Columns

Drastic reduction in expenditure and increased revenue by progressive taxation crucial for fiscal consolidation

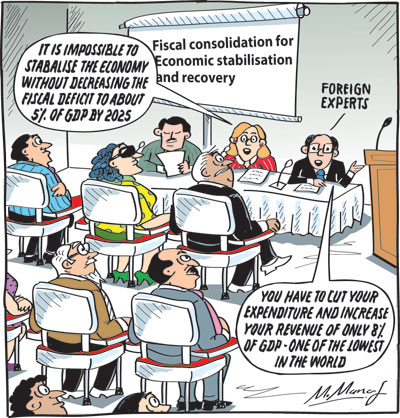

View(s): The immediate reduction in the fiscal deficit and its progressive decrease in the next few years are essential for the island’s economic recovery. It has to be achieved by both a curtailment of expenditure and an increase in revenue by progressive taxation.

The immediate reduction in the fiscal deficit and its progressive decrease in the next few years are essential for the island’s economic recovery. It has to be achieved by both a curtailment of expenditure and an increase in revenue by progressive taxation.

Fiscal consolidation

The reduction of the fiscal deficit to a minimum is crucial for economic stability and growth. For many years, the country has spent more than its income and those deficits had to be financed by domestic and foreign debt.

Fiscal deficit

The fiscal deficit that is currently estimated to be as high as 13 percent of GDP has to be drastically reduced to challenging task. This is no easy task. There are enormous difficulties and significant changes that have to be undertaken to reduce expenditure and increase revenue.

Such fiscal consolidation is a difficult and challenging task for the government. The fiscal deficit has to be reduced from the current 12 percent of GDP to about five percent of GDP in the next three years by drastic cuts in Government expenditure and an effective system of progressive taxation.

Strategy

The reduction of the budget deficit has to be achieved through a twin strategy of enhancing revenue, on one hand, and a drastic reduction in expenditure, on the other. Both strategies are politically unpopular and administratively difficult.

Resolve

The government has indicated its resolve to undertake a fiscal reform programme. However, it focused mainly on increasing tax revenues rather than reducing public expenditure in the interim budget.

Expenditure

While revenue to GDP is only eight percent of GDP, expenditure is estimated at over 20 percent of GDP. The revenue collected is in fact inadequate to even meet the expenditure on salaries, pensions and debt repayments.

Defence expenditure

The distortions and prioritisation of public expenditure are imprudent and unproductive. For instance, defence expenditure is the largest item of expenditure in the budget and exceeds the proportion that many developed countries that have large defence needs spend! Surprisingly, defence expenditure has increased after the three-decade war.

Implications

This implies that much needed other expenditure that should be increased to improve the quality of services, such as research, health and education, are starved of adequate resources. A reform of public expenditure structure is expedient. Bold political decisions that are difficult, but imperative, have to be taken.

Revenue

Government’s revenue has progressively declined and is as low as eight percent of GDP. This is almost the lowest revenue collection ratio in the world. Only two countries are at a lower level–Zimbabwe and Bangladesh.

Taxation

Several drastic changes have to be implemented to increase personal and corporate taxes. The threshold for income taxation has been reduced from a high exemption level of Rs. Two million to Rs. 1.2 million per year in the interim Budget for 2022. However even this would be inadequate due to the widespread tax evasion and avoidance.

Tax evasion

There are few income tax payers in the country. Many high-income earners pay little income taxes. Income taxes are mainly from public and corporate employees and a few professionals who understate their incomes. Some of the highest income earners are evaders of taxes.

Indirect taxes

Obtaining their tax dues directly is a near impossible task. It is therefore imperative that indirect taxes that fall on the consumption of the rich be adopted. Taxes on what the rich possess or consume is the pragmatic way forward.

Conspicuous consumption

Expenditure taxes on conspicuous spending of the rich, higher property taxes, increased licence fees especially on high value vehicles and other conspicuous consumption must be implemented to ensure the rich who avoid direct income taxes bear the tax burden.

Impractical

In this context of tax evasion, putting in place a conventional method for obtaining their tax dues is impractical and ineffective in implementation. It is certainly not possible immediately.

It is therefore imperative that we adopt indirect taxes that fall on the consumption of the rich. Steep increases in property taxes, on luxury consumption items, licence fees on motor cars and other conspicuous consumption should be implemented. A system of expenditure taxation that fall on the rich and the affluent should be implemented.

Much of the needed increase in revenue must be sought through direct and indirect taxes whose incidence falls on the rich and the affluent.

Past reluctance

Somehow, the country’s history of taxation demonstrates a reluctance of successive governments to impose such taxes. There was only a short period in the country’s history when there was an effort to introduce such taxes in the latter half of the 1950s.

Much of the needed increase in revenue must be sought through direct and indirect taxes whose incidence falls on the rich and the affluent. Somehow there has been a reluctance of successive governments to impose such taxes.

Conclusion

The progressive reduction in budget deficits is imperative for the economy’s revival, recovery and development. The IMF would insist on a programme of fiscal consolidation for granting the Extended Fund Facility (EFF) of US$ 2.9 billion in the next four years. Will the government be able to curtail expenditure drastically and increase revenue sharply? If we fail, the economic prospects for the country are dismal.

Buying or selling electronics has never been easier with the help of Hitad.lk! We, at Hitad.lk, hear your needs and endeavour to provide you with the perfect listings of electronics; because we have listings for nearly anything! Search for your favourite electronic items for sale on Hitad.lk today!

Leave a Reply

Post Comment