News

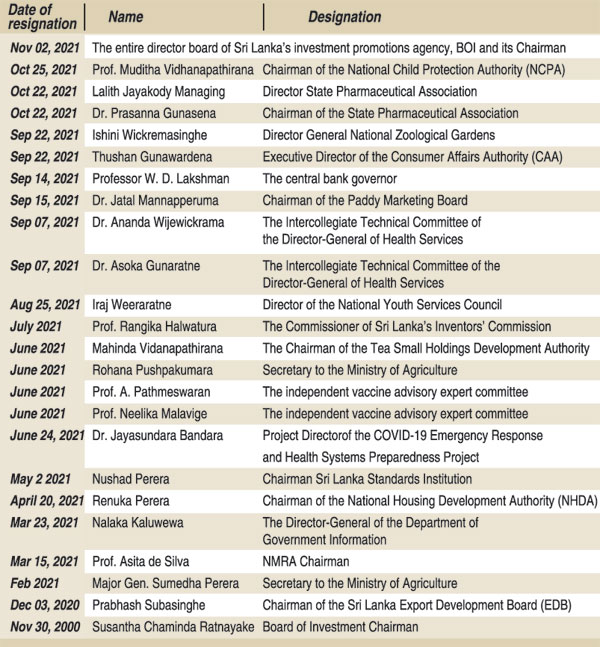

BOI resignations expose crisis within

Mohottala: Resigned as BOI chairman

This week’s mass resignations at the Board of Investment (BOI) were partly catalysed by staff resentment against a Finance Ministry and Cabinet-backed move to recruit private sector professionals to a new special unit at salaries far higher than internal scales.

But the chairman, three directors and the director-general — all private sector draftees — were also affronted by the line of questioning adopted by the Committee on Public Enterprise (COPE) on several matters, including the manner in which the unit was set up and the emoluments decided.

During the COPE session, Government and Opposition MPs together cautioned that the move would cause serious internal turmoil and that the Board might not be able to run the institution efficiently, owing to unhappiness over the huge discrepancies in salaries.

They said each Parliamentarian had received petitions and other files from aggrieved BOI staff and urged the management to ensure the dispute was carefully resolved. Seven out of the proposed 29 members of the special unit have already been enlisted on three-year contracts. The BOI has around 1,300 existing employees.

However, Directors Harsha Cabraal, PC, Sanjay Kulatunga and Harsha Subasinghe resigned along with Chairman Sanjaya Mohottala and Director-General Pasan Wanigasekara. Among other things, they did not wish to suffer reputational damage as all of them held respected private sector positions, a source familiar with their thinking said. Mr Mohottala had left a well-paid job at the Boston Consulting Group to take over at the BOI.

COPE also questioned steep expenditure on investments zones in 2017 and 2019 and asked how two Directors-General were recently paid salaries of Rs 1mn a month for an entire year (until one retired). These and other issues had been flagged by the National Audit Office and taken up by the Committee, under usual procedure.

Mr Mohottala said this week that his main intention had been to improve the functions of the BOI, particularly in terms of investment promotion. “We have to go and actively hunt for the investments we need,” he said. “That is investment promotion and putting the country on the map, in my mind. We have done a poor job.”

“If you take the last many years, unfortunately, we can’t point to any substantial investments that we actively pursued and realised,” he continued. “We should not be an entity that just approves the projects that come to us.”

“If you take the last many years, unfortunately, we can’t point to any substantial investments that we actively pursued and realised,” he continued. “We should not be an entity that just approves the projects that come to us.”

In this and other areas, there were serious skills lacunae in the BOI, Mr Mohottala pointed out, adding that this had been identified by previous administrations. “For instance, even under the previous chairman, one of the deficiencies identified was that an entity like BOI, which enters into agreements with international companies, requires legal expertise of international standing,” he said.

“While it has a good legal team to offer support on contracts, to work with the Attorney General’s Department on legal matters and to take things forward, those skills are necessary,” he pointed out. “Repercussions of not having them would be felt by the country much later, as we are experience in ongoing arbitrations against Sri Lanka.”

Internally, many officers had retired and there had been no succession plan. There were no employees drawn in directly from the private sector. In January this year, after considering appeals from several other agencies for specialised skills, the Finance Ministry submitted a Cabinet memorandum titled ‘Enhancing the Capacities of Key Regulators and State Enterprises’. It was written, Government sources said, by the Treasury.

In November 2020, the Cabinet had already empowered the Board of Directors of the Information and Communication Technology Agency (ICTA) “to establish its own methods of recruitment and set remunerations in accordance with market rates to attract the highest calibre of professionals and industry experts”.

In its January Cabinet memorandum, the Finance Ministry proposed to allow the boards of entities like the BOI to decide on recruitment procedures and the remuneration packages of “newly-proposed recruitments” with the Treasury Secretary’s concurrence, having followed accepted recruitment procedures.

“In deciding to recruit such specialised staff, entities are also encouraged to adjust their organisational structures when required to create a specialised unit while suppressing the normal cadres,” the paper said.

An officials’ committee headed by the Treasury Secretary (with the Secretaries of several other Ministries) was appointed to decide on the institutions and staff positions that required specialised skills. Recruits were to be taken on “market based remuneration packages”.

The BOI requested 29 recruits. In March, the Finance Ministry submitted another Cabinet memorandum containing the committee’s recommendations. It proposed the establishment of a new unit at the BOI “which supports to inculcate performance driven culture with high caliber professionals and industry experts with private sector exposure and international experience”.

“This team will comprise 29 specialised personnel and suggested to offer attractive remuneration packages in line with the market rates with specific performance targets,” it said. Attached were job specifications for each post along salaries and allowances going up to Rs 700,000 a month. This was approved by the Cabinet, therefore granting the BOI permission to proceed.

Mr Mohottala said he had suggested the unit be located outside of the BOI but was told to make it an internal body. The creation of the unit, therefore, caused significant unhappiness among existing BOI employees who were paid according to usual scales. It also led to angry petitions being signed on various matters (including a proposed refurbishment plan), BOI unions campaigning against the top management and refusal of staff to cooperate with new recruits.

COPE Chairman Charitha Herath and other members had warned the BOI during the session in November that things were likely to get unpleasant.

At the time, resignations had not been contemplated. It now remains uncertain who will take the helm at what is known as the “foremost investment promotion agency of Sri Lanka”. Or, what would happen to the plans and strategies the outgoing top management had tirelessly devised.

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!