Columns

The disappointing economic performance of 2019

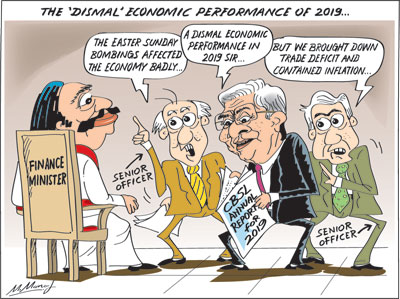

View(s): Last year’s economic growth of 2.3 percent was a further decline in economic performance from the low growth of 3.3 percent in 2018. It was less than half the average economic growth of South Asia of over six percent in 2019. The Annual Report of the Central Bank of Sri Lanka for 2019 described it as a “dismal” performance.

Last year’s economic growth of 2.3 percent was a further decline in economic performance from the low growth of 3.3 percent in 2018. It was less than half the average economic growth of South Asia of over six percent in 2019. The Annual Report of the Central Bank of Sri Lanka for 2019 described it as a “dismal” performance.

Declining trend

The economic performance of the country has been on a declining trend. Economic growth fell from 4.1 percent in 2016 to 3.1 percent in 2017, 3.3 percent in 2018 and slipped further to 2.6 percent in 2018. The annual average growth of 3.56 percent for 2015-19 was lower than the annual average growth of about 4.5 percent for the 65 year period (1950-2014).

Overview

All three sectors of the economy- services, industry and agriculture – performed inadequately. Services grew by 2.3 percent, manufacturing (including construction) expanded by 2.6 percent and agriculture grew by only 0.6 percent.

The trade deficit declined significantly from US$ 10.3 billion in 2018 to US$ 8 billion and the balance of payments had a small surplus of US$ 377 million. Inflation was moderate at around 4 percent.

Central government debt rose from 83.7 per cent at end 2018 to 86.8 percent of GDP by end 2019 owing to higher net borrowings to finance the budget deficit and the slow growth in GDP in 2019. The fiscal deficit ballooned to 7.3 percent of GDP and foreign debt peaked to US$ 55.9 billion or two thirds of GDP.

Sectors and subsectors

The growth of all three sectors of the economy was modest. Several subsectors of the economy, such as construction and tourism fared badly. The worst affected subsector was tourism which tumbled after the 2019 April Easter bombings. The setback to tourism that contributes around 10 percent to the GDP was pervasive as a number of economic activities linked to tourism was severely affected.

Services

The severest set back was to the services sector that decelerated significantly to 2.3 per cent in 2019, compared to the growth of 4.6 per cent in 2018.The impact of the Easter Sunday terrorist attacks on tourism and related activities was mainly responsible for the downturn in services.

In spite of this, services grew by 2.3 percent owing to growth in wholesale and retail trade, telecommunications and IT related services that continued to record a double digit growth.

Manufacturing

Manufacturing

The manufacturing or industrial sector grew by 2.7 per cent in 2019, compared to the growth of only 1.2 per cent in the previous year. This was mainly due to increased production of textiles, wearing apparel, leather products, food, beverages and tobacco products. Construction, mining and quarrying activities also grew.

Agriculture

Agriculture performed badly with a growth of only 0.6 per cent in 2019, compared to the growth of 6.5 per cent in 2018. This decrease is attributed mainly to extreme weather conditions in 2019 that affected mainly tea and rubber production. On the other hand, production of vegetables, fruits, animal products and coconut increased. Marine fishing and marine aquaculture, forestry and logging recorded lower production.

Paddy production decreased by 0.3 percent, tea production fell by 1.1 percent and rubber production declined by as much as 9.5 percent. However coconut production increased by 9.2 percent owing to rainfall in the previous year.

External trade

The performance of Sri Lanka’s highly trade dependent economy is inextricably connected with her trade performance. In 2019, the trade deficit was brought down significantly to around US$ 8 billion from US$ 10.3 billion in 2018. However, the reduction in the trade deficit was due to a 11 percent reduction in imports and only an export growth of about 5 percent. The reduction in imports was due to policies to curtail certain imports and slower growth in the economy.

Balance of payments

Although the trade deficit was brought down by as much as US$ 2.3 billion, the balance of payments did not reflect this improvement due to a decrease in tourist income, inadequate foreign investment and capital outflows. This underscores the vital need for export growth to achieve a better balance of payments outturn.

Inflation

The rate of inflation during last year was in the desired range of 4-6 percent. This, according to the Central Bank, was “mainly as a result of subdued demand conditions and well-anchored inflation expectations.”

External Finances

Foreign reserves were US$ 7.64 billion at the end of the year. According to the Central Bank, gross official reserves improved by end 2019, supported by significant inflows to the Government and the Central Bank, despite large foreign currency debt service payments by the Government in 2019. The Central Bank said “the exchange rate remained broadly stable during 2019, supported by a significant improvement in the current account, despite some transient volatility experienced amidst outflows of portfolio investment, responding to domestic and global developments.”

Fiscal performance

Fiscal consolidation faced a severe setback in 2019. The fiscal deficit expanded to 7.3 percent of GDP, owing to a significant decrease in government revenue and a rise in government expenditure. The repercussion of this on economic stability is inevitable.

Debt

Central government debt rose to 86.8 per cent of GDP by end 2019 from 83.7 per cent at end 2018 owing to higher net borrowings to finance the budget deficit and the relatively modest growth in nominal GDP (the denominator) in 2019.

Summing up

The recent declining trend in economic growth continued into 2019 with growth falling to 2.3 percent from 3.3 percent in 2018. This was due to all three sectors of the economy performing badly. Inflation was moderate at 4 percent partly due to the slower economic growth.

Although the trade deficit declined significantly by US$ 2.3 billion, the balance of payments had only a small surplus owing to reduced earnings from tourism, a dip in workers’ remittances and capital flight. The public debt rose to 86.8 percent of GDP by end 2019 from 83.7 per cent at end 2018 owing to higher net borrowings to finance the budget deficit and the slow growth in GDP in 2019.The fiscal deficit ballooned to 7.3 percent of GDP, Foreign debt peaked to US$ 55.9 billion or 66.6 percent of GDP.

Concluding reflection

When the above economic facts are considered, the economy is in a dire state. Unfortunately the economy cannot be expected to revive in 2020 owing to the global economic shutdown and the curfew that has brought most economic activities to a standstill. The international containment of the COVID-19 pandemic, a global economic recovery that could be expected only in 2021 and our return to normalcy are vital for the revival of the economy. Our economic policies must be pragmatic to be able to respond to the global opportunities.

Finally, the Central Bank of Sri Lanka, especially the Economic Research Department, must be commended for bringing out the Annual Report before the deadline of April 31amidst the prevailing curfew.

Leave a Reply

Post Comment