Losses from EU isolation

View(s):

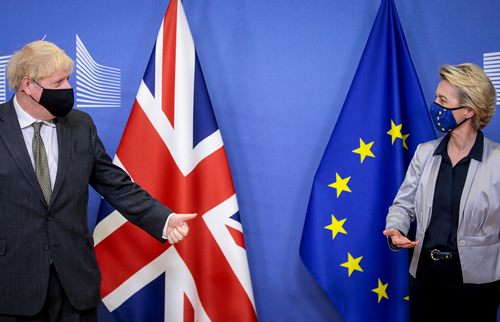

European Commission President Ursula von der Leyen welcomes British Prime Minister Boris Johnson (left) in Brussels, Belgium December 9, 2020. Olivier Hoslet/Pool via REUTERS

Starting from next year, goods arriving from the UK to European Union (EU) countries would be subject to border taxes as well as customs procedures and inspections. The businesses located in the UK, supplying to the EU “common market” may also lose their market share due to higher border taxes and regulatory barriers; anticipating that, some have already left the UK soil. The UK is losing not just the EU market, but also the markets of 70 plus non-EU countries which are having trade agreements with the EU. The UK passport holders arriving in EU countries may not have free entry as before; they would be lining up at separate immigration counters for passport controls.

Voted for isolation

All these would be the result of Brexit – the departure of the UK from the EU, which is due to complete its transition by January 1, 2021. And the biggest issue for the UK as well as for the EU is, however, not any of the above, but the Northern Ireland land border between the UK and the EU. This land border splits between Republic of Ireland and Northern Ireland; the former is part of the EU and the latter, part of the UK. The Republic of Ireland and Northern Ireland are deeply integrated countries; in fact, about 45 per cent of Northern Ireland people are also dual citizens of the two countries, having their work, businesses and other relations with the Republic of Ireland as well.

As long as the UK was part of the EU, there was no land border, because it was open for free movements of goods, services, money and people. But now it begins to matter a lot. A new border to control all these free movements between the UK and the EU is emerging, not at UK’s Northern Ireland border, but within the UK it self! It would split the UK between Northern Ireland and rest of the UK (which is Britain that comprises England, Wales and Scotland) rather than between the Republic of Ireland and Northern Ireland. After all, Northern Ireland together with Scotland voted against leaving the EU. But when all votes in the UK were counted, it was just 52 per cent majority that voted in favour of leaving the EU.

Before all these things happen, there was more than a three-year period to prepare for the UK’s departure from the EU since June 2016 when UK residents voted for Brexit; and then another 11-month period for transition by January 1, 2021. But Brexit as well as post-Brexit implications were much more complicated than they appeared to be.

Blocs in the open world

I jotted down the above event to continue with our discussion that we initiated last week, which was on the peculiar movement in the world during the past few decades – “grouping” amidst “free trade”. Free trade means opening the borders and removing the barriers. But grouping means forming their own trading blocs, ousting others. The two episodes, perhaps contradictory ones, have seen an outstanding character of growing international trading arrangements since the 1990s.

The EU is, perhaps, the longest and the deepest integrated bloc in the world and now there is disintegration too as in the case of Brexit, while some others have also faced difficulties to remain integrated during the past decade. As and when the time comes, I intend to break all these issues into weekly episodes.

As for today’s discussion over the economic and political gravity of the UK’s departure from the EU bloc, it is important to begin with different levels of integration of nations through agreements:

1. The very basic level of integration is the Preferential Trading Arrangements (PTA) under which countries provide “preferential” access to their markets, unilaterally or reciprocally.

2. The second level of integration is the Free Trade Area (FTA) under which there is bilateral or “free trade” in goods and services. In that sense, the 20-year old “India – Sri Lanka Free Trade Agreement” has never been an FTA.

3. The third level of integration is the stage of Customs Union under which the members of the union, apart from having free trade among themselves, adopt common tariffs against the non-member countries.

4. The fourth level is the Common Market under which free movement of capital and labour is allowed, in addition to free trade and common external tariffs. European integration which began with the adoption of the Treaty of Paris in 1951, established its common market – European Economic Community (EEC), through its Treaty of Rome in 1957.

5. The fifth level is the Economic Union, which includes the harmonization of macroeconomic policies – the fiscal and monetary policies. EEC was elevated to an economic union – the EU, through its Treaty of Maastricht in 1993. Further, 12 countries of the EU established the single currency – Euro, by surrendering their monetary policy autonomy to the European Central Bank in 1999.

Staying together

The EU provided not only free trade in goods, but also in services including the free movement of professionals delivering such services. Free movement of capital guaranteed that there are no regulatory barriers and exchange controls over any form of money flows. People could also move across the countries freely while they can have access to work permits and complementary EU citizenship to travel and work anywhere.

The UK also had the growing discontent of too much integration. Free movement of people in the “common market” created growing tensions in the UK as it was an important destination for migrants from poorer countries although it was an important source of labour supply for “blue-collar” work. From an economic point of view, stronger EU members including the UK had to bear the burden of the problems of weaker EU members. Finally, the future of the EU is likely to depend on even more integration which may not be in line with UK’s interests.

The UK also had the growing discontent of too much integration. Free movement of people in the “common market” created growing tensions in the UK as it was an important destination for migrants from poorer countries although it was an important source of labour supply for “blue-collar” work. From an economic point of view, stronger EU members including the UK had to bear the burden of the problems of weaker EU members. Finally, the future of the EU is likely to depend on even more integration which may not be in line with UK’s interests.

In spite of that, the economic benefit of integration was, however, massive too. In a nutshell, companies can produce goods and services in any EU country by employing the best professionals, achieving greater economies of scale, facing greater competitiveness, enjoying greater opportunities to innovate, and finally selling in a massive market with 513 million people in 28 countries with no trade barriers. Consumers would enjoy the benefits of having a wider range of choices to buy the best quality at the cheapest possible prices. In fact, EU trade among themselves grew massively, while 68 per cent of the EU exports was sold within the EU countries. In South Asia, the exports within the region is no more than 5 per cent of their total exports.

New trading partners

This shows the economic loss to the UK that the country has to face after leaving the EU – the loss of getting isolated. Over the past four years the UK tried without success to avoid this loss by entering an FTA with the EU. The UK has, however, decided not to remain isolated by initiating FTAs with non-EU countries in the world. They include both developed and developing countries from all over the world, out of which 26 agreements are expected to be effective on January 1, 2021. In addition, the UK has already entered agreements with the US, Japan, New Zealand, and Australia, and 12 more agreements under negotiation.

Two Asian countries which have been negotiating trade agreements with the UK are Singapore and Vietnam. These two countries have already signed trade agreements with the EU with Singapore in 2018, and Vietnam in 2019. Along with that Singapore has 25 trade agreements in force and Vietnam 13 trade agreements in force, as notified to the WTO. Their partner countries included Australia, New Zealand, China, Japan, India, South Korea, and the US. They all know that “isolation” from the world economy would lead to them being left behind. For them, moving towards unilateral “free trade” is not a sufficient condition as it should be complemented with trade agreements too. By the way, at the same time, there are also some other countries which need neither of them.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk and follow on Twitter @SirimalAshoka).