Columns

Prospects and uncertainties in the balance of payments

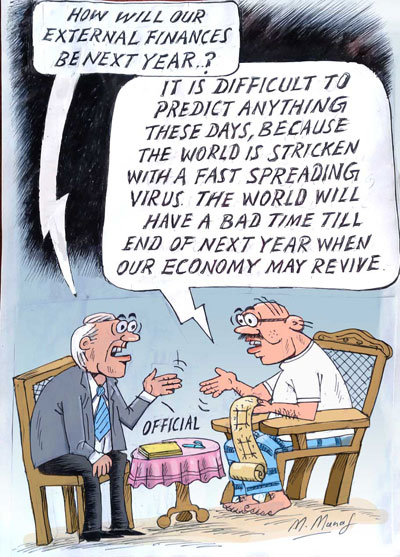

View(s): Considerable uncertainties in the global containment of COVID-19 and when the international economy would rebound as well as the recent resurgence of COVID-19 in the country, make economic projections quite hazardous. It is in this uncertain health and economic environment that we venture to discuss the prospects of Sri Lanka’s balance of payments.

Considerable uncertainties in the global containment of COVID-19 and when the international economy would rebound as well as the recent resurgence of COVID-19 in the country, make economic projections quite hazardous. It is in this uncertain health and economic environment that we venture to discuss the prospects of Sri Lanka’s balance of payments.

Global economy

Economists are diverse in their views on when and what shape the international economic recovery will take. Will it be U shaped, V shaped or W shaped? However there is a broad consensus that the earliest likelihood of containing the global pandemic would be in late 2021. Any global economic recovery till then would be restrained by COVID-19.

IMF assessment

The recent assessment of the global economic outlook by the International Monetary Fund (IMF) is that COVID-19 “is still unfolding around the globe. In Asia, as elsewhere, the virus has ebbed in some countries but surged in others. The global economy is beginning to recover after a sharp contraction in the second quarter of 2020, as nationwide lockdowns are lifted and replaced with more targeted containment measures”.

Consequently the IMF has revised the global economic growth to −4.4 percent in 2020, “because of better-than-expected second quarter outturns in some major countries where activity began to improve sooner than expected after lockdowns were scaled back.”

Next year

Furthermore, “In 2021 global growth is projected at 5.2 percent, a little lower than projected earlier, consistent with the expectation that social distancing persists into 2021 and fades thereafter,” the IMF said.

With respect to Asia and the Pacific, it says: “It is also starting to recover tentatively, but at multiple speeds. Economic activity is expected to contract by −2.2 percent in 2020, due to a sharper-than- expected downturn in key emerging markets, and to grow by 6.9 percent in 2021—0.6 percentage point lower and 0.3 percentage point higher, respectively, than in the June 2020 World Economic Outlook Update.”

Varied performance

The outlook for Asian countries varies by country depending on the success in containing the virus and restoration of economic activities. The recovery is projected to be more gradual than previously forecast. In 2021 global growth is projected at 5.2 percent, 0.3 percentage point lower than projected in June 2020, reflecting the persistence of social distancing into 2021.

Implications

The relevance of these global developments for Sri Lanka is that the global economic conditions would not be conducive to us in the remaining months, especially with respect to our manufactured exports, but see a modest revival sometime next year, perhaps in the second half of 2021.

However the resurgence of the virus since October is a serious threat to our production and export capacity. The constraints in demand for our exports due to lower international demand could be compounded by lesser production and export capacity, if there is a resurgence of the virus and lockdowns. Therefore the effective control of the virus and ensuring that lockdowns are at a minimum are vital to ensure export growth. On the other hand, inadequate precautions could spread the virus and aggravate the economic downturn.

However the resurgence of the virus since October is a serious threat to our production and export capacity. The constraints in demand for our exports due to lower international demand could be compounded by lesser production and export capacity, if there is a resurgence of the virus and lockdowns. Therefore the effective control of the virus and ensuring that lockdowns are at a minimum are vital to ensure export growth. On the other hand, inadequate precautions could spread the virus and aggravate the economic downturn.

Balance of payments

The revival of the Sri Lankan economy, especially the country’s trade and balance of payments, is very much dependent on the improvement of global economic conditions and revival of international trade and travel. An improvement in the balance of payments (BOP) would ease the debt repayment liability in 2021 and reduce the country’s external financial vulnerability. Then, what are the prospects of a low BOP deficit this year and in 2021?

Trade balance

A lower trade deficit is vital to achieve this, especially as tourist earnings and workers’ remittances, the two strengths of the BOP, have been weakened to a large extent. A lower trade deficit has to be achieved by containing imports and increasing exports.

Increasing exports is difficult owing to the reduction in demand for our manufactured exports from western markets that are the main markets for apparel, tyres, ceramics and other manufactured exports. Reducing imports from our current levels too is no easy task as reduction of most non-essential items have been done already. The continued low prices of oil that has been a significant advantage to the reduction of the trade deficit in 2020, will be important to ensure imports at current levels.

Expectations

Imports that were US$ 10.3 billion in the first eight months of this year, could increase to about US$ 15 billion in 2020 and to about US$ 16 billion in 2021. Exports that were US$ 6.4 billion till August could be expected to increase to nearly 11 billion, if the current wave of COVID-19 does not disrupt industrial production. Given an improvement in international trade exports could expand to US$ 14 to 15 billion next year.

Trade deficits

With these projection scenarios, the trade deficits would be about US$ four billion in 2020 and decrease to about US$ two billion in 2021.

Balance of payments

With these outcomes in the trade balance, the overall BOP balance is likely to be in surplus by about US$ two billion this year despite the negligible earnings from tourism. However workers’ remittances are likely to be about US$ six billion compared to last year’s US$ 6.7 billion and fall sharply next year.

The overall BOP balance could be expected to be a surplus of around US$ two billion this year and about US$ one billion next year. .

Capital inflows

The balance of payments could however be strengthened by capital movements or official transfers such as aid, loans from multilateral agencies like the IMF, World Bank and ADB and loans and financial arrangements like swaps in the coming months. These would enhance the reserves but loans would increase our foreign debt.

Prospects in 2021

If the trade deficit is contained at US$ two billion in 2021, as projected, then despite a likely fall in workers’ remittances an overall balance of payments surplus could be expected next year too.

Finally

As the global economic environment is not expected to recover till the end of 2021, the Sri Lankan international trading prospects would be much the same as in 2020.

Furthermore, the control of COVID in the country will be an important determinant of our export capacity. ‘In as much as the revival of the international economy is vital for an improvement in exports, the containment and control of the epidemic in the country is vital to increase and improve the trade balance.

Leave a Reply

Post Comment