Columns

Trade and balance of payments prospects in 2021

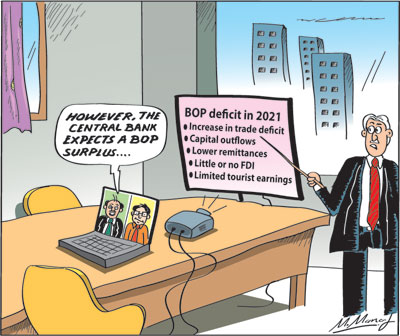

View(s): The prospects for a favourable balance of payments outcome this year is bleak. While the trade deficit is likely to expand, the balance of payments deficit is likely to increase owing to lesser workers’ remittances, capital outflows, negligible FDIs and inadequate tourist earnings.

The prospects for a favourable balance of payments outcome this year is bleak. While the trade deficit is likely to expand, the balance of payments deficit is likely to increase owing to lesser workers’ remittances, capital outflows, negligible FDIs and inadequate tourist earnings.

Overview

An improvement in the trade balance is of paramount importance for strengthening the balance of payments this year. However, there is little prospects of achieving it as import expenditure is likely to increase. Although exports are expected to increase this year, their increase will be inadequate to offset the increase in imports.

In addition to the larger trade deficit, worker’s remittances are likely to decrease from that of last year, foreign direct investments (FDI) are not likely to be significant, tourist earnings are likely to increase only in the latter part of the year by an inadequate amount. Consequently, the balance of payments deficit is likely to increase. Debt repayments and capital outflows are likely to increase the balance of payments deficit further and erode foreign reserves.

Trade deficit

The magnitude of the trade deficit is important for the balance of payments outcome. The trade deficit was reduced by US$ two billion last year from that of 2019 due to the significant decrease in imports. However, this year’s trade deficit is likely to widen due to an increase in imports, especially owing to the steep rise in oil prices.

Last year’s trade deficit of about US$ six billion was the lowest in recent years. It was achieved mainly by a drastic reduction of imports by 19.5 percent to US$ 16 billion, compared to US$ 19.94 billion in 2019.

Exports too were lower than in the previous three years. It was 15.6 percent less in 2020 at US$ 10.07 billion.

The trade deficit narrowed owing to the reduction in imports being larger than the reduction in exports. Such a favourable trade balance is unlikely this year for several reasons.

Imports are likely to be much higher than last year’s US$ 16 billion due to increased import costs of fuel, raw materials and possibly food. The increase in exports is not likely to compensate for the increase in import expenditure.

Imports

Imports

Fuel imports are likely to double this year owing to fuel prices nearly doubling from what it was last year. Fuel prices have already increased from about US$ 32 per barrel on average in 2020 to nearly US$ 60 per barrel so far this year.

Fuel imports that fell by 34.7 percent last year to US$ 2.54 billion, are likely to increase to US$ four billion or more this year, even without an increased volume of fuel imports. It was US$ 3.89 billion in 2019.

Food

The expenditure on basic food imports may increase. However, the situation with respect to paddy production is not clear. Unfavourable weather conditions were expected to reduce the Maha paddy crop, while pest damage was expected to reduce the maize harvest. Recent estimates of paddy production are in contradiction of this.

The Maha paddy harvest that was expected to decrease to 2.2 metric tons owing to climate related causes, is expected to exceed three billion metric tons according to the most recent estimate of the Department of Agriculture. If this be the case, there is no need to increase imports of rice. The maize crop is also expected to be high despite considerable pest damage.

However, reports of widespread damage to the harvest makes one sceptical of the official estimates. The Government has also permitted even the import of coconut kernel owing to shortages of coconut.

Raw Materials

In addition, there will be a need to Increase imports of raw materials for industries as they are likely to increase production and exports.

Exports

Much of the fortunes in the country’s external finances would depend on an expansion in exports. There is a prospect of increased exports, provided the dislocation to industrial production at the latter part of the year owing to the spread of COVID does not recur this year. The expected containment of the virus later this year may enable factory production at full capacity.

Global demand

There are initial signs of a revival of global demand owing to the gradual revival of the global economy. There are indications of increased orders for manufactured exports, especially apparel.

While international demand is likely to expand, it is important that the country’s export capacity is not hampered by non-availability of essential raw materials and the increasing spread of COVID.

It is noteworthy that manufactured exports increased to US$ 1.8 billion in December compared to US$ 1.1 billion in December 2019.

Expectations

It is important to achieve export earnings of US$ 18 billion or more to keep the trade deficit to around last year’s US$ six billion. This has to be achieved mainly by manufactured exports as agricultural exports are constrained by an inability to increase export surpluses.

Agricultural exports

Last year agricultural exports declined by 5.3 percent, with tea exports decreasing by 7.8 percent. The current disruption of estate tea production will further decrease tea exports that are of much significance for export earnings.

Services

Workers’ remittances are likely to reduce, tourist earnings, though much higher than that of last year, is not likely to be large and foreign direct investments (FDI) are unlikely to be significant. Increased earnings from ICT services are likely this year.

Workers’ remittances

Although workers’ remittances that are the highest contributor to the balance of payments, was expected to fall sharply last year, they in fact increased from US$ 6.8 billion in 2019 to US$ 7.1 billion in 2020. However, the Central Bank expects them to increase to US$ 7.5 billion in 2021. There is considerable scepticism that this would happen as large numbers of workers’ have returned and few would be leaving for employment abroad.

The increase in remittances last year may have been due to returning workers bringing their savings through official banking channels. Remittances are likely to fall rather than increase this year. This is a serious setback to the country’s external finances.

Tourist earnings

Tourist earnings took a huge blow last year owing to the COVID pandemic the world over restricting travel. Tourist earnings that had risen to US$ four billion fell to US$ 2.1 billion owing to the April 2017 Easter Sunday bombings. It fell precipitously last year to a paltry amount due to the global pandemic.

There is a prospect of revival in travel and tourism at the latter part of the year. However, such earnings are likely to be only about US$ 1.5 billion at best.

Summary

The trade deficit was reduced by as much as US$ two billion last year owing to a large decrease in imports that was higher than the decrease in exports. This reduction in the trade deficit by US$ two billion was due to a decrease in imports owing to import restrictions and the low international price of fuel. This year’s trade deficit is likely to increase owing to higher imports and export growth being inadequate to offset the increase in imports.

The increased trade deficit, lower worker’s remittances, negligible foreign direct investment (FDI), capital outflows and low tourist earnings are likely to create a further dent in the balance of payments. While earnings from tourism are likely to increase especially in the latter part of the year, workers’ remittance may dip and foreign direct investments are unlikely.

Central Bank forecast

However, the Central Bank of Sri Lanka forecasts a balance of payments surplus this year. Despite the increase in fuel prices, imports are not expected to increase and exports are expected to Increase to US$ 16 billion. Workers’ remittances are expected to be somewhat higher, while tourist earnings are forecast to rise substantially. Larger FDI and other capital inflows are expected to result in a balance of payments surplus.

Finally

All factors considered, the prospects of an improvement in the trade and balance of payments is remote. All factors point to an increase in the balance of payments deficit this year. Only bilateral and multilateral foreign assistance could buttress the country’s foreign reserves.

Leave a Reply

Post Comment