Private sector management hasn’t enhanced performance of state-owned rubber estates

Rubber trees.

Management of rubber estates in the country changed hands from foreign companies to state-owned corporations and then to the current private sector. Generally, change in management in any business envisages performance enhancements. But has this objective been realised in the case of the state-owned rubber estates in Sri Lanka? This article attempts to evaluate the performance of rubber estates in the country under different management structures enabling to take informed decisions on the way forward.

Inception

Natural rubber cultivation in the country commenced with the introduction of around 1,700 seedlings by Sir Henry Wickham in 1876. Soon after, there had been a tremendous enthusiasm shown by the growers for cultivating this crop and by 1907 the cultivated extent in the country had risen to 65,000 hectares (ha). Ownership of rubber cultivations had been predominantly by smallholders currently defined as rubber lands below 20 ha in extent. The rubber estate sector mainly owned and managed by foreign companies accounted for around 35 percent of total extent. By 1970, the rubber production and extent in the country had increased to 159 million kg and around 230,000 ha respectively. Smallholders have been responsible for around 2/3rds of the country’s natural rubber production.

Changes in management

With the change in policy of the Government of Sri Lanka (GOSL) all estates owned by foreign companies were nationalised in 1970. The objective of this change had been to enhance government revenue through increases in productivity and profitability. State-owned Janatha Estates Development Board (JEDB) and Sri Lanka State Plantation Corporation (SLSPC) were responsible for managing these estates after nationalisation. Two decades after nationalisation, the natural rubber production dropped to 123 million kg whilst the extent dwindled to 200,000 ha. Obviously, the rubber production and land productivity in the estate sector too would have declined. The Plantation Restructuring Unit of the Ministry of Finance in its 1992 report said that the huge land mass the two corporations had to manage, the bureaucratic and centralised system of planning and control and shortage of specialised skills have been responsible for the downward trend in rubber production and productivity in the estate sector during the period of state management.

Prof. Asoka Nugawela

When national productivity during this period was compared with the other rubber growing countries in the world, it had been relatively low. This had been attributed mainly to planting of clone PB 86 predominantly in the country. High annual rainfall and wet days interrupting harvesting of rubber, low number of productive plants per unit land area and non-adoption of novel tapping systems together with the use of yield stimulants were the other reasons identified.

With the GOSL policy of liberalisation of the economy, except for a few extremely underperforming estates, the management of the rest were transferred to 22 newly formed private plantation management companies in 1992. GOSL remains as the golden shareholder and the lease period is for 53 years ending in 2045. This is the third structural change in management of the Sri Lankan estates with the first and second phases been foreign owned companies and state corporations respectively.

Performance enhancements?

The Plantation Restructuring Unit report said that agricultural conditions and processing facilities of estates transferred to private companies had been in a reasonably good status especially with the World Bank-funded capital development programme just been completed. Thus, a good platform for improvement in performance of the estates through introduction of efficient commercial management and adoption of appropriate good agricultural practices had existed.

Having identified the weaknesses in style of management and technology adoption during the period of state management a leap enhancement in performance was anticipated with the privatisation of the management of estates. The improvements in agricultural practices anticipated were, introducing high yielding clones (replacing PB 86), increasing density of rubber trees in clearings to be planted, appropriate fertiliaer programmes and use of tapping techniques together with the use of yield stimulants.

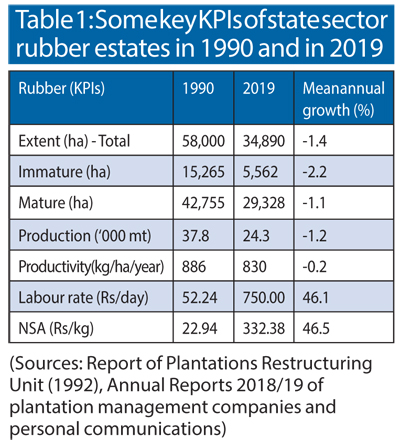

In an attempt to assess the impact of privatisation of management on the performance of rubber estates, a few key performance indicators (KPIs) of the rubber estate sector couple of years prior to privatisation (1990), were compared with the same recorded in 2019 (Table 1). Apparently in 2019 the private plantation management companies completed around 50 percent of the 53-year lease period. This time period under private management will give a reasonable indication to what level the anticipated improvements are being achieved.

Information gathered reveals that total rubber extent in the estate sector of the country has declined by 23,110 ha, i.e., a reduction of 1.4 percent per annum on an average, during the period 1990 to 2019. Crop diversification, awaiting replanting of uneconomical/uprooted rubber lands, government land acquisition and showing unplantable extents in rubber lands separately are a few possible reasons for this gap. Nevertheless, reconciling this gap is a worthwhile exercise to determine ground realities. Further, it is also apparent that the mature and immature rubber extents in 2019 are only about 68.6 percent and 36.4 percent of the 1990 extents respectively.

The estate sectors contribution to the national natural rubber production in 1990 had been 37.8 thousand MT whilst in 2019 it was 24.3 thousand MT, i.e., a drop of 13.5 thousand MT. Accordingly the annual mean decline in total natural rubber production in the estate sector during the period 1990 to 2019 was around 1.2 percent. The rubber land productivity in 1990 has been 886 kg hectare per annum whereas in 2019 it has declined to 830 kg per hectare per annum which is equivalent to a 0.2 percent annual mean decline during the 27-year period of private management.

The estate sectors contribution to the national natural rubber production in 1990 had been 37.8 thousand MT whilst in 2019 it was 24.3 thousand MT, i.e., a drop of 13.5 thousand MT. Accordingly the annual mean decline in total natural rubber production in the estate sector during the period 1990 to 2019 was around 1.2 percent. The rubber land productivity in 1990 has been 886 kg hectare per annum whereas in 2019 it has declined to 830 kg per hectare per annum which is equivalent to a 0.2 percent annual mean decline during the 27-year period of private management.

Moreover, a decline observed in the extent of rubber replanting’s, i.e., around 10,000 ha from 1990 to 2019 (Table 1) is an indication that the contribution from the estate sector to national rubber production would decline further in the future. This anticipated decline in rubber production in future could be highly significant if the new clearings currently established in the estate sector does not have adequate number of quality plants per unit land area. A fundamental requirement for high land productivity is quality rubber clearings.

The labour wage rates applicable to the estate sector and the net sales average for rubber have increased by similar proportions during the period under consideration, i.e., a mean annual increase of 46 percent during the period 1990 to 2019 (Table 1). Therefore, increased worker costs are compensated to a certain level by similar gains in selling price of the produce. The rate of increase in costs of agro-chemicals too needs to be considered to establish an impact on cost of produce. Fertiliser prices, however, were subsidised during certain periods.

Meaningful change

What is apparent from the above analysis is that the performance of the rubber estates under private management has actually declined though expectations were otherwise. This is surprising as the private sector is considered the engine of economic growth in a country. Further, this is despite having access to improved technologies such as young buddings to raise quality planting material, high yielding clones, rain guards to overcome negative impact of rain on harvesting, planting densities giving rise to high stand per hectare and also low intensity tapping systems to minimise worker requirement and improve worker productivity. In fact, these are the technologies that were identified to overcome the low performance that was recorded during state management of rubber estates.

The downstream activities of the rubber sector in the country continue to show a remarkable growth. In fact, the national rubber production in the country is not adequate to cater to the demand of the natural rubber-based industries. Hence, rubber product manufactures are compelled to import around 60 thousand MT of natural rubber annually leading to a significant outflow of valuable foreign exchange from the country. In this context increasing the national rubber production is of utmost importance to save foreign exchange, support the rubber product manufacturing sector and develop the national economy.

A silver lining on a somewhat dark cloud is the improved performance shown by a few private plantation management companies. They have committed themselves to achieve the objectives of privatisation through an efficient management structure, investments on capital development and adhering to good agricultural practices. Replicating such successful models to other private plantation management companies is the need of the hour to achieve real change anticipated through privatisation. The ‘golden’ shareholder (GOSL) needs to take the initiative in this regard and also to create a business environment so that the lease period, to end in around 22 years, would not to be a hindrance/excuse for continuing capital development and adoption of agricultural practices ensuring sustainability in the rubber estate sector of the country.