes 40 percent of the total mobile top line. Data revenue is not liable for telco levy.

The construction industry is also expected to get a boost with the sector’s income tax being halved from 28 percent to 14 percent. The government has also decided not to bring in Value Added Tax (VAT) on condominium property sales. The existing 15 percent VAT for units valued above Rs 25 million had caused most of the developers to scale back on new property launches amid a continued weak demand.

“Easing pressure on interest rates and positive private credit growth will improve affordability, thus assuring a recovery in demand in the residential segment,” a financial analysis prepared by a Colombo-based business firm said.

Co-cabinet spokesperson and Minister Bandula Gunawardena told the Sunday Times the new government’s tax relief would increase the buying capacity of the people who were struggling due to the high amount of taxes on goods.

“During the Yahapalana government, people were forced to bear unreasonable taxes while there was no substantial economic growth. In keeping with the election pledge made by President Gotabaya Rajapaksa, we have decided to ease the tax burden on people,” Minister Gunawardena said, emphasising that the government would cover the revenue loss by other means such as effective usage of state resources and attracting more foreign direct investments.

A day after the government announced the tax bonanza on Wednesday, the Colombo Stock Exchange (CSE) saw a positive boost with total turnover exceeding Rs 2 billion in its daily business transactions. The CSE’s Market Development Chief Niroshan Wijesundere said it was too early to predict market performances in various sectors such as construction and telecommunications, since clear-cut policies were ye to be put in place on a long-term basis.

| At least 25 taxes scrapped for economic growth, says Cabinet | |

| The government has decided to scrap at least 25 taxes and introduce a new taxation system in a major step to enable an economic boom and quick economic growth, according to a cabinet paper. With this week’s sweeping tax cuts, only five key direct and indirect taxes are to be in the tax books. According to the new tax structure, the entire taxation system consists of two direct taxes on personal income, a company tax targeting profits and three categories of indirect taxes — Value Added Tax (VAT) on goods, services, banking and finance; Special Goods and Services tax and the simple customs tariff structure. The VAT has been reduced from 15 to 8 percent and the two percent Nation Building Tax (NBT) scrapped. The NBT levied at Customs will be combined with the Ports and Airport Development Levy and the relevant ratio will be 10 percent. The people-friendly tax reliefs are being introduced in keeping with the election pledge of President Gotabaya Rajapaksa. In his election manifesto, the President assured a ‘simple, transparent and efficient tax framework that will provide an enabling environment for consumers, working population, entrepreneurs and the tax paying community to engage in their activities while ensuring tax compliance.” Products which are not manufactured in Sri Lanka but beneficial tothe country to have access to global markets will be made duty free while machinery and equipment which are not made in Sri Lanka along with advanced technology too will be made duty free, the Cabinet paper said. Concerns have been raised in some influential economic circles over the sustainability of these tax reforms and the massive revenue loss, which some economists estimate to be nearly one third of the total government revenue. However, the government is to make a policy statement on the economic policies soon followed by an address by President Rajapaksa in Parliament. The cabinet paper also noted that the proposed measures would have some reduction in government revenue but assured that potential benefits from re-engineering the tax system wouldeventually revive the economy and increase government revenue. “As it will take some time to recoup government revenue, it is necessary to go slow on public spending to manage fiscal imbalances. I urged the line ministries and agencies to curtail non-essential and non-priority expenditure, including those spent on vehicles, travel, building, facilities etc. The government expenditure including those incurred by semi-government agencies and State-owned Enterprises should also decline as taxes on goods and services are to be lower,” the Cabinet paper noted. Issuing its monthly Monetary Policy Review on Friday, the Central Bank Monetary Board observed that the recent tax revisions would support lower inflation and higher economic growth in the short term, but was of the view that greater clarity with regard to the medium term fiscal path of the government was required to assess the impact on the economy over the medium term. It also noted the fiscal slippages thus far during the year. The outgoing Governor of CBSL Indrajit Coomaraswamy noted on Friday that the whole rationale behind this stimulus package introduced by the new government was to put more aggregate demand into the system to revive the economy. “We have had persistent low growth for sometime now and the idea is that this reduction in taxes would help to grow the economy. There seems to be some space to do that if you look at the monetary aggregate and credit growth, for incremental changes come into the system,” he said. |