Columns

Remittances from around the world strengthen balance of payments

View(s): Remittances that are the main strength of the balance payments, have been increasing in recent years. They increased from US$ seven billion in 2019 to US$ 7.1 billion in 2020. In the first five months of this year, remittances increased by a further 18 percent compared to the same period last year to US$ 2.8 billion. If this increasing trend in remittances continues, they may exceed US$ seven billion this year.

Remittances that are the main strength of the balance payments, have been increasing in recent years. They increased from US$ seven billion in 2019 to US$ 7.1 billion in 2020. In the first five months of this year, remittances increased by a further 18 percent compared to the same period last year to US$ 2.8 billion. If this increasing trend in remittances continues, they may exceed US$ seven billion this year.From around the world

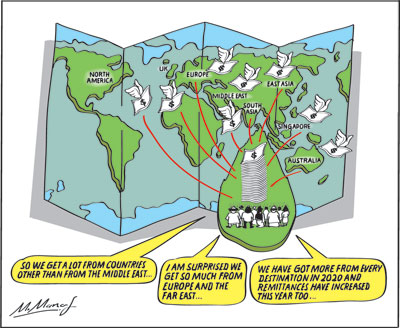

Although a little over one half (52 percent) of these remittances are from the Middle East, there are significant amounts of remittances (48 percent) from many countries. There are remittances from North America, Europe, Australia and the Far East, among others.

BOP strength

Remittances have been and are the main source of strength for the balance of payments. For many years, either a large proportion of the large trade deficits or even the entirety of large trade deficits have been offset by remittances.

Trade deficits

For instance, remittances offset the entirety of the trade deficit in 2020. The deficit of US$ six billion was wiped out by remittances of US$ 7.1 billion. In 2019 a high proportion of the trade deficit (83 percent), was offset by remittances. The trade deficit was US$ eight billion and remittances were US$ seven billion in 2019.

It is difficult to imagine the plight of the country’s external finances without these earnings.

“Workers’ remittances”

“Workers’ remittances”

These remittances to the country are known as “workers’ remittances”. Undoubtedly, the remittances from the Middle East are the main component of remittances and these are from migrant workers. However, there is little awareness that nearly one half of these remittances are not from workers in the Middle East.

Many countries

While a little more than a half (51.5 to 51.7 percent) of these remittances are from workers in the Middle East, nearly one half (48 percent) are from other regions of the world.

Sri Lanka receives remittances from nearly all regions of the world. These include North America, UK, Europe, Japan, East Asia, South East Asia and Australia. We even receive remittances from South Asia.

In 2019, remittances from the Middle East accounted for 51.5 percent of total remittances. The other regions accounted for a significant 48.5 percent of remittances.

In 2020, the sources of remittances changed very little. Remittances from the Middle East accounted for 51.7 percent of total remittances, while other regions accounted for a significant 48.3 percent of remittances. The European Union (EU) and the Far East accounts for about 19 and 12 percent of remittances to the country.

Reasons

Many Sri Lankan expats send money to support their families. The extent of their support may have increased owing to the severe hardships of their dependents in Sri Lanka. Some of these remittances are for the purchase of property as expats expecting to retire in the land of their birth may be motivated to increase remittances owing to the higher interest rates and the gains from the continuous depreciation of the Rupee.

Diaspora

Furthermore, it is well-known that the Tamil diaspora sends significant amounts to their families in the North. These are from a large number of professionals who have left the country. They are doctors, engineers, accountants and technically qualified persons. Moreover, social service organisations, think tanks, schools and NGOs too receive regular remittances.

Bottom line

The bottom line is that so called “workers remittances” are not an accurate description of the remittances received by the country as a substantial amount of remittances are from varied sources in numerous countries. Although migrant workers do remit a high proportion of remittances to the country, these remittances are more accurately described as foreign remittances.

Increasing remittances

The increase in remittances after COVID-19 was unexpected, as a large proportion of workers from the Middle East had lost their jobs and were returning, it was feared that remittances would fall precipitously. However, it turned out that remittances increased from US$ seven billion in 2019 to US$ 7.1 billion in 2020.

The Increase in remittances has been explained as due to returning workers remitting their savings and such remittances being remitted through banking channels rather than through informal methods.

While these explanations have a validity, another reason is that the sources of remittances are not entirely from workers in the Middle East and remittances from other places did not decrease as the motives for their remittances were for various reasons as explained earlier.

Summing up

In brief, remittances are the strength of the balance of payments. They have increased from US$ seven billion in 2019 to US$ 7.1 billion in 2020.They have increased by 18 percent in the first five months of this year to US$ 2.8 billion compared to the same period last year.

A little over one-half of remittances are from the middle East, while almost one half are from the rest of the world. Middle Eastern workers have accounted for only a little above one–half of such remittances. In recent years they have been between 50 to 55 percent of remittances. In 2020, after COVID, they accounted for 51 percent of remittances that increased from US$ 7.0 billion in 2019 to US$ 7.1 billion.

Conclusion

Over one-half of the remittances received by the country are from countries in the Middle East. On the other hand, nearly one half of remittances are from other regions of the world. As the remittances come from all over the world and for a variety of reasons, they are a more stable source of foreign earnings than if they were from workers in the Middle East. It is the misconception that workers’ remittances are overwhelmingly from workers in the Middle East that led to the anxiety that these earnings would drop sharply with workers returning to the country. Even if remittances from the Middle East falls, its impact on total remittances will not be that severe owing to the remittances from the rest of the world accounting for nearly half the country’s remittances.

Leave a Reply

Post Comment