Columns

Progressive taxation vital to reduce fiscal deficit

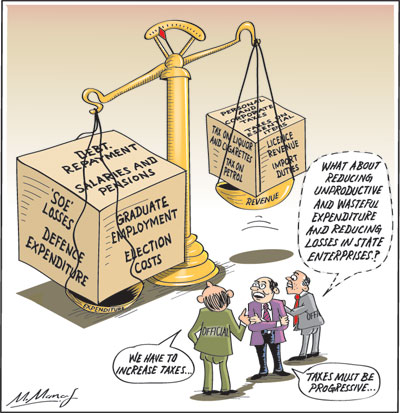

View(s): The reduction of the fiscal deficit is of utmost importance to achieve economic stability, economic growth and social development. The high fiscal deficit has to be reduced by enhancing government revenue through higher direct and indirect taxes that are progressive and fall on the rich and the affluent.

The reduction of the fiscal deficit is of utmost importance to achieve economic stability, economic growth and social development. The high fiscal deficit has to be reduced by enhancing government revenue through higher direct and indirect taxes that are progressive and fall on the rich and the affluent.

VOA 2020

The Vote on Account (VOA) of Rs 9.1 trillion for expenditure in the last four months of this year that was passed by Parliament unanimously on August 28, together with the expenditure incurred in the first eight months of the year, would widen the fiscal deficit for 2020 to one of the highest, if not the highest, in recent years. It is estimated to balloon to 8.5 percent of GDP, surpassing the high fiscal deficit of 7.6 percent in 2015.

High fiscal deficits

Fiscal deficits have been large in recent years. From 2013 to 2019 they were over five percent of GDP and as high as 7.6 percent in 2015 and 7.5 percent in 2019. The lowest was 5.3 percent of GDP in 2018.

Elusive

The objective of bringing down the fiscal deficit to the desired 3.5 percent of GDP has eluded us. It is likely to be one of the highest in 2020. Although estimated to be 8.5 percent of GDP this year, indications are that it may exceed nine percent of GDP.

Impacts

Large fiscal deficits destabilise the economy and hamper economic growth. Recurring large fiscal deficits over the years have distorted priorities in public expenditure and retarded the nation’s economic and social development.

Inflation

Large fiscal deficits result in inflationary pressures, which in turn increase costs of production and erode the country’s export competitiveness. Consequently, the depreciation of the Rupee is needed in order to remain competitive with other countries that have lower rates of inflation.

Otherwise, lesser export earnings would increase the trade deficit and strain the balance of payments. Reduced export earnings would result in loss of employment and lower incomes to workers in export industries.

Cost of living

Inflationary pressures caused by large fiscal deficits increases the cost of living that result in severe hardships to the lower wage earners and pensioners and leads to strikes demanding higher wages and social unrest.

Debt

Debt

The large accumulated debt is a result of persistent fiscal deficits over the years. The public debt has increased mainly due to large foreign and domestic borrowing. The public debt that rose to 85 percent of GDP at the end of last year would have risen further this year.

Large fiscal deficits lead to borrowing and in turn to huge debt servicing expenditure that distort public expenditure priorities and hamper economic and social development.

Failures

The fiscal deficit as a percent of GDP was reduced to 5.4 in 2016, 5.5 in 2017 and 5.3 in 2018. The fiscal deficit increased in 2019 owing to election motivated expenditure.

Elections

Efforts to reign in fiscal deficits have often been derailed by excessive expenditure during election periods. This happened in 2014 when the incumbent government facing the 2015 Presidential election increased government expenditure that increased the fiscal deficit to as much as 7.6 percent of GDP.

The newly formed Government in 2015 facing a parliamentary election in August 2015 too increased expenditure without enhancing revenue. Consequently the fiscal deficit rose to 7.6 percent of GDP. Efforts to reduce the fiscal deficit from 2016 were derailed owing to the 2019 Presidential election and the parliamentary election in August this year.

Furthermore, the new Government had to face a fall in revenue owing to the economic slowdown and the fiscal stimulus policy that decreased revenue. Expenditure too expanded in the run up to the parliamentary election. These recurring large fiscal deficits over the years have been a core reason for the county’s economic instability and inability to achieve the desired economic and social development.

Resolution

The fiscal deficit must be reduced from 2021 by increasing revenue through progressive taxation. At the same time government expenditure should be prioritised towards economic development and improvements in education, health, expansion of care for the elderly, improved social welfare and targeted social security programmes to alleviate poverty. Unproductive and wasteful expenditure must be reduced drastically.

Increasing revenue

The fiscal deficit has to be reduced progressively in the next five years (2021-25) mainly by increasing progressive taxation. While the priorities in government expenditure should be reoriented, there is little scope for reducing aggregate expenditure.

The path to fiscal consolidation is one of increasing revenue. And this must be achieved through progressive taxation. The current inadequate revenue and high indirect taxation that falls on the poor must be reversed.

The Budget for 2021 must increase government revenue to decrease the fiscal deficit to around five percent of GDP in 2021. This should be achieved by enhancing revenue through a system of progressive taxation.

Increasing revenue

Immediate measures to increase revenue that have been proposed by the government have to be followed by a comprehensive programme of taxation in the Budget for 2021. Such increases in taxation should not fall on the poor: taxation should be on the rich.

Progressive taxes could be both direct and indirect. Since tax evasion and avoidance is widespread, those evading direct taxes should be taxed through appropriate taxes such as licence fees, stamp duties, taxes on property and luxury goods and services. However higher taxes should not be disincentives for savings and investment.

Low revenue

The country’s revenue as a proportion of its output or GDP is one of the lowest, if not the lowest for the level of per capita income in the country. It was about 14 percent of GDP a few years ago, but may have fallen this year. The Government’s objective should be to increase this ratio to around 20 percent of GDP in the next few years. It must be achieved through taxation of the rich rather than by burdening the poor through indirect taxation of widely consumed consumer items.

Progressive taxes

Enhancing revenue through progressive taxation should be a fundamental principle and objective of the government‘s fiscal policy. The reforms in taxation should be undertaken during the commencement of the Government’s tenure when political compulsions to increase expenditure are minimal.

Conclusion

The reduction of the fiscal deficit to less than five percent of GDP is crucial to stabilise the economy and achieve economic and social development. The fiscal deficit has to be reduced progressively in the next five years (2021-25) mainly by increasing government revenue by progressive taxation.

While the priorities in government expenditure should be reoriented, there is little scope for reducing aggregate expenditure.

The path to fiscal consolidation is one of increasing revenue, and this must be achieved through progressive taxation. The current inadequate revenue and high indirect taxation that falls on the poor must be reversed.

Leave a Reply

Post Comment