Columns

Lower trade deficit in 2020: Imports and exports decrease

View(s): The reduction of the trade deficit last year has been important in containing the balance of payments deficit. A higher trade deficit would have increased the balance of payments deficit and depleted foreign reserves. The reduction in the trade deficit has been achieved by reducing imports.

The reduction of the trade deficit last year has been important in containing the balance of payments deficit. A higher trade deficit would have increased the balance of payments deficit and depleted foreign reserves. The reduction in the trade deficit has been achieved by reducing imports.

Trade deficit in 2020

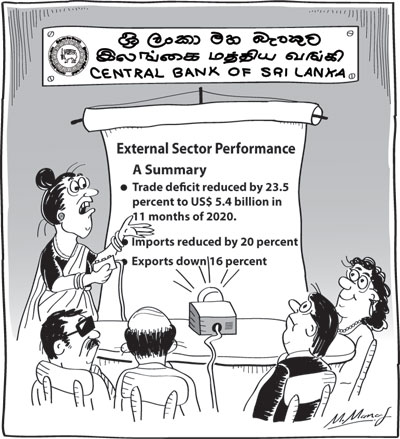

The trade deficit is likely to be around US$ six billion in 2020. It was US$ 5.4 billion in the 11 months of 2020. This reduction of the trade deficit is of paramount importance for the country’s balance of payments and external finances.

Trade deficit 2020

One of the important economic achievements of last year was this reduction of the trade deficit. The data for the 11 months of 2020 indicate a 23.5 percent lower trade deficit than that of the same period of 2019.The trade deficit in the first 11 months of this year was US$ 5.4 billion compared to US$ 7.2 billion in the same 11 month period in 2019.

This reduction in the trade deficit by 23.5 percent or US$ 1.8 billion is a significant decrease in the trade deficit. It was achieved by imports decreasing by 20 percent from US$ 18.1 billion in the 11 months of 2019 to US$ 14.5 billion in the 11 months of 2020. However exports too decreased by 16.7 percent from US$ 18.1 billion to US$ 14.5 billion during this 11 month period.

Significant decrease

The projection of this data for the year gives a trade deficit of about US$ 5.9 billion for 2020. This is a significant decrease from the trade deficit of US$ eight billion in 2019 and US$ 10.3 billion in 2018.

This lower trade deficit of around US$ six billion compared to the much higher trade deficits of 2018 and 2019 is a boon to the balance of payments that has been adversely affected by a sharp decrease in tourist earnings and capital outflows.

Reduced imports

Reduced imports

The reduction of the trade deficit last year was primarily due to a reduction of imports by as much as 20 percent. This offset the reduction in exports by 16.7 percent last year. Exports fell by US$ 1.8 billion, while imports declined by US$ 3.6 billion.

Reasons

This decrease in imports was due to restrictions in several categories of imports and lesser demand for intermediate and capital goods imports, both of which decreased. Imports of consumer, intermediate and investment goods decreased.

Fuel imports

Most significant was the reduced expenditure on fuel that contributed much towards the reduction in oil imports. In the first 11 months of 2020, fuel imports decreased by 35.2 percent from US$ 3.6 billion in the 11 months of 2019, to US$ 2.3 billion in the same period in 2020. This decrease in oil imports by about 35 percent was owing to both a lesser demand for fuel and the fall in international oil prices. The domestic demand for fuel decreased owing to lower transport and other activities. International prices of oil dipped owing to decreased global demand.

Exports

Export earnings too fell last year. The global pandemic had serious consequences for the country’s exports in the second quarter of 2020. The main manufactured exports such as apparel, tyres, and ceramics fell sharply. However, export manufacturers responded to the crisis by reorienting their exports to new commodities demanded internationally.

Exports of personal protective equipment (PPE) items, such as masks, rubber gloves and surgical gloves bridged the gap and export earnings reached the pre-COVID monthly amount of US$ one billion.

There was however a fall in exports in October and November 2020, attributed to the disruption of production due to the second wave of COVID.

Agricultural exports

Agricultural exports too declined due to lower exports of tea, coconut and spices. Agricultural exports declined by 5.9 percent in the first eleven 11 months while industrial exports decreased by 19.5 percent.

Consequently, export earnings for the 11 months of the year of US$ 9.1 billion were 16.7 percent less than that of the 11 months of last year of US$ 10.9 billion. There has been a decrease in exports in the last quarter owing to the disruption of production due to the second wave of COVID spreading. Last year’s export earnings are likely to be about US$ 10.5 billion, which is about US$ two billion less than the exports of 2019.

Agricultural exports

Agricultural exports have fared badly last year mainly due to production shortfalls. Agricultural exports in the first 11 months of 2020 were 5.9 percent lower than in 2019.

Summary

Last year’s trade deficit is likely to be significantly lower than the trade deficits of the previous two years. It is likely to be about US$ six billion compared to US$ eight billion in 2019 and US$ 10.3 billion in 2018. The lower trade deficit was achieved despite a 16 percent decrease in exports due to imports declining by as much as 20 percent.

The lower trade deficit has in turn helped to lessen the balance of payments deficit that has been adversely affected by a sharp fall in tourist earnings and capital outflows. Workers’ remittances have however picked up to exceed last year’s amount.

Conclusion

The salient issue is whether the trade deficit could be contained this year. Early indications are that this year’s trade deficit will be much higher for reasons that will be discussed in next Sunday’s column.

Leave a Reply

Post Comment