Nation Branding – Investor Confidence and Moody’s Ratings – Looking Beyond the Rating

View(s): As I was talking of Nation-branding in my previous article, and as we are just beginning to conceptualise branding Mother Lanka, as a preparation of capitalising on Post-Covid opportunities, we as a nation are ambitious and hopeful that the pandemic will come to an end by mid-2021.

As I was talking of Nation-branding in my previous article, and as we are just beginning to conceptualise branding Mother Lanka, as a preparation of capitalising on Post-Covid opportunities, we as a nation are ambitious and hopeful that the pandemic will come to an end by mid-2021.

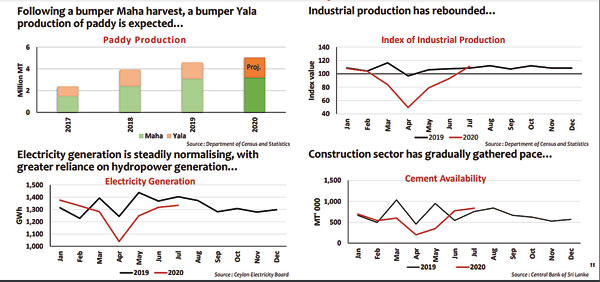

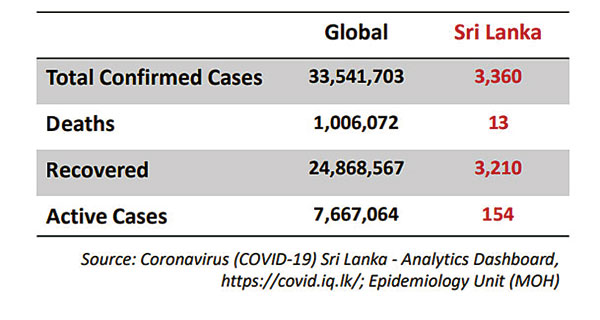

At the same time, whilst most of the developed countries are getting ready for a second wave we Sri Lankans are getting ready with preparation of land for cultivation and rejuvenating primary industries etc. to be ready for a revival of the economy despite several issues that could hamper the economic plans of the government. In this backdrop; the world is eyeing Sri Lanka for handling the unprecedented COVID19 pandemic with timely and accurate decisions taken to safeguard the nation.

The next hurdle for the government is to build investor confidence in Sri Lanka so that FDIs can flow into the country which will bring much needed foreign currencies which are invaluable in maintaining the exchange rate without fluctuations. Whilst the majority are being patient and positive about the changes that are taking place, there seems to be a minor fraction with negative sentiments on the progress being made.

Moody’s Investors Service yesterday downgraded Sri Lanka’s long-term foreign currency issuer and senior unsecured ratings to Caa1 from B2 and changed the outlook to Stable, raising concerns on the country’s debt affordability, high Budget deficits and limited room for reforms.

Issuing a statement the international rating agency said this concluded the review for downgrade initiated on 17 April 2020.The decision to downgrade Sri Lanka’s rating to Caa1 reflects Moody’s assessment that the coronavirus-induced shock, which Moody’s regards as a social risk, will significantly weaken Sri Lanka’s already fragile funding and external positions.

Explaining its rationale Moody’s said Sri Lanka continues to face very tight external financing conditions and a significant decline in revenue from a sharp and prolonged economic slowdown. “This shock occurs at a time when Sri Lanka’s credit profile is highly vulnerable given low reserve coverage of large forthcoming external debt payments, and very weak debt affordability.”

Are we that bad?

It’s worth taking a look beyond the ratings which would have been done based on certain parameters which are not yet clearly known to us. It’s obvious that as far as the region is concerned, Sri Lanka has done well and continues to do so when handling the pandemic. It’s unfortunate how an individual rating firm can affect the plans of a nation purely based on ratings which doesn’t capture certain parameters which have not been looked at properly. Are we bad or are we that bad? Are we fragile as an economy? Are we having a crisis?

Before directly answering the questions it’s worth looking at the overall picture.

Moody’s rating downgrade fails to recognise and do justice to the ground reality of the ongoing rapid economic recovery backed by vastly improved business confidence arising from the return of political and policy stability after a lapse of five years. Sri Lanka has been able to decisively deal with the domestic spread of the COVID-19 pandemic, for which the country is hailed as one of the few countries to have been able to do so.

Sri Lanka, like many of its peers in the emerging market group, experienced initial capital outflows, exchange rate depreciation, slowdown in activity, and pressure on government finances, in response to the effects of COVID-19 pandemic. But, the swiftness with which decisions were taken followed by the landslide victory of the Government, enabled Sri Lanka to move along a recovery path towards growth and stability.

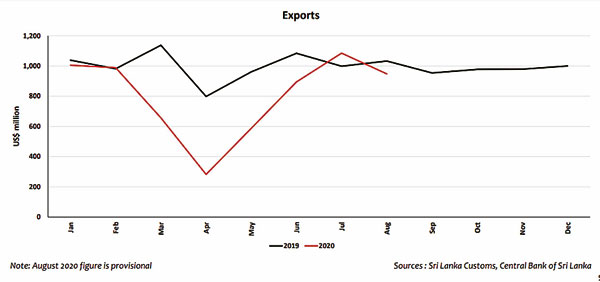

Since May, merchandise exports have bounced back, & by July, had returned to pre-COVID monthly averages of US$ 1 bn.

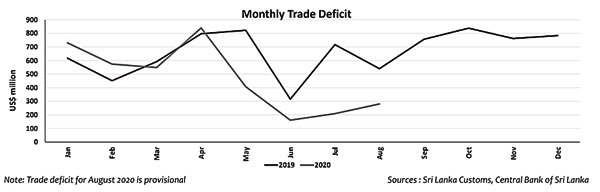

Sri Lanka recognised the probable external sector pressure early, and decisively curtailed non-essential imports in order to prioritise external debt service obligations. By end December 2020, the cumulative trade deficit is expected to be US$ 5.8 bn only, significantly down from US$ 8.0 bn in 2019. The savings on the import bill due to curtailment of non-essential imports as well as the significant reduction in fuel import bill is expected to be over US$ 2.0 bn. Although inbound tourist movements are yet not possible given the global pandemic situation, other service exports, including IT services and shipping, remain robust.

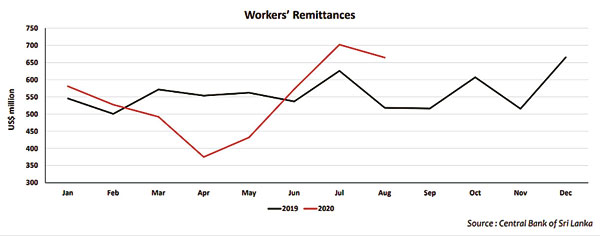

Workers’ remittances have recorded a sharp increase in spite of the initial expectation of a slowdown. Looking at the current trend, the cumulative decline in workers’ remittances is likely to be marginal, compared to the previous expectation of a decline of 15%.

FDI inflows have slowed, but the investment pipeline is strengthening. FDI, which slowed in the first half of the year, appear promising looking ahead, particularly with the expected inflows to the Port City project and for new manufacturing projects. The expected finalisation of new legislation for the Port City within a month will result in the realisation of investment by those who have already completed due diligence on such investment. Other expected investments include import alternative industries as well as investments by international financial institutions will add to the direct inflow of funds to the economy. FDI inflows during 2020 are expected to be over US$ 750 mn, which is only about US$ 400 mn less than in 2019. At the start of the pandemic, FDIs were expected to be only around US$ 300 mn for the year 2020.

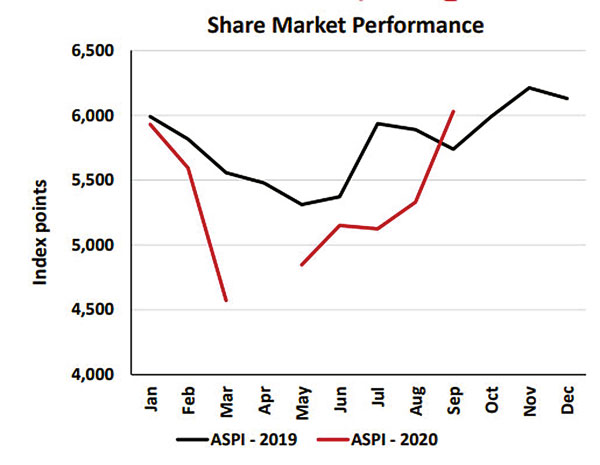

The stock market indices have improved dramatically to pre-COVID levels, & are likely to gather further momentum. The ongoing efforts toward digitalisation will also help attract investors, while supporting new plans to have 500 entities listed by 2025.

Foreign inflows to the government securities market have already shown signs of resumption, & according to initial responses, are likely to increase in the coming months, particularly in the wake of the attractive SWAP arrangement offered by the Sri Lankan authorities. With increased emphasis on domestic agriculture, agro-based industries and resource-based industries, domestic economic activity has seen a remarkable turnaround & recorded V-shaped recoveries…

n Sri Lanka re-affirms to foreign investors that it remains willing and able to meet its debt obligations, as it has done impeccably in the past.

n All payment transactions for the repayment of the International Sovereign Bond of US$ 1 bn maturing on 04 October 2020 have already been lined up, and funds are to be credited to the paying agent’s account on 02 October 2020.

Conclusion

Instead of understanding the economic turnaround as well as awaiting the Budget that is due in November 2020, Moody’s downgrade of Sri Lanka at the beginning of the Economic Revival is inexplicable. This hasty rating action seems similar to the previous premature and reckless downgrades by rating agencies in the immediate aftermath of the end of the internal conflict in 2009 and during the political impasse at end of 2018.

In both instances, the rating actions were proven to be hasty and erroneous, and those actions only resulted in several investors suffering unnecessary losses and missing out on emerging opportunities. The Government will commence regular virtual roadshows to strengthen investor relations following the announcement of the National Budget in November 2020.

Those interactions will provide further clarity on the Government’s medium term fiscal and financing plans, as well as keep Investors posted on the progress relating to the economic initiatives of the new Government.