News

New tax revisions: More revenue for Govt, more price blows for people

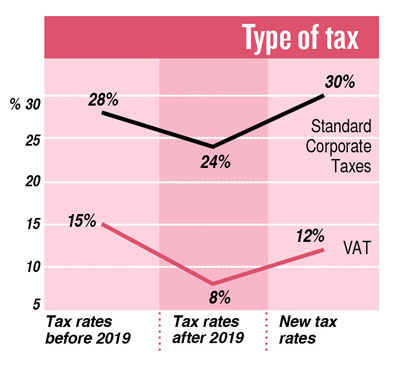

The new tax reforms announced this week have, more or less, reversed the tax cuts introduced in 2019 soon after President Gotabaya Rajapaksa assumed office, but some of the new rates are still below the pre-2019 rates.

The Value Added Tax that was increased from 8 to 12 percent stood at 15 percent back then. This means that the prices of goods will increase by 4 percent if traders pass the burden onto customers.

The Government had brought back the withholding tax on employment income or the Pay As You Earn (PAYE) tax, which it had removed in 2019, Naqiya Shiraz, Research Analyst at the Advocata Institute, an independent think-tank. She said taxes ensured a constant source of income and, therefore, their removal had a large impact on the overall revenue of the Government.

PAYE and withholding taxes were based on systems that placed the burden of tax collection at the source instead of the individual taxpayer. This resulted in more taxes being collected. Its reintroduction had been a recommendation put forward by economists for a while now, the analyst pointed out.

As part of the latest tax reforms introduced by the Finance Ministry, other levies have also been increased. The telecommunications levy was increased this week from 11.25 percent to 15 percent. Accordingly, customers will have to pay more for phone and telecommunication services charges incurred from yesterday.

Also increased was the betting-and-

gaming levy.

Standard Corporate taxes are also now higher than pre-2019 rates. “After the 2019 tax reforms, the corporate taxes were charged at rates ranging from 4 to 24 percent with the first tax bracket at Rs 600,000, but now this has been changed to 4-32 percent with the first tax bracket being Rs. 1.2 million, Ms. Shiraz noted.

The personal income tax relief ceiling, which was lowered to Rs. 1.2 million from Rs. 3 million in terms of the 2019 tax overhaul, will be set at Rs. 1.8 million from October this year. This tax relief is in view of personal expenditure on healthcare, education, and similar spending.

“When the VAT increases, consumer goods will undoubtedly increase,” said Advocata’s Chief Operations Officer Dhananath Fernando, pointing out that consumer goods prices had already increased significantly because of the depreciation of the rupee and inflation.

“Food inflation is about 50% and headline inflation is about 40%; so one could say that a VAT increase of 4 percent is negligible. Inflation will happen obviously but will be comparatively lower. The burden will fall on the consumers yet again, nonetheless,” Mr. Fernando said.

The 2019 tax cuts exacerbated Sri Lanka’s trend of low tax income, and economists have pointed out that the hikes may help curb excess demand within the economy and reduce government borrowings to narrow the budget deficit.

Mr. Fernando said it was crucial that appropriate portions of the revenue were used for social safety nets aimed at the most vulnerable communities and not misused

He added that the new tax increases were inevitable, given the severely low government revenue. But he warned that the effort would be futile unless it was accompanied by extreme expenditure cuts.

The loss of state revenue due to the 2019 tax cuts has been calculated to be at Rs. 500 billion. With the new tax reforms, the Government expects to increase revenue by Rs. 300 billion.

| Importers lobby for open account/DA payment methods or adequate dollars The open account and DA (Document against Acceptance) payment system terms have been a matter of controversy between policymakers and importers over the past few weeks. “We have met the Central Bank Governor, the Prime Minister, and top officials to urge them to restore the method at least for the import food items,” Essential Food Importers and Traders Association (EFITA) spokesperson Nihal Seneviratne said. While the Governor was firm on the decision to maintain the open account ban, he had agreed to try and supply the necessary foreign exchange from the banking channels. On May 6, a gazette was published stating that imports coming in on open accounts from May 20 will be liable to penalties. Based on this gazette, the customs announced that penalties up to 50 would be imposed on goods imported through the open accounts facility. “What we pointed out was, no one has done anything wrong to pay penalties, and penalties as high as 50 percent would cause exponential and completely impractical price increases,” Mr. Seneviratne said. The penalty clause has been deferred until tomorrow. After Monday importers will face penalties and require bank approval to import things under the open account and DA system. Commenting on the relaxation of restrictions on imports, Mr. Seneviratne said licences were not a requirement for essential food items anyway. He said the importers’ biggest concern was making payments to suppliers. “The Government should find at least US$ 100 million a month for food imports; otherwise people will go hungry,” he said, insisting that the open account and DA systems were vital to ensure adequate stocks of essential items since opening LCs was still extremely difficult. “If the Government is insistent on keeping the policy then we have sought an assurance that at least US$ 100 million may be released to importers.” Since the Indian credit line is also bringing food in, the importers claim that for now, US$$ 100 million should be enough. The Governor has agreed to consider this request. The ban on imports through open account/DA systems came despite protest from importers as part of CBSL Governor Nandalal Weersainghe’s mechanisms to disrupt unofficial money channels and diver the flow of foreign currency to formal channels. “The open account/DA systems allow imports that are paid through the hawala channels,” noted Chayu Damsinghe, Product Head of Macroeconomic and Thematic Research at Frontier Research. However, traders said the ban would only expedited the precipitation of the food crisis.

| |

| How new customs duties will impact pricesA series of custom duties have been introduced along with the relaxation of import restrictions. The alarming percentages of the increases caused panic among consumers following the release of a list of more than 350 goods with tax rate surcharges of 15-200 percent. The surcharge only meant that the tax rate or duty had been increased by amounts ranging between 15 and 200 percent, not the value of the import itself, an official said. This means that if an item on the list cost Rs. 50,000 and had a customs duty of 10 percent, that duty would now be increased to 20 percent, meaning that the item which would have cost Rs. 55,000 with the earlier duty, would now cost Rs. 60,000. The duty has only been imposed on non-essential food items and luxury goods. Along with the duty increase, the Government also removed licence requirements on several items, reducing restrictions on their imports. “Before the restrictions were rescinded, traders were required to obtain a license from a government official to import goods. This process gave a lot of discretionary authority to government officials and led to corruption. Importers’ ability to function becomes too dependent on the official’s decision,” explained Advocata COO Dhananath Fernando. Importers noted that the duty was most likely an attempt to discourage non-essential imports and, thereby, mitigate the forex crisis. Both the increased duties and lowered restrictions will achieve the government’s long-standing goal of reducing imports but will allow the government to earn some revenue in the meantime. “But the core problem exists – we don’t have dollars,” noted Mr. Fernando. “The only real change is the fact that now if someone can find dollars they can import. Earlier they couldn’t because of the licence restrictions.” He added, however, that the surcharge on the general duty and how these custom calculations were done were complicated. According to Mr. Fernando, PAL (Ports and Airport Levy) and the Cess percentages are also added on top of the general duty. “It isn’t an addition it’s a percentage on the tax + original value of the item being imported.” Thus, the third tax will be on top of both values, magnifying the impact. |

The best way to say that you found the home of your dreams is by finding it on Hitad.lk. We have listings for apartments for sale or rent in Sri Lanka, no matter what locale you're looking for! Whether you live in Colombo, Galle, Kandy, Matara, Jaffna and more - we've got them all!