Columns

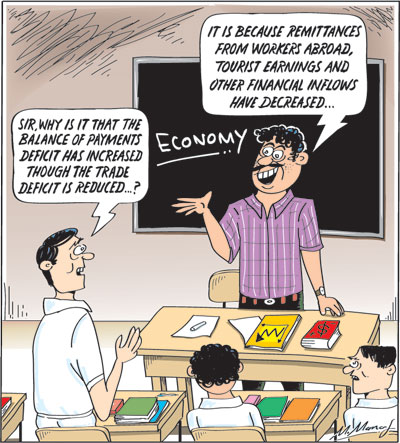

Balance of payments deficit increases despite lower trade deficit

View(s): In spite of a narrowing of the trade deficit in the first seven months of this year, the balance of payments (BOP) has deteriorated owing to lower workers’ remittances, earnings from tourism and financial inflows.

In spite of a narrowing of the trade deficit in the first seven months of this year, the balance of payments (BOP) has deteriorated owing to lower workers’ remittances, earnings from tourism and financial inflows.

Meanwhile as an interim measure to cope with the declining foreign reserves and to strengthen it, the Government has obtained a financial swap of US$ 400 million from the Reserve Bank of India (RBI). Foreign reserves of the country that were US$ 7.6 billion at the end of 2019 was US$ 7.1 billion at the end of July 2020.

Overview

This year’s trade deficit is likely to be less than last year’s, despite a fall in exports owing to a restriction of imports and a saving on oil imports due to decreased import prices. Exports have also increased in the last three months compared to the previous three months of this year, though the seven months exports this year were lower than the export earnings of the first seven months of last year.

Exports

The average monthly exports were US$ 960 million in the three months of June, July and August this year. Merchandise exports were US$ 969 million in August compared to US$ 1.06 billion in July and US$ 906 million in June this year.

Trade performance

Trade performance

The trade performance in the first seven months of this year exports decreased by 20.7 percent from US$ 6993 million in 2019 to only US$ 5498 billion. In the first seven months of this year, imports fell by 21.4 percent and compensated for reduced exports. Consequently the trade deficit in the first seven months of this year reduced from US$ 4314 million in 2019 to US$ 3470 in 2020.

Imports

The significant decrease in imports was due to the restriction of imports of motor vehicles, gold and a whole range of non-essential imports. There was a significant decrease in oil imports too owing to a 39 percent decrease in international oil prices.

Exports

While exports fell from US$ seven billion in the first seven months of last year to US$ 5.5 billion in the same period this year, imports fell from US$ 11.3 billion to nearly US$ nine billion ( US$ 8.967 million) in the first seven months of this year. Consequently the trade deficit was contained at US$ 3.47 billion in the first seven months of this year compared to US$ 4.3 billion for the same period last year.

BOP 202

Although this year’s trade deficit is likely to be contained to a modest amount mainly due to decreased imports, the balance of payments deficit is likely to be high due to the two recent strengths of the BOP, workers’ remittances and tourist earnings, weakening. Earnings from tourism have fallen sharply and workers’ remittances have dipped significantly. Other inflows of capital too are small.

Surplus to deficit

Consequently, the trade deficit will not be offset by much and the BOP deficit will be large. In the first seven months of this year the BOP deficit reached US$ 939, compared to a BOP surplus of US$ 1490 million for the same period last year. The BOP deficit would lead to an erosion of the country’s foreign reserves.

Prospect

If the trade performance continues as in the first seven months, the trade deficit could be reined in to about US $ six billion this year. If exports have averaged about US$ 900 million a month in June –August accelerate, they could make a useful contribution to narrow this year’s trade deficit further.

On the other hand, the relaxation of controls on non-essential imports like gold could widen the trade and balance of payments deficits. Furthermore, the restriction of imports should not hamper exports that are dependent on imports of raw material.

Foreign reserves

The balance of payments has deteriorated in spite of a narrowing of the trade deficit in the first seven months of this year. Consequently, the country’s external reserves declined from US$ 7.6 billion at the end of 2019 to only US$ 6.5 billion at the end of June this year. This erosion of foreign reserves in a context of large debt servicing obligations has increased the country’s external financial vulnerability to a critical level.

As suggested in this column earlier, it is imperative to obtain international assistance in the form of debt relief from multilateral international organisations, and creditor nations and concessionary loans from friendly countries. Meanwhile the interim measure to strengthen reserves by obtaining a financial swap of US$ 400 million from the RBI has increased foreign reserves to US$ 7.1 billion.

In conclusion

Hopefully the trade deficit will be contained to around US$ six billion this year owing to reduced imports, growth in merchandise exports and financial inflows, including remittances and earnings from ICT services. The longer term solution to the country’s balance of payments problem lies in increasing exports.

Leave a Reply

Post Comment