Columns

External reserves decline as strengths in balance of payments weaken

View(s):The country’s foreign reserves of US$ 7.6 billion at the end of 2019 have fallen to US$ 6.5 billion at the end of May mainly due to the deteriorating balance of payments.

The continued deterioration of the balance of payments in the second half of the year would diminish foreign reserves to a critically dangerous level by the end of the year and pose a severe threat to the economy.

The continued deterioration of the balance of payments in the second half of the year would diminish foreign reserves to a critically dangerous level by the end of the year and pose a severe threat to the economy.

The only way out of this external vulnerability is through foreign assistance by way of aid, concessional loans and moratoria on debt repayment.

Balance of payments

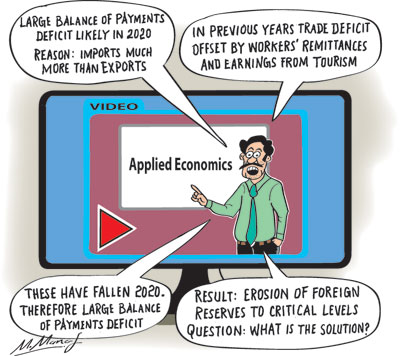

This year’s balance of payments deficit is likely to be high owing to a large trade deficit, lower workers’ remittances and insignificant earnings from tourism. It is likely to be over US$ 2 billion, one of the highest, owing to the precipitous decrease in tourist earnings and dip in workers’ remittances that were two strengths in the balance of payments for many years.

Consequently, there will be a severe erosion of the country’s foreign reserves to a critically dangerous level by the end of the year. Foreign reserves that were US$ 7.6 billion at the end of 2019 fell to US$ 7.2 billion by April and to US$ 6.5 billion at the end of May. This decreasing trend in foreign reserves is likely to continue and erode the reserves. This poses a severe threat to the economy.

Trade balance

Despite the significant decrease in exports, the trade deficit may be contained at around last year’s US$ 8.3 billion or less. While exports are likely to decrease significantly from that of last year, imports are likely to decrease to compensate for the decrease in merchandise exports.

Imports of intermediate and investment goods are likely to decrease this year. Import restrictions and higher tariffs have reduced consumer imports as well. Exports are expected to increase during the second half of the year though this year’s exports are likely to be much less than that of last year. Consequently the trade deficit may be even less than that of last year. Nevertheless, the balance of payments deficit will widen this year owing to shortfalls in workers’ remittances and much reduced earnings from tourism.

Remittances and tourism

Remittances and tourism

The shortfalls in workers’ remittances and the drying up of earnings from tourism are the main causes for the increase in the balance of payments deficit this year. In 2019 these sources of foreign earnings converted the trade deficit of US$ 8.3 billion into a surplus of US$ 772 million. These two strengths in the balance of payments have weakened significantly to cause a large balance of payments deficit.

Tourism

In the first five months of the year earnings from tourism have been negligible, while workers’ remittances fell from US$ 2733 million in 2019 to US$ 2407 million in the same period of this year. The decrease in workers’ remittances in May were higher than in the previous months and likely to decrease by higher amounts during the rest of the year.

Prospects

As these trends are likely to continue during the next six months of this year, the 2020 balance of payments deficit is likely to reach an unsustainable level and erode the external reserves to critical levels. Regrettably, there is little prospect of a reversal in tourist earnings and workers’ remittances during the rest of the year.

A global economic recovery is likely only after the containment of the COVID-19 pandemic and the international wheels of industry and commerce revives. This is especially so with respect to international travel and tourism.

Earnings from tourism have fallen sharply in the first half of this year and at best is likely to recover partially only at years’ end. This too remains uncertain as international travel is severely curtailed and the fear of the pandemic looms large in many parts of the world. Furthermore loss of employment and lower income in countries of tourist origin would decrease the demand for travel. There is a chance that tourists from China and neighbouring countries may revive tourism. However this too is dependent on the containment of the COVID-19 pandemic in those countries and ours and the lifting of travel restrictions.

Strengths weakened

Earnings from tourism and remittances from workers’ abroad have been pillars of strength in the balance of payments. Large trade deficits of many years have been offset by these two sources of foreign earnings. This is not so this year. These two strengths have weakened this year to pose serious difficulties to the balance of payments.

Remittances

Large number of workers in the Middle East have lost their jobs, many have been infected by COVID-19 and most workers are clamouring to return to the Island. Workers’ remittances that amounted to US$ 7 billion and US$ 6.5 billion may be halved this year.

Apart from the loss of remittances this year there is the likelihood of remittances drying up on the near future owing to much less migration of workers to many countries owing to lesser demand for such services and lesser number of persons willing to migrate.

Prerequisite

A global economic recovery is a prerequisite to a revival of international trade and travel. We may however be able to attract tourists from the Asian and Middle East regions and partially recover tourist earnings. Regrettably, there is little prospect of a reversal in tourist earnings and workers’ remittances during the rest of the year. A global economic recovery is likely only after the containment of the COVID-19 pandemic and the wheels of industry and commerce revives. This is especially so with respect to international travel and tourism.

Tourist earnings may recover next year if the pandemic is eliminated and there is an economic recovery. However these too are still uncertain. Therefore two of the strengths of the balance have of payments been seriously weakened and this year’s balance of payments is likely to be in a large deficit. Despite the fall in exports this year, the trade deficit is not likely to expand by much as there is a significant reduction of imports. Despite this the balance of payments deficit will be large and erode the country’s reserves to an unsustainable level.

Imperative

In this perilous situation of external finances, international assistance is of utmost importance to stave off a severe financial crisis. Moratoria on debt repayments, assistance from multilateral agencies, loans at low interest and long term repayment conditions and foreign aid are needed to save the country from the impending financial crisis.

Sound economic management and insightful international diplomacy are needed to obtain such assistance. The Government must not “look at the mouth of a gift horse” given by donors and offend friendly countries that assist us.

Leave a Reply

Post Comment