Columns

Fresh economic thinking and pragmatic policies imperative

View(s): Economic difficulties reaching crisis proportions are clear evidence that the Government’s policies have failed. Some commentators have said that we are in a predicament that can lead to situations like in Myanmar, Argentina or Lebanon. Fitch Ratings has downgraded the economy to a cc- level, close to one of insolvency.

Economic difficulties reaching crisis proportions are clear evidence that the Government’s policies have failed. Some commentators have said that we are in a predicament that can lead to situations like in Myanmar, Argentina or Lebanon. Fitch Ratings has downgraded the economy to a cc- level, close to one of insolvency.

Recognition of crisis

Recognising the problem and the need for economic reforms is the first step towards the resolution of the crises of multiple dimensions. Fortunately, there has been an acknowledgement of this recently and consequently significant policy reversals such as on organic fertiliser.

Fresh look

A fresh look at the failed economic policies and the adoption of pragmatic monetary, fiscal, agricultural, trade and other policies are vital for economic stabilisation, economic recovery and growth.

Rice and fertiliser imports

The recent decision to allow the free import of rice and chemical fertiliser for tea is blatant admissions of the folly of the sudden switch to organic agriculture, which the scientific community had forewarned of and farmers protested against.

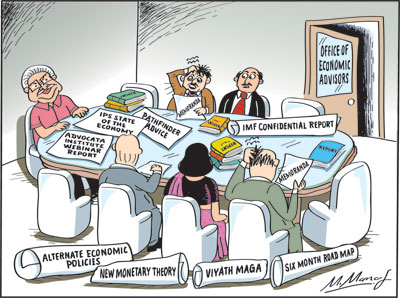

Alternate economic policies and NMT

Similarly, the Government’s undefined alternate economic policies and the New Monetary Theory (NMT) pursued by the government have led to unprecedented inflation, a huge fiscal deficit, large trade and balance of payments deficits, depletion of foreign reserves and depreciation of the currency. No doubt external factors such as increasing oil prices impacted adversely on the economy.

Time to change

Time to change

The alternate economic policies of the Government and its monetary and trade policies have led the country into a severe economic crisis. Clearly, the time is opportune to take a fresh look at these policies and undertake reforms that would resolve the pressing problems of the country.

A fresh look at, and reversal of, so called alternate economic policies and the abandonment of New Monetary Theory is imperative. Foreign assistance from whatever quarter coupled with economic reforms is urgent and imperative.

Budget 2022

The Budget for 2022 to be presented on November 12 is the appropriate occasion to make a break from recent policies and charter a pragmatic economic policy framework.

This would include a more selective restriction of imports, trade liberalisation, a realistic exchange and interest rate policies and a phased implementation of organic agriculture to a limited extent, as in most countries. Fiscal consolidation is unquestionably vital to achieve economic stability, but difficult and painful to achieve, yet essential.

Economic crisis

The current economic crisis has many dimensions. The most focused issue has been the severe shortage of foreign currency. The country’s reserves have depleted to as low as US$ 2.5 billion at the end of September. The depreciation of foreign currency, has led to unavailability of foreign exchange for essential imports owing to a wide margin between the official and unofficial or black market rates.

Shortages of food and other essential items have been the outcome. These are symptomatic of the critical shortage of foreign currency. The depreciation of the rupee and the reduction or elimination of the wide margin between the administered and market rates of exchange that should be narrowed and, if possible, eliminated are among the needed changes.

Fiscal deficit

Less recognised, but underlying problems are the burgeoning fiscal deficit and monetary expansion. The folly of the imprudent large expansion of money supply justified by the Government and Central Bank by its advocacy of New Monetary Theory has proved catastrophic. It has led to inflation and weakening of the currency.

Foretold

This was pointed out repeatedly by economists, but stubbornly pursued by the Government’s economic advisors to create inflation and increased pressures in the balance of payments. This has had widespread economic ramifications and repercussions. Fiscal and monetary policy reforms are essential to stabilise the economy.

Triple problems

The triple problems of reducing the trade deficit, consolidating the public finances and reducing the monetary expansion and inflationary pressures require policy reforms. The continuation of the current policies would deepen the crises and lead the country to disaster.

Expanding trade deficit

Despite stringent import controls, the trade deficit expanded in the first seven months of this year to US$ 4.9 billion compared to US$ 3.5 billion- an increase of as much as 40 per cent from that of the same period last year. Based on this trend, the projected trade deficit may exceed US$ ten billion for 2021.

Imports and exports

What is surprising about the trade performance this year is that the widening trade deficit was brought about by imports increasing despite increasing import controls. This clearly demonstrates that the country’s trade imbalance cannot be resolved by import controls. As discussed in last Sunday’s column, the country’s future lies in a liberalised trade regime that expands the country’s exports.

Growth in exports

Despite constraints posed by COVID-19 and import restrictions, exports increased by 24 per cent to US$ 6.9 billion in the first seven months. Both agricultural and manufactured exports increased.

Moreover, exports exceeded US$ one billion in June, July and August, lending expectations of exports exceeding the export target of US$ 12 billion this year.

Balance of payments

With remittances showing a decline in recent months, tourist earnings small and net capital outflows, the balance of payments deficit is likely to be about US$ five to six billion.

In the first seven months of this year, the BOP deficit was US$ 2.75 billion. May be foreign assistance and foreign currency swaps would relieve the situation, but not resolve the foreign currency crisis.

Conclusion

We may be able to tide over the critical difficulties in foreign finances by assistance from foreign countries and multilateral organisations. However, the need of the hour is recognition that the policies pursued have been inappropriate at best and faulty at worst.

A reversal of faulty policies and adoption of comprehensive economic reforms are the only means of stabilising the economy and placing it on a path of economic recovery. Fiscal, monetary and trade reforms are imperative. Are we on the threshold of policy reforms?

Leave a Reply

Post Comment