Columns

Pragmatic economic policies for post COVID economic growth

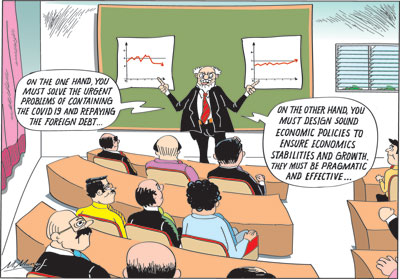

View(s): Containing the spread of COVID-19 is the immediate and paramount concern. At the same time the adoption of correct economic policies for recovery and growth must address the fundamental weaknesses of the economy. They must be pragmatic and realistic.

Containing the spread of COVID-19 is the immediate and paramount concern. At the same time the adoption of correct economic policies for recovery and growth must address the fundamental weaknesses of the economy. They must be pragmatic and realistic.

Immediate concerns

The repayment of foreign debt obligations this year is an immediate and pressing task. The Government is confident of meeting these obligations despite low foreign reserves and the deteriorating balance of payments.

Debt obligations

No doubt the methods of meeting the debt obligations of around US$ 4.5 billion will unfold in the coming months. The focus must then be on adopting policies that stabilise the economy and ensures economic growth.

Agriculture

The emphasis on increasing agricultural production is a step in the correct direction. Long term strategies are needed to enhance tea, rubber, coconut, cocoa and other tree crop production that has been neglected over the years. Increasing their production could contribute much to export earnings in the medium and long run.

Manufactures

Enhancing manufactured exports by providing a favourable environment is crucial for the current trade balance. It is by enhancing exports that the trade deficit could be reduced further.

Pressing problems

Recent columns have discussed the three pressing problems of the economy: containing the spreading COVID-19, resolving the foreign debt repayment and fiscal consolidation, as prerequisites to economic stabilisation and growth. While, their resolution is necessary, they are not sufficient, as there are other conditions, both economic and non-economic, that have to be fulfilled for sustained economic and social development.

Unity

Maintaining national harmony and not allowing communal tensions is of paramount importance to focus on the complex economic issues facing the country. As in the past, the country’s economic development could be derailed if communal tensions prevail.

Fiscal consolidation

Although previous columns stressed that fiscal consolidation is vital to stabilise the economy, it cannot be achieved this year. It has to be progressively resolved over the next five years. In fact, the fiscal deficit is likely to expand further this year due to shortfalls in revenue and extraordinary expenditure aggravating the fiscal outcome.

Long term

In the current economic and fiscal context, fiscal consolidation is a long term process.

Recognise problem

However recognising the problem is a first step towards taking the necessary measures towards reducing the fiscal deficit. The importance of progressively reducing the fiscal deficit from the current nearly two-digit level must be recognised and initial steps to contain it must be devised this year and implemented from next year.

Initial step

The initial step of not aggravating the problem through excessive monetary expansion must be avoided. The excessive printing of money would aggravate the problem rather than contain it. Justifying monetary expansion by citing Modern Monetary Theory (MMT) could destabilise the economy further.

MMT

One of the misleading economic policies that is guiding fiscal and monetary policies is Modern Monetary Theory (MMT). The gist of the theory is that a depressed economy could be stimulated by increasing the money supply and low interest rates.

Validity

There is a limited validity of this theory, especially for an economy that is depressed owing to a lack of domestic demand. It has less adverse consequences for an economy whose dependence on trade is limited and whose currency is a reserve currency.

Concerns

Yet even in less trade dependent economies whose currency is a reserve currency, such as the US, there are concerns about pumping too much money into the economy.

Economists

The suitability and unsuitability of MMT for Sri Lanka has been discussed by economists in Sri Lanka. The sober conclusion is that even if the increase in money supply has a relevance in developed countries whose currencies are reserve currencies, unrestrained increase in money supply in Sri Lanka could lead to inflation that could retard growth and increase imports that may require further depreciation of the Rupee. An increase in money supply could not only cause inflation, but severe balance of payments difficulties.

Eminent economists

Eminent international economists have pointed out that even in less trade dependent developed countries, whose currencies are reserve currencies, excessive resort to increasing the money supply could lead to counter-productive financial and economic instability. In contrast, developing countries whose currencies are not reserve currencies are not in a position to increase their money supply without dire consequences on inflation, balance of payments and their foreign reserves.

Policy makers

This is one instance where policy makers should take pragmatic policy decisions that are appropriate in the country’s economic conditions. Economists guided by ideological and impractical theories could do more harm than good.

Long term policies

The long term prospects for economic growth requires a number of measures that could be summed up as the pursuance of pragmatic economic policies and structural reforms.

Pragmatic policies

Economic policies should be adopted for their efficacy rather than adherence to ideologies and political motives and prejudices. A highly trade dependent small economy cannot afford to pursue economic policies that do not work. In fact, the country’s post-independent economic history is replete with policies that hindered economic development: Policies that killed the geese that laid golden eggs.

Underperformance

The underperformance of the post independent economy has been primarily due to two reasons: communal violence and inappropriate policies.

Pragmatism

The secret to rapid economic development of China and Vietnam, two erstwhile communist countries was their willingness to change their economic policies drastically to achieve economic growth. Xi Jinping captured the essence of pragmatic policies in his oft quoted saying: “I don’t care whether the cat is white or black as long as it catches mice.”

Conclusion

It is imperative that the country pursues pragmatic and effective economic policies to redeem the economy from its severe foreign indebtedness, macroeconomic instability, fiscal imbalance, balance of payments deficits and low productivity. The pursuance of correct economic policies, eradication of corruption and national unity are vital to achieve economic stability and growth in 2020-25.

Leave a Reply

Post Comment