Prospering in a crisis

View(s):

A row of housing in Singapore

There are some nations – I believe, they are a few in the world -, which consolidate their positions in the midst of the crisis in order to prosper when the time is right. At the same time, many seem to have taken the crises as unavoidable stages of the world economy so that it’s better to stay with belts tightened until they pass through it. Of course, there are others too, who struggle to keep the nose above water not knowing where the next meal comes from.

For some time, I didn’t focus on the Singaporean economy. And now I thought of writing about some issues of the crisis-ridden world economy and, then look at how Singapore was doing in the midst of that.

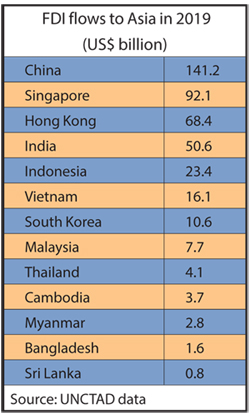

Last year was bad for foreign direct investment (FDI) flows in the world. According to UNCTAD data, World FDI inflows dropped by 42 percent from a colossal US$1.5 trillion in 2019 to just $859 billion in 2020. It was the rich countries which were hit hardest, as FDI flows plummeted by almost 70 percent whereas its decline in developing countries was 12 percent only. Among these developing countries too, it was Asian countries which reported the least reduction of FDI inflows by 4 percent only.

Peculiar trends

Peculiar trends

World FDI trends in the past few decades have been interesting. If we understand these trends, we would be able to comprehend why the economies of the developed countries were slowing down, while those of the developing countries in Asia were growing. Development needs capital, while capital gets accumulated through FDI, at least in the early stages of development.

Someone could still rely on an old argument that capital could be generated through own savings. Well, I don’t dispute that; if you choose to wait for about 100 years until we generate enough savings, then our own savings can also be a primary source of capital.

By looking at the historical FDI trends, we find that about 25 years ago, world FDI flows amounted to $200 – 300 billion, which continued to remain over $1,000 billion after 2006 and, exceeded $2,000 billion in 2015. The world’s developed countries acquired about 70 – 80 percent of the world FDI flows until the turn of the century; then it turned towards developing countries which improved their share over half of the world FDI. Last year in the midst of the crisis, developing country share has increased further to 73 percent, leaving only 27 percent for the developed countries.

It was Asia which continued to attract increasing share of world FDI. The increase in FDI outflows from developed countries and, its diversion towards Asian region explains why the developed countries were slowing down resulting in a recession and, at the same time why the countries in Asia started growing fast as never before. Capital moved away from recessions, while this happening made the recessions faster resulting in a global economic crisis which got aggravated by the COVID-19 pandemic. For the same reason, Asian growth got accelerated and did not feel much about the global economic crisis until the whole world was hit by the COVID-19 pandemic.

Among all the regions in the world including both developed and developing countries, generally Asia performed well against the global economic crisis as well as the COVID pandemic-led economic crisis.

Singapore’s investment

Singapore has a different story too. In spite of being a developed country – in fact, a highly developed country, Singapore continued to attract increasing amount of FDI flows too; it attracted historically the largest amount of $92 billion in 2019. However, hit by the COVID pandemic issue, it declined to $58 billion in 2020, a reduction of 37 percent.

Singapore has experienced its worst economic recession in 2020, but its investment in fixed assets has grown by a historically high amount of $12 billion (Singapore$17.2 billion). It has exceeded $11 billion investment in the previous year and, while it was reported to be the highest level of fixed assets investment since 2008, doubling the official forecast. More than half of it has been contributed by the US, while Singapore’s own share accounted for 17 percent. Japan, China and European countries have also contributed to this achievement by taking sizable shares.

Singapore has experienced its worst economic recession in 2020, but its investment in fixed assets has grown by a historically high amount of $12 billion (Singapore$17.2 billion). It has exceeded $11 billion investment in the previous year and, while it was reported to be the highest level of fixed assets investment since 2008, doubling the official forecast. More than half of it has been contributed by the US, while Singapore’s own share accounted for 17 percent. Japan, China and European countries have also contributed to this achievement by taking sizable shares.

Contrary to the rather volatile and uncertain business outlook in the world, three factors were important for this remarkable achievement, according to official sources. The first is that Singapore was the number one choice by the global companies that are looking forward to their business growth beyond the pandemic. The second was the strong business fundamentals such as the global trade and transport connectivity and highly talented human resources. Even though Singapore does not have an agriculture sector, still the global agriculture-related companies set up their regional headquarters because of these strong fundamentals. The third factor is the business confidence because the business companies can trust the government and its policies and regulations.

Foreign reserves

With high investment in fixed assets in the midst of the crisis, Singapore is looking forward to high growth recovery with over 5 percent rate of annual GDP growth in 2021. For a developed country, this is also a very high growth forecast, because matured economies do not grow usually at high rates as such.

Another field of good performance for many of the countries in Asia, including Singapore, was the accumulation of foreign exchange reserves. Due to subdued domestic demand conditions and the lower world market prices, they were able to build up their foreign reserve positions. The stock of official foreign reserves in Singapore, which was $279 billion in 2019, increased to $362 billion in 2020 and further to $398 billion by the end of first half of 2021. Some other Asian countries such as Bangladesh, Bhutan, China, India, Malaysia and Vietnam have also been able to build up their official foreign exchange reserves during the pandemic.

As the pandemic situation is set to subside with administered vaccine programmes all around the world, the world economy is also expected to recover in 2021. While the increase in GDP is from a lower base in 2020, statistically many countries are expected to record higher growth rates over 5 percent. While the world GDP is also forecasted to grow by 5.4 percent, the highest growth rates could be observed in Asia led by China and India.

For some of the countries the recovery is just returning to normalcy. But for other countries, which set the foundation for a higher growth momentum by addressing the growth fundamentals it would be a new era of growth prospects. Industry-wise, a dramatic growth could be observed in technology sectors, healthcare and the digital economies. For the countries which are not prepared for the new era, it is just a recovery to get back to their pre-pandemic normalcy.

(The writer is a Professor of Economics at the University of Colombo and can be reached at sirimal@econ.cmb.ac.lk

and follow on Twitter @SirimalAshoka).