Columns

Looking back at a year of human tragedies and economic disasters

View(s):There has not been a single year in living memory when the global economy was devastated to the extent it was this year. It was not a financial or economic crisis; it was not a recession; it was an economic catastrophe and a human tragedy.Economies around the world have been disrupted. Economic growth of most countries has contracted. Global economic growth is negative.

Global tragedy

Global tragedy

The COVID-19 pandemic was a global tragedy. It killed millions all over the world, infected many millions more, brought about widespread hunger and starvation, threatened livelihoods, increased unemployment, poverty and inequality.

The pandemic

At the year’s end, the pandemic is spreading, deaths are increasing and economies are disrupted. There is a glimmer of hope with the use of the vaccine. Yet, it may be at the end of next year that COVID-19 will be contained for the global economy and economic life to return to normal, or to what has been described as a “new normal.”

Economic overview

Looking back at the year that is ending, it has been one of the worst globally and for Sri Lanka. The disrupted global economy had a significant impact on the island’s trade dependent economy that contracted.

The country’s manufactured exports, tourism and related services were severely disrupted. Agricultural production was the least affected, though it too faced difficulties in marketing produce and obtaining inputs. Although the trade deficit narrowed, the balance of payments widened. External financial reserves fell to a critical level in relation to the country’s debt repayment obligations next year.

Economic performance

Economic performance

As to be expected, the country’s production of goods and services were seriously disrupted by the global spread of the pandemic and its infection in the country. Although, the economy’s poor performance was primarily due to COVID, it is misleading to attribute it to the COVID alone. This year that was one following a pre-COVID negative growth of 1.6 percent in 2019 is also expected to record a negative growth.

Three quarters

The economy grew by only two percent in the first quarter of this year prior to the COVID. It slumped to a negative growth of 16.3 percent in the second quarter and recovered to a 1.5 percent growth in the third quarter. As the fourth quarter’s growth has been disrupted by the second wave of the corona that resulted in factories closing down, the economy would have contracted in the fourth quarter as well.

The GDP growth rate for the third quarter of 2020 has been estimated as 1.5 percent, compared to the 2.4 percent of positive growth in the third quarter of 2019. During the third quarter of 2020,agricultural production increased by 4.3 percent, while the industrial sector grew by only 0.6 percent, It is significant that during this quarter ,manufacturing industry, grew by 5.3 percent and services by 2.1 percent, compared to the third quarter of 2019.

Consequently, in common with most other countries, the Sri Lankan economy too would have contracted this year.

Sectors

The three sectors of the economy have not fared well. There was a contraction in all three sectors of the economy in the second quarter. Agriculture contracted by 5.9 percent, Industries by 23.1 percent and services by 12.9 percent.

Agriculture was the least affected sector in 2020,while services were the worst affected. Industries had severe setbacks, but there was a resurgence in some export industries by adapting to new international demands.

Exports

The global COVID pandemic disrupted global trade from early in the year. The country’s industrial exports such as apparel, tires and ceramics were adversely affected from the second quarter of the year. Responding to this challenge export industries diversified into emerging new international demands for personal protection equipment (PPE). Consequently, exports reached about US$ one billion a month that was about the monthly export earnings prior to COVID.

Exports decreased

However, despite the revival of exports by such diversification, exports declined by 16 percent from nearly US$ ten billion in the ten months of 2019 to US$ 8.3 billion in the ten months of this year. Although exports were expected to reach about 11.5 billion for this year, export earnings may be only about US$ ten billion in 2020 owing to the dislocation in export production in October due to the second wave of COVID disrupting production and weakening of demand from foreign buyers.

Trade deficit

This year’s trade deficit was reduced to US$ 4.85 billion at the end of October 2020 from US$ 6.45 billion at the end of October 2019. Although this US$ 1.6 billion lower trade deficit in the ten months of this year is significant, the balance of payments deficit widened to US$ 2.1 billion at the end of October 2020 due to a large fall in tourist earnings and net outflow of capital.

Balance of payments

In contrast to last year’s small balance of payments surplus of US$ 377 million, this year’s balance of payments is expected to record a deficit of between US$ two to 2.5 billion. These developments in the balance of payments this year poses a serious threat to the economy as the external reserves are falling to a critical level.

External finances

The external finances of the country have been a concern during the course of the year, as the country’s exports and tourist earnings were adversely affected. The declining reserves implied difficulties in the repayment of debt obligations in 2021.

At the end of November external reserves had fallen to US$ 4.9 billion.

Foreign reserves have been on a declining trend this year. At the end of October, after the repayment of an International Sovereign Bond (ISB) of US$ one billion, foreign reserves were US$ 5.9 billion. They have fallen to US$ 4.9 billion at the end of November. It is likely to be less than US$ four billion at the end of 2020, unless there are substantial capital inflows.

Foreign debt

The critical issue at the end of the year is whether we could meet our foreign debt obligations.Foreign debt repayment is estimated at US$ four to 4.5 billion in 2021 and about US$ 23 billion for 2021-24. The capacity of the country to meet these debt repayments will be threatened if the weakening trend in the balance of payments gains momentum.

Summing up

The global disruption of economic activities, international trade and travel had a severe impact on the island’s underperforming economy. The economy contracted with manufactured exports, tourism and other services being severely disrupted. Though agricultural production was the least affected by the pandemic, production was low. Employment and livelihoods of many have been lost, poverty and inequality, hunger and starvation have increased significantly this year.

Although the trade deficit narrowed, the balance of payments deficit widened owing to a sharp decline in tourist earnings and capital outflows. Consequently, foreign reserves fell to a critical level of US$ 4.1 billion at the end of November.

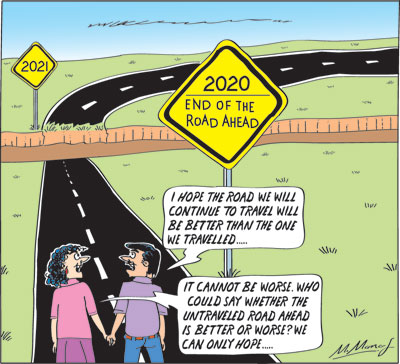

Last word

Describing this year as a lost year is an understatement. It was a global disaster and an unprecedented human tragedy. The containment of the COVID pandemic globally and in the island is a prerequisite to an economic revival next year.

Leave a Reply

Post Comment